Have your seen the term “zombie company” used in the financial media over the past year or so? What is it?

In simple terms, a zombie company is one that isn’t generating enough income to cover its annual interest payments on its debt. With the sharp move down in interest rates last year, the population of zombie companies has markedly increased to a surprising level as firms have taken on more debt.

See the chart below. The universe shown here is the Russell 3000, a mix of both large and small firms.

Out of this universe of 3,000 firms, 692 were considered zombie companies (23%) this past January, an all-time high.

The analyst that I cite this research from was prudent in that he only considered companies that didn’t generate enough income to cover their debt service over the span of three years in total, rather than a single year, recognizing that firms can have ups and downs in any given year.

Most zombie companies do not even have a rating from the major bond rating agencies. Specifically, only 162 of these 692 do.

What I find surprising is that out of these 162 firms that carry an official rating 25 have a rating of “BBB” or higher, which is considered investment grade by the major credit rating agencies!

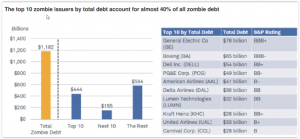

The distribution of zombie debt in circulation is very top heavy. The top 10 issuers comprise almost 40% of the total amount.

The chart below lists the top ten issuers by name.

Some fairly recognizable large cap companies populate this list, including General Electric, Boeing, Dell, Kraft, a few major airlines, and one large cruise ship operator.

Again, these major firms have not even covered their interest expenses in aggregate over the past three years, at least from an accounting net income standpoint.

Keep in mind, this is even with interest rates generally at historically low levels allowing their debt servicing costs to remain fairly low. This assumes they have been able to refinance any time over the past couple years, and take advantage of the low interest rates.

So, what’s the risk here? At some point, this debt will need to be repaid or refinanced. Refinancing up until now has not been particularly difficult given the low rates.

If rates rebound up in a major way refinancing risk can elevate substantially. Given that much of this zombie debt is actually short or intermediate term paper, the refinancing need could certainly be there. This might be an issue for these particular borrowers down the road.

Lastly, all of the above is really no reason for investors to shun the entire corporate bond market, which is on the order of $10.5 trillion in aggregate.

At $1.2 trillion, zombie debt is only around 10% of this total. But this analysis does unearth the possible vulnerabilities of a small corner of this debt market, which has so far taken shelter within this environment of very low interest rates.

Looking ahead over the next year or two as interest rates rise…beware of the zombies!