You just retired, ready to enjoy life after years of hard work, and now you have noticed your retirement plan income will being taxed.

Retired people can extend life of their savings, however, by moving to a place where taxes are lower. The less taxes one pays, the better, especially if one has to live on a fixed income.

One way retirees can help their savings last longer is by moving to a place with lower taxes. Please note, states that don’t have an income tax might seem like a good option, but many collect revenues in other ways.

That might be through steep property or sales taxes. Such taxes can offset the lack of an income tax.

Income tax may be your top priority if you expect to have a good income or if you continue to work part-time after retirement. Property and sales taxes might be more of a concern if you’ll be living on Social Security. These benefits are exempt in many states.

Make a Plan

One of the best things to do is consult with a certified financial planner who can look at you total net worth, understand what your goals, needs, and wants are and then designed a custom financial plan.

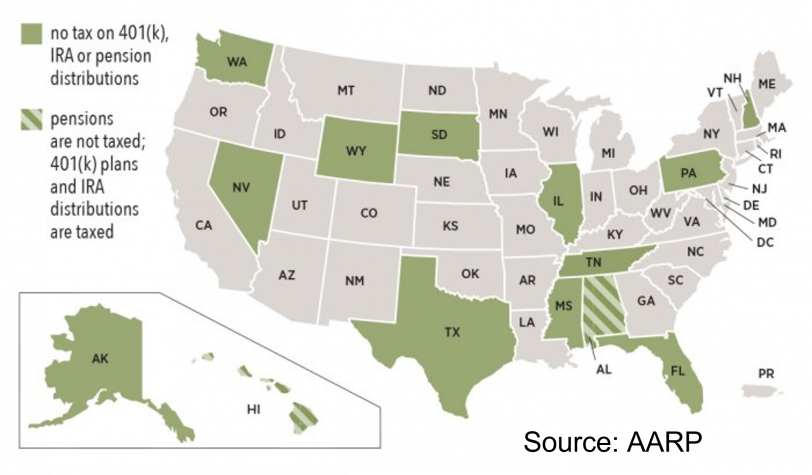

In the meantime, if you’re thinking of moving somewhere else, consider one of the 12 states that don’t tax distributions from pensions or defined contribution plans, such as 401(k) plans.

Nine of those states that don’t tax retirement plan income simply have no state income taxes at all: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming.

The remaining three — Illinois, Mississippi and Pennsylvania — don’t tax distributions from 401(k) plans, IRAs or pensions. Alabama and Hawaii don’t tax pensions but do tax distributions from 401(k) plans and IRAs.

States to avoid

Listed below are a few states are less kind to retirees. Not only are some of their tax rates high, but they also fully tax pension income, as well as 401(k) and IRA distributions. According to the Tax Foundation (Tax Foundation), these states and their top tax rates as of the 2021 tax year are:

California: 13.3% on incomes over $1 million ($1,198,024 for married filers of joint returns), but Social Security benefits aren’t taxed here.

Minnesota: 9.85% on incomes over $166,040 ($276,200 for married filers of joint returns).

Vermont: 8.75% on incomes over $204,000 ($248,350 for married filers of joint returns).

Idaho: 6.925% on incomes over $11,760 ($23,520 for married filers of joint returns), but Social Security benefits that are included on a federal return aren’t taxed.

Connecticut: 6.99% on incomes over $500,000 ($1 million for married filers of joint returns).

Nebraska: 6.84% on income over $32,210 ($64,430 for married filers of joint returns).

West Virginia: 6.5% on income over $60,000 (for both single filers and married filers of joint returns).

Rhode Island: 5.99% on income over $150,550 (for both single filers and married filers of joint returns).

Kansas: 5.7% on income over $30,000 ($60,000 for married filers of joint returns).

North Carolina: 5.25% on all income, but Social Security benefits aren’t taxed.

Massachusetts: 5% on all income, but Social Security benefits included in federal income aren’t taxed.

Arizona: 8% on income over $250,000 ($500,000 for married joint filers) but Social Security benefits that are included on a federal return aren’t taxed.

Indiana: 3.23% on all income, but Social Security benefits aren’t taxed.

North Dakota: 2.9% on income over $440,600 (for single filers and married filers of joint returns).

Again, we all want our retirement savings to last as long as possible. Lowering your tax bill when you retire can be a great way to stretch every dollar.

Working with a planner will help you understand your tax bill in retirement. It’s all about where you live and being informed of on the states, county, and city income tax, sales tax, and property tax.