For over 20 years, I have worked within the wealth management industry helping individuals with retirement planning. One of the big decisions one will need to make is deciding which withdrawal strategy is the best for your specific situation. When choosing a withdrawal strategy, it is important to take factors such as taxes, life expectancy, additional income sources, as well as your investment portfolio into consideration. These factors can influence your savings, so the earlier you plan for them, the more flexibility you will have during retirement. After all, you have worked hard to save for retirement, and now you’re ready to turn your savings into a paycheck. Here are three options to consider.

The 4% withdrawal rule

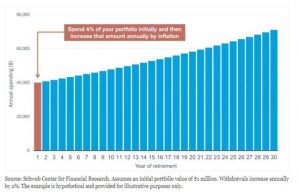

The 4% rule is when you withdraw 4% of your retirement savings in your first year of retirement. In the following years, you adjust for inflation, for this example, assume inflation is at 2%. If you have $1 million, you will withdraw $40,000 during your first year in retirement. In the second year, you would take out $40,800 (the original amount plus 2%). In the third year, you would withdraw $41,616 (the previous year’s amount, plus 2%), and so on. The strategy is based on historical market returns and assumes a 30-year time horizon. Advantages of this strategy: Simple to follow and gives you a predictable amount of income each year.

Disadvantages of this strategy: The 4% you decide to withdraw is unlikely to equal the same amount of constant income each year. Your portfolio may adjust based on market swings.

While many maintain a 50% fixed income/50% equity asset allocation within this approach, it would be advantageous to be more tactical and diversified.

As you know, it’s not easy to predict the future. Strategic asset allocation sets the foundation for your achieving your goals and objectives and diversification is the cornerstone for creating efficient and optimal portfolios.

Advantages of this strategy: Simple to follow and gives you a predictable amount of income each year.

Disadvantages of this strategy: The 4% you decide to withdraw is unlikely to equal the same amount of constant income each year. Your portfolio may adjust based on market swings.

While many maintain a 50% fixed income/50% equity asset allocation within this approach, it would be advantageous to be more tactical and diversified.

As you know, it’s not easy to predict the future. Strategic asset allocation sets the foundation for your achieving your goals and objectives and diversification is the cornerstone for creating efficient and optimal portfolios.

Systematic withdraw plan

The systematic withdrawal plan today has changed a bit from the original concept, where you typically only withdrew the income from the investment portfolio, such as dividends or interest. The initial principal remains whole, and the capital appreciation continues to stay invested within the investment products allowing them to grow higher in value. However, now some institutions allow you to take capital appreciation as well. In the past few years, where the market has done extremely well, I can understand taking some appreciation. However, in low-performing or negative years, do you really want to dip into capital? This would not be advantageous as you want to stretch those dollars into further years so that you don’t run out of money when you need capital. In a systematic plan you typically have the option to redeem the accumulation or a fixed amount on a monthly, quarterly, or annual basis. Advantages to this strategy: You only withdraw income, maintaining principal and capital appreciation for later years when the portfolio doesn’t produce enough to sustain the lifestyle needed. Withdrawing any interest generated from investments in your taxable accounts is taxed as ordinary income (unless it’s from a tax-free municipal bond or municipal bond fund). Dividends, on the other hand, are often taxed at the lower long-term capital gains rates of 0%, 15%, or 20% (depending on your income level, how long you’ve held the asset, and other requirements). Disadvantages to this strategy: It’s important to understand how the rate of return works and the impact of a bear market. Are you receiving enough money to keep up with your lifestyle and is inflation eating into your hard-earned dollars?Buckets withdrawal strategy

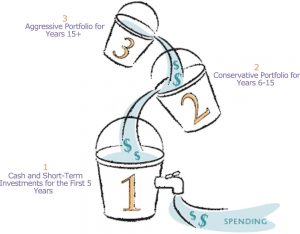

The “buckets” strategy is focused on separating and withdrawing assets from three buckets or separate types of accounts. Under this strategy, the first bucket holds some percentage of your savings in cash and short-term fixed income securities to cover one to five years of living expenses and backup emergency funds.

The second bucket holds mostly fixed income securities of longer terms as well as quality type to generate higher income for time periods 6 to 15 years. However, this bucket also starts to implement domestic large and mid-cap equities to help generate capital appreciation as well as generate dividends for additional income.

The third bucket contains investments in equities and alternative investments to help provide a better diversity within and across asset classes and providing an overall higher return with a longer-term time period of 15+ years.

As you use the cash from the first bucket, you replenish it with earnings from the second and third buckets. This lets you set aside a percentage of your investments to grow while having the confidence of a steady income stream.

By setting aside several years’ worth of living expenses, your investments ideally would have more time to grow, sustaining as much of your savings as you can for as long as possible.

Advantages of this strategy: The major benefit of this approach is that you have more control over when you want to sell the investments and by how much you need to live off by channeling the interest, dividends, and capital appreciation through the buckets.

Disadvantages of this strategy: This approach is more time-consuming, and the retiree/investor needs to be aware of both economic and market conditions when being tactical on rebalancing buckets two and three.

Under this strategy, the first bucket holds some percentage of your savings in cash and short-term fixed income securities to cover one to five years of living expenses and backup emergency funds.

The second bucket holds mostly fixed income securities of longer terms as well as quality type to generate higher income for time periods 6 to 15 years. However, this bucket also starts to implement domestic large and mid-cap equities to help generate capital appreciation as well as generate dividends for additional income.

The third bucket contains investments in equities and alternative investments to help provide a better diversity within and across asset classes and providing an overall higher return with a longer-term time period of 15+ years.

As you use the cash from the first bucket, you replenish it with earnings from the second and third buckets. This lets you set aside a percentage of your investments to grow while having the confidence of a steady income stream.

By setting aside several years’ worth of living expenses, your investments ideally would have more time to grow, sustaining as much of your savings as you can for as long as possible.

Advantages of this strategy: The major benefit of this approach is that you have more control over when you want to sell the investments and by how much you need to live off by channeling the interest, dividends, and capital appreciation through the buckets.

Disadvantages of this strategy: This approach is more time-consuming, and the retiree/investor needs to be aware of both economic and market conditions when being tactical on rebalancing buckets two and three.