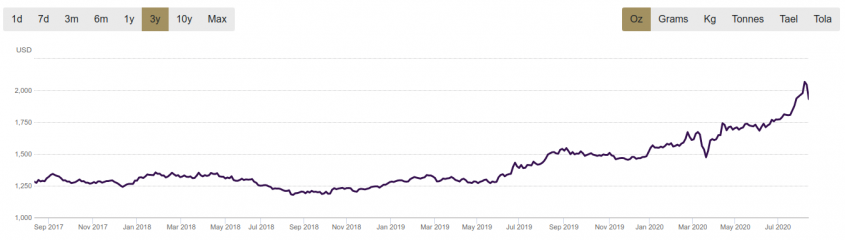

It has been a very good year to be a gold investor.

The value of one ounce of gold passed the $2,000 mark on August 5th, a 32% increase from the previous year.

As of this writing, an ounce of gold is hovering just under the $2,000 mark.

Some experts believe that gold prices could continue to surge because of a weakening dollar and because retail investors are using exchange-traded funds (ETFs) to access gold as easily as the rich and the world’s central banks.

If you are looking to invest in gold via an ETF, here are four to consider.

SPDR Gold Shares (GLD)

The SPDR Gold Shares (GLD) business method is to allow investors a relatively cost effective and efficient way to enter the gold market and track its pricing.

Investors can buy into the gold market, trade, or sell an interest in gold securities without ever taking physical ownership of gold itself.

A single SPDR Gold Shares ETF investment represents about one-tenth of an ounce of gold. This ETF has strict bid-ask spreads and its fund is very liquid. GLD has $40 in expenses for every $10,000 invested.

State Street, the issuer, manages one of the largest reserves of physical gold bullion in the world. The firm reportedly stores more than 1,265 tons of gold in the London-based vaults of HSBC.

That amount of gold is larger than the gold stored in the central banks of India and Japan combined. SPDR Gold Shares is jointly owned by Boston-based bank State Street and the World Gold Council, a gold industry trade association.

iShares Gold Trust (IAU)

iShares Gold Trust (IAU) is essentially the lower-cost investment alternative to GLD.

iShares investors can invest into the gold market efficiently via fractional interest of physical gold without direct ownership of the precious metal.

Founded in 2005, IAU’s fractional interest of physical gold reserves is smaller. The typical iShares investment represents 1/100th an ounce of gold against SPDR’s 1/10th of an ounce.

iShares investments are not very liquid. Additionally, there is a more daylight between the bid-ask spreads so short-term traders should tread carefully. iShares has fees of $25 for every $10,000 invested.

VanEck Vectors Gold Miners (GDX)

VanEck Vectors Gold Miners ETF (GDX) is an ETF for investors who want direct exposure to gold mining stocks rather than gold metal.

VanEck Vectors is comprised of 50 gold mining company stocks. This gold mining ETF was founded in May 2006 in the middle of gold’s bull market in that era.

Gold mining operations try to mine, extract, and process gold ore into gold at a lower cost than the market prices of the gold they eventually sell.

As a result, this ETF can be an optimal investment entry point for investor looking to leverage the gold market from the cheaper mining state of production.

VanEck Vectors has fees $52 for every $10,000 invested.

U.S. Global GO GOLD and Precious Metal Miners ETF (GOAU)

The U.S. Global GO GOLD and Precious Metal Miners ETF (GOAU) gives investors access to gold mining companies and pre-processed gold.

It is comprised 30 gold mining companies. U.S. Global is a relatively new ETF, having only been launched in 2017.

Investors can use this gold ETF to gain access to active gold mining or passive mining investment via royalty staking and gold mining production streams.

U.S. Global costs investors $60 in fees of every $10,000 invested.