If Vice President Joe Biden wins the election on November 3, 2020, you might want to consider adding these five equities positions to your portfolio: XLU, TSLA, XLV, MLM, and EEM.

Why? Because the Biden presidential campaign is built on creating new economic opportunities for all workers, restoring environmental protections and healthcare rights, building sustainable and clean energy, a better infrastructure, as well as international alliances.

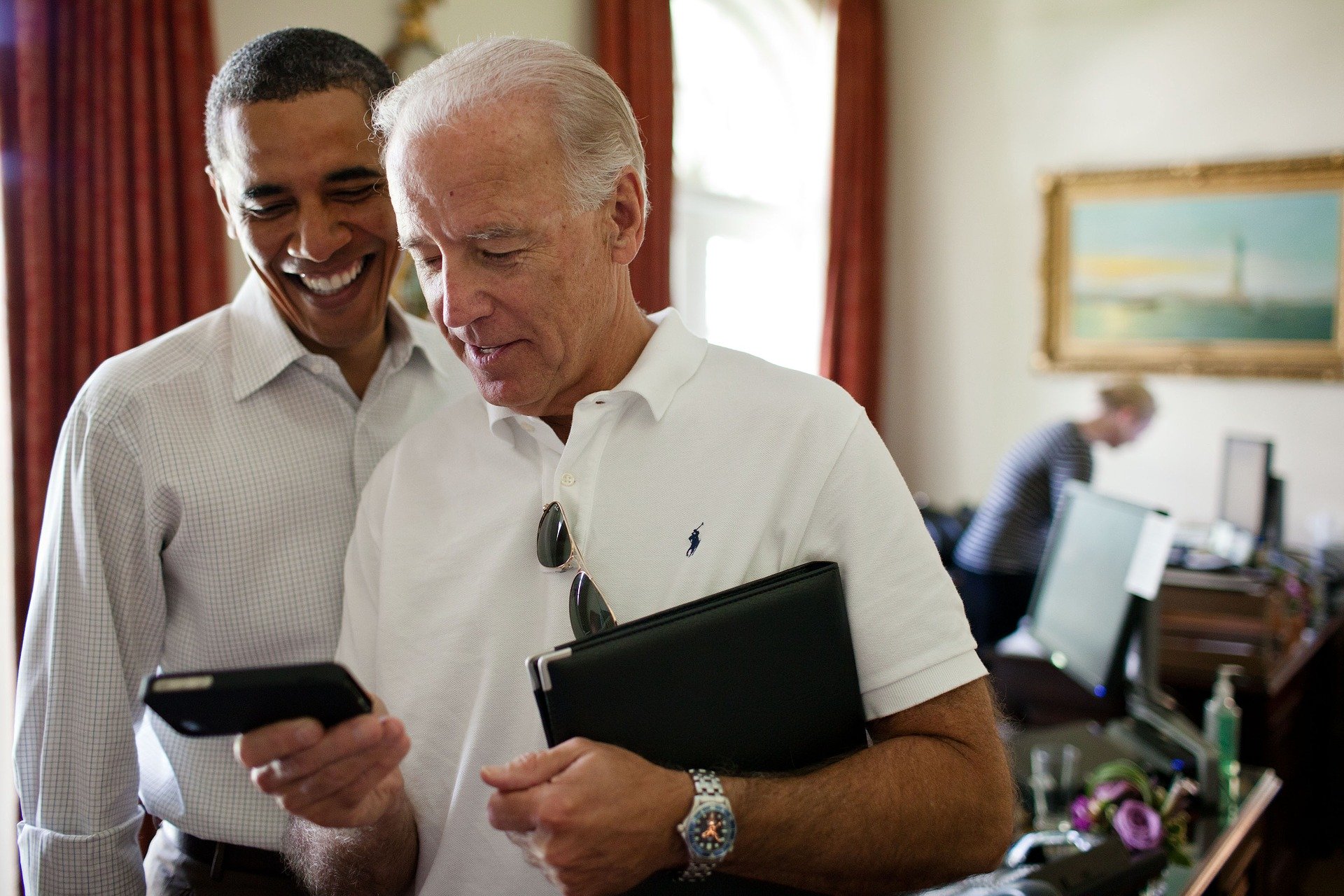

Biden has had a 40-year political career in the senate and was the vice president to President Obama. Between his experience and history of being business-friendly, he should be successful in getting the support needed to executive his policies outlined on his website.

