According to Experian, one of the three major credit bureaus, an individual’s credit score measures his or her likelihood of repaying debts.

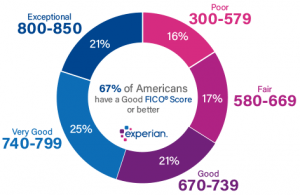

Credit scores range between 300 and 850 points. Higher credit scores indicate that a borrower is less risky and more likely to make on-time payments.

In many cases, credit scores are used to determine whether someone is eligible for loans, mortgages, credit cards, rent and utilities accounts. Scores can be used by lenders to assess credit limits and interest rate offers.

Generally, a score ranges of 700 or higher is considered “good.” On the same scale, a score of 800 or higher is considered “excellent.”

The average credit score hovers between 600 and 750.

A higher credit score can increase the confidence of creditors. However, creditors may also set their own criteria for determining what constitutes good or bad credit scores when evaluating consumers for loans and credit cards.

What affects your credit scores

Common factors can affect all your credit scores, and these are often split into five categories:

- Payment history: Making on-time payments on your credit accounts can help your scores. Missing payments, having an account sent to collections or filing bankruptcy could hurt your scores.

- Credit usage: How many of your accounts have balances, how much you owe and the portion of your credit limit that you’re using on revolving accounts all come into play here.

- Length of credit history: This category includes the average age of all your credit accounts, along with the age of your oldest and newest accounts.

- Types of accounts: Also called “credit mix,” this considers whether you’re managing both installment accounts (such as a car loan, personal loan or mortgage) and revolving accounts (such as credit cards and other types of credit lines). Showing that you can manage both types of accounts responsibly generally help your scores.

- Recent activity: This considers whether you’ve recently applied for or opened new accounts.

Good credit can help you achieve your financial and personal goals more easily. Depending on your score you can pay higher interest and fees than other if you’re approved.

It could also mean the difference between qualifying for an important loan and being denied one, such as a home mortgage or car loan.