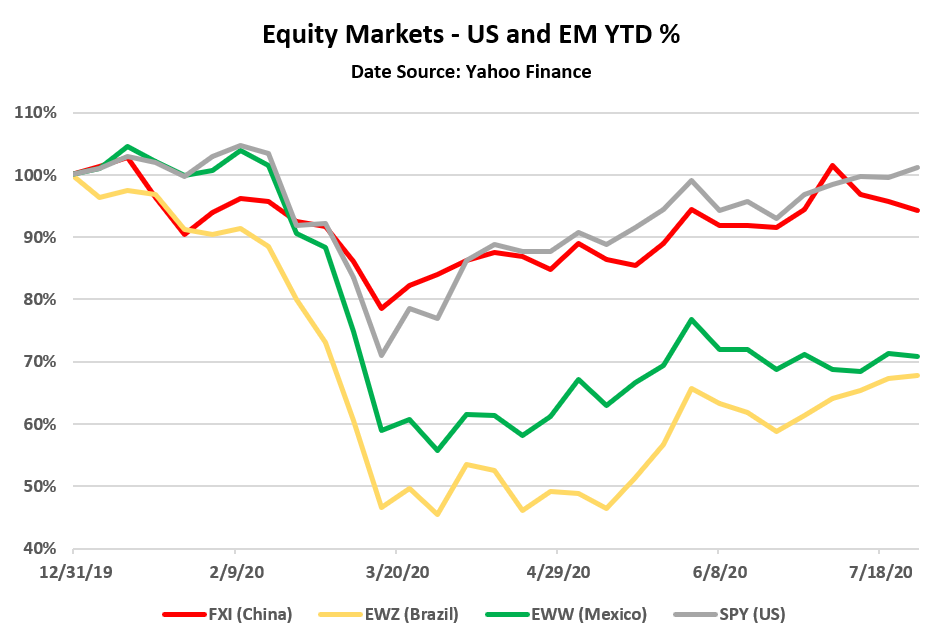

As did most risk asset classes, emerging markets equity, fixed income and currency markets sold off earlier this year.

The first to be affected was China, which saw price declines since January. By the middle of March all markets had experienced steep selloffs after the health crisis worsened and oil markets collapsed.

The chart shows how Latin American equity indexes have suffered the most. China, in the other hand, had a quick recovery and is trading close to U.S. markets levels for the year.

Currency markets have also suffered. The Brazilian real has lost more than 20% of its value this year, and the Mexican peso about 15%.

Sovereign bond markets have recovered after selling off, but lesser credits such as Argentina and Ecuador defaulted in the last few months. They are well advanced in their debt restructuring efforts.

Four ways to invest

There are four distinct sectors of emerging markets that can be traded by foreign investors, consisting of equities, hard currency bonds, foreign exchange and local bonds.

The risk-reward for each of these sectors is different, and I expect their evolution out of the crisis to diverge.

Three key factors will determine the evolution of emerging markets out of the crisis: The economy at local and global levels, credit markets in each country, and a prevailing low interest rate environment in hard currencies — which will most likely last for a long period of time and provide support to local markets.

Equity markets in Latin America could be posed to regain some ground. The Brazilian equity market iShares MSCI Brazil Index (EWZ) returned 11% in July. It is still more than 30% down for the year.

Under the right conditions it has plenty of room to recover. The country is in the middle of a political crisis, but a fiscal reform is beginning to make its way through its legislature.

The Mexican equity market iShares MSCI Mexico ETF (EWW) is in a similar situation. The links between Mexico and the United States are much stronger.

NAFTA was renegotiated into the new USMCA in 2018. The new treaty was ratified this year in all three participating countries (Canada is also part of the agreement). In the aftermath of the crisis, strong trade ties may resurge, as global production chains get rerouted closer to home for U.S. companies.

Hard currency sovereign bonds have recovered after selling off early in the crisis. The outlook for credit in the corporate sector is negative.

As in the previous oil crisis, the middle ground is in quasi-sovereign bonds, which are corporates partially owned by the government, most notably in the energy sector. Such bonds offer interesting risk rewards and have good upside from current levels.

Investing in them relies in an implicit support by the government, which is not guaranteed to materialize when needed, and some of them might not be able to survive a prolonged crisis on their own.

Foreign exchange and local currency bonds offer some interesting opportunities, mostly driven by the low interest rates environment. They are not as liquid or transparent for individual investors, but with some homework they can be accessed.

Global liquidity

Mexico has a developed local currency market, with sovereign peso bonds trading at above 5%. Brazil is less opened, but some reais-denominated bonds settle in dollars and can be accessed from brokerage accounts in the United States. I expect the yield component of such bonds to decrease on the back of low global interest rates.

Currencies have stabilized in the last few months, but their path remains uncertain in the near term. They will most likely recover once global economic activity is reignited, but until then they face strong headwinds, worsened by fiscal imbalances, and a twin collapse of global supply and demand.

The Federal Reserve has started a swap program with most central banks, providing easy access for U.S. dollars and clearing the way for a stable market during the months ahead, and for U.S. liquidity to become global.