As you know it is not easy to predict the future, nor the kind of stock market swings or volatility that occurs every year, though some years more extreme than others.

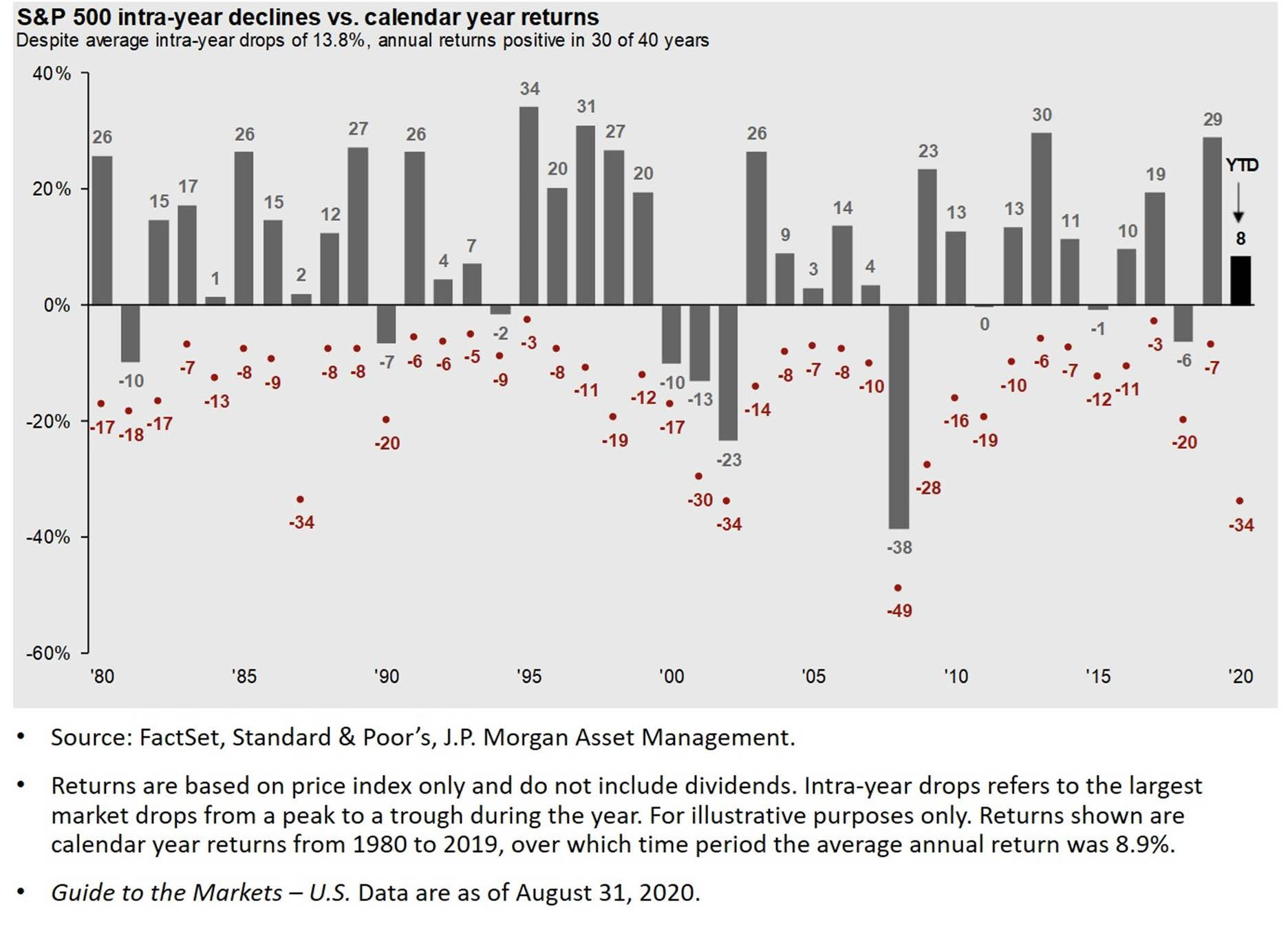

Bear in mind that before the COVID pandemic that caused the market to crash or sink 35% back in March 2020 has only happened eight times since 1926 and five times since 1980, as indicated in the chart below.

Plus the S&P 500 has only reported nine negative calendar losses in the last 40 years, with the biggest loss back in 2008, down 38% due to the bank financial crisis.

I am not saying that you are guaranteed to make money. However, investors who attempt to time the market often miss periods of exceptional returns, negatively affecting their investment strategy.

Stocks generally have provided between 7% and 10% returns and have outperformed bonds over long periods of time. Therefore, stay the course and avoid short-term losses — unless you are rebalancing your portfolio to realign back to your goals and plan on taking some capital gains as well.