However, for Biden to legislate his policies depends heavily on the Democrats winning back the Senate in addition to holding their majority in the House.

One caution to consider if Biden wins in November he will dramatically change taxes in the United States by repealing many Trump’s tax cuts. Biden’s proposed capital gains tax hike could spark a big sell-off in stocks, especially, after a strong bullish market. Many investors, including mutual funds, will be ready to harvest long-term capital gains.

Here are my picks for a Biden win, if that happens:

Tesla, Inc. (TSLA)

Green energy and infrastructure are Biden’s top priorities. The Green New Deal policies will favor utilities with a hand in wind and solar power generation as well as electric vehicle manufacturers.

Tesla, Inc. designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, Netherlands, Norway, and internationally.

Following Tesla’s September 2020 Battery Day, some analysts reevaluated their target price for the company after a disappointing showing. Nevertheless, Oppenheimer confirmed their upbeat outlook and continued with their target price of $451.

Based on continued strong demand for Tesla vehicles and battery costs that are likely to come down, plus with cheaper Tesla models around 2023, they anticipate an increase in volume deliveries from 2020 to 2029 at around 10%.

All of these are favorable things to consider on a trendy automaker showing up in more neighborhood driveways year over year.

Utilities Select Sector SPDR (XLU)

Considering Biden’s proposed mandate for the U.S. power sector to become carbon neutral by 2035 and a projected $2 trillion outlay, why not consider adding some utility stocks to your portfolio?

The Utilities Select Sector SPDR invests primarily in companies that produce, generate, transmit, or distribute electricity or natural gas. There are 28 companies in the Utilities Select Sector SPDR. The component companies include NextEra Energy, Duke, Southern, and Dominion.

If Biden wins there will be broad new incentives to invest heavily in wind and solar as well as find ways to improve energy efficiency in buildings throughout the United States.

The Utilities Select Sector SPDR will provide you with diversity within and across the sub-sectors to capture these opportunities.

What’s more, income investors often overlook ETFs and focus solely on equities, but they shouldn’t.

XLU has an expense ratio of 0.13%, which is much lower than its category average of 0.42%. Its performance has an annualized return of 6% for 3 years, 10% over 5 years, and 10% over 10 years with a current dividend yield of 3.28%.

Health Care Select Sector SPDR Fund (XLV)

The warning on Wall Street is don’t buy healthcare stocks if Democrats sweep the November elections. I disagree. Biden wants to restore Obamacare if he should win. Health care is a diverse sector and Biden’s policies may benefit other corners of that sector, such as areas of insurers and hospitals.

The Health Care Select Sector SPDR consists of companies whose primary business may include healthcare equipment and supplies, healthcare services, biotechnology, XLV, and pharmaceuticals. There are 62 companies in the Health Care Select Sector SPDR.

XLV has an expense ratio of 0.13%. Its performance has an annualized return of 12% for 3 years, 11% over 5 years, and 16% over 10 years with a current dividend yield of 2.10%.

iShares MSCI Emerging Markets ETF (EEM)

The U.S. dollar has been on a bull run for over a decade. However, with a weakening dollar, exploding commodities such as copper, silver, and gold along with projected higher inflation now may finally be the time to increase exposure to foreign equities.

The iShares MSCI Emerging Markets ETF seeks to track the investment results of an index composed of large and mid-capitalization emerging market equities with over 800 stocks.

In terms of valuation, U.S. domestic stocks seem overvalued compared with the rest of the world. China was the first country to enter the COVID-19 crisis and appears poised to be the first out. Ample liquidity from the Fed and a weakening dollar should catalyze investor interest. China stands to gain the most from U.S. tariff rollbacks and global trade dynamics should improve.

EEM has an expense ratio of 0.68%. Its performance has an annualized return of 0.065% for 3 years, 8% over 5 years, and 2% over 10 years with a current dividend yield of 2.60%.

Martin Marietta Materials, Inc. (MLM)

Biden has ambitious plans to spend up to $1 trillion on infrastructure. Road- and bridge-building would boost the industrial and materials sector.

Martin Marietta Materials, Inc., a natural resource-based building materials company, supplies aggregates, and heavy building materials to the construction industry in the United States and internationally. It offers crushed stone, sand, and gravel products, ready mixed concrete and asphalt, paving products and services.

Martin Marietta reported a strong second quarter that showed a limited impact from the coronavirus pandemic. Though with an active hurricane season and some unfavorable weather in parts of its footprint there is still a huge demand for road spending needs and strong finances to support high growth.