Space…the final frontier.

When the creators of “Star Trek” first wrote down those words, the world could hardly imagine just how true this mantra would become. Improved science and declining technology costs have opened a door to the market that was once thought closed — space businesses.

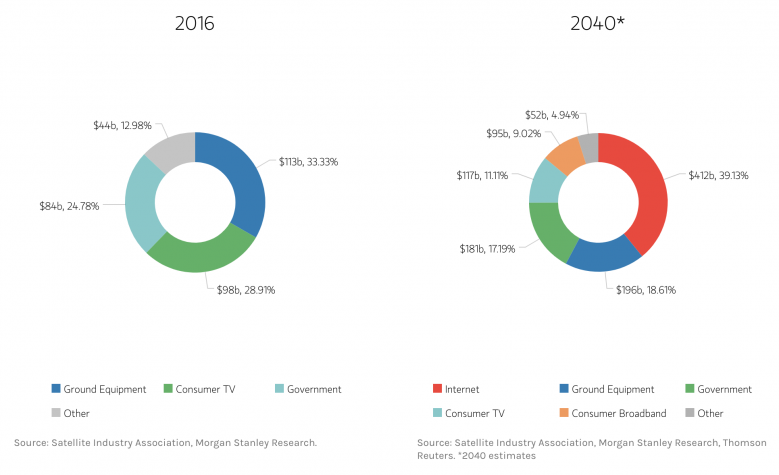

According to Morgan Stanley, the global space market was worth $339 billion in 2016. With a projected annualized growth rate of 6%, it should reach $1.05 trillion by 2040.

As we move closer to that future, significant opportunities exist for the earliest adopters in the market. The same holds true for the investors with the foresight and good fortune to jump into those firms.

Iridium Communications (IRDM)

No serious discussion of space companies can exist without mentioning Iridium Communications (IRDM). The company owns 75 satellites circling the globe, 66 of which are operational.

Its collective $3 billion investment in these satellites has paid off. Today, Iridium boasts a network thats allow its customers to communicate anywhere on the planet. Major customers have included the U.S. government and mariners at sea. Its partially-owned Aireon Holdings subsidiary uses some of the systems’ payload capacity to provide the first global real-time tracking for aircraft.

As of the end of its latest quarter, Iridium had 1.362 million billable subscribers. This is up 12% year-over-year.

This has yielded robust sales, with service revenue this year on track to hit between $447.2 million and $456.1 million. EBITDA of $360 million will be comfortably higher than the $331.7 million generated last year, bringing net leverage down from 4.8 in 2019 to 4.3 by year end.

Free cash flow for 2020 should be around $208 million. This implies an increase of 23.8% over 2019’s $168 million.

Virgin Galactic Holdings (SPCE)

Another interesting play on the space market is Virgin Galactic Holdings (SPCE). The company is building and testing aircraft and systems that it plans to use for space tourism.

Already, Virgin has met 27 of the 29 elements the FAA requires to be able to accept paying customers on its platform. To help fund its operations to date, it has locked in reservations from around 600 customers, raking in a collective $80 million from the advances.

This represents $120 million in future revenue for the firm. With ticket prices of up to $250,000, you might believe that the market for Virgin is small, but small is relative. Management believes that there are around 2 million people in the world worth in excess of $10 million. This implies a total addressable market of $500 billion.

Revenue to-date has been de minimis, totaling $8.62 million from the start of 2017 through the first half of this year. Over that time, the company lost $609.76 million and saw net operating cash outflows of $593.82 million.

This has led the company to dilute shareholders. As recently as August, the business issued 27.14 million shares of its stock in exchange for $529.2 million in gross proceeds.

The end result was existing shareholders losing 11.4% of the firm. Of course, if the business does achieve the success it is aiming for, the end result will be a nice payoff.

Northrop Grumman (NOC)

Another, much-larger player in the space market is Northrop Grumman (NOC). The aerospace and defense firm has significant involvement in the space industry. Its Space division designs, develops, and manufactures spacecraft systems, sensors, and communications payloads.

Projects include the James Webb Space Telescope and a large infrared telescope being developed for NASA. Its Space Systems unit develops satellites for commercial broadcasting and research purposes. And its Flight Systems unit produces solid rocket motors for NASA’s Space Launch System.

Management at Northrop does not break out financials in a way that lets us see the firm’s space operations only. But the business as a whole has done well in recent years.

Last year, NOC generated $4.3 billion in operating cash flow and $3 billion in free cash flow. This year, operating cash flow should range between $4.5 billion and $4.9 billion, with free cash flow coming in between $3.15 billion and $3.55 billion. This represents gains, at the midpoint, of 9.3% and 11.7%, respectively.