As a former senior investment portfolio manager, over the years I have seen three types of investors:

- The do-it-yourselfer, the person who likes to market time, day trade, and gamble on a handful of securities.

- The enthusiast investor who has a passion yet still needs some guidance. He or she has a basket of securities, needs help with due diligence, and recommendation on diversification due to sector or asset class concentrations.

- The astute investor who hires a fiduciary investment management team to oversee their investments based on their goals and objectives while they spend their free time enjoying other activities.

So which investor is best? Well, it all goes to risk vs. reward. Sure, you can invest all your money within one position like Apple, Amazon, Tesla, or others. But you are literally putting your money on one stock to win like a horse on the track.

You will definitely be happy and excited if it pays off but sure enough you would be would be upset and frustrated if it doesn’t.

In my personal opinion, the enthusiast investor would do much better than the do-it-yourselfer because he is asking for guidance or a second opinion to make sure he is aligned to his goals and objectives.

The astute investor would do much better than the other two because he is working with a team of investment professionals that will create an efficient and optimal diversified portfolio based on clients’ goals within and across asset classes, making tactical adjustments along the way instead of buy-and-hold or market timing.

Some diversification ideas

While one market is going down another market is going up. In addition, many asset classes move at faster speeds than others because of other economic and global conditions.

So, while the S&P 500 might swing up or down violently at times, your diversified portfolio as a whole would not feel so much of the impact.

Granted, for the past 10 years everything has gone upward in a positive direction. However, the focus truly has been on equities vs. fixed income, domestic vs. international, and growth vs. value leading up to 2020.

However, if you were paying close attention to the market 400% rally at the end of 2019 from March 2009, and listening to President Trump’s rhetoric in telling the Federal Reserve to lower interest rates, the best thing you could have done to help offset equity losses within your portfolio was to take a tactical move and add more fixed income and alternative investments, such as commodities, to your portfolio.

Here are some ways to diversify along those lines:

iShares 20+ Year Treasury Bond ETF (TLT)

The iShares 20+ Year Treasury Bond ETF (TLT) seeks to track the investment results of an index composed of U.S. Treasury bonds with remaining maturities greater than twenty years. It has delivered solid annualized performance 12.14% over 3 years, 9.41% over 5 years, and 7.89% over 10 years. Plus, it has a yield of 1.75%.

SPDR Gold Shares (GLD)

The investment objective of the Trust is for SPDR Gold Shares (GLD) to reflect the performance of the price of gold bullion. It has delivered solid annualized performance 13.82% over 3 years, 11.07% over 5 years, and 4.02% over 10 years.

Both the TLT and GLD are up close to 30% while the S&P is pretty much flat for the year after bouncing back. With equities overvalued and having such a long run, it was only a matter of time for an event to occur that would cause investors to panic and send stocks back down in the dumps, like COVID-19 did.

While short-term, intermediate, corporate and high-yield bonds were not attractive for years, they are now a relatively better investment. iShares 20+ Year Treasury Bond ETF (TLT) is providing a suitable alternative, especially with the Fed holding still and not raising rates.

Gold tends to move inversely with the U.S. dollar, so a weaker dollar means an increase in the value of gold. Therefore, gold is seen by some as a safer investment than other assets in uncertain times. Until COVID departs or a vaccine is proven, holding these investments within your portfolio should be a hedge against the equities market.

Lastly, within equities, I would be focused on adding more dividend-paying stocks. They offer investors the potential for competitive upside performance in strong market environments and the potential for lower downside risk in weak environments.

Finally, one good defensive position that pays great dividends is the utility sector.

Utilities Select Sector SPDR (XLU)

The Utilities Select Sector SPDR will provide you with diversity within and across the sub-sectors to capture these opportunities. It has delivered solid annualized performance 6% over 3 years, 10.54% over 5 years, and 11.67% over 10 years. Plus, it has a strong dividend yield of 3.44%.

The Utilities Select Sector SPDR invests primarily in companies that produce, generate, transmit, or distribute electricity or natural gas. There are 28 companies in the fund. The component companies include NextEra Energy, Duke, Southern, and Dominion.

In addition, if Joe Biden wins on Nov. 3 there will be broad new incentives to invest heavily in wind and solar as well as find ways to improve energy efficiency in buildings throughout the United States.

A fund manager I know once said, “Diversification is not the sports car. It’s the family cruiser with the good gas mileage and has great safety features.”

That being said, I would re-examine your portfolio holdings, take necessary gains off the table, and rebalance your portfolio to be in line with your future goals and objectives. Be blessed that the stock market has performed stronger than expected in the past decade!