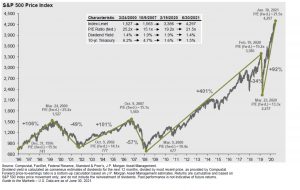

U.S. stocks continued to increase during the first half of 2021 and are up 92% since the bottom of the market correction back on March 23, 2020.

For five straight months, the S&P 500 continued to rise to attain its latest all-time high.

So, what has been driving the performance in the 1st half of 2021?

A healthy rotation across a range of industries as the economy continues its reopening and more and more people are returning to work. Historic fiscal and monetary stimulus has also provided a consistent tailwind since the spring of 2020.

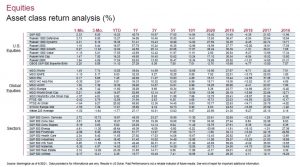

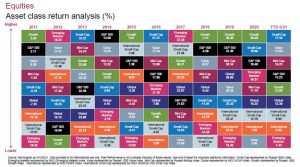

Small-cap stocks are outpacing large and mid-caps stocks by a narrow margin, wile the Russell 1000 Value Index (+17% YTD) has outperformed the Russell 1000 Growth Index (13% YTD) in the first half of 2021.

Value’s booster shot peaked back in March and in the last quarter growth stocks dominated due in large part to a more hawkish Fed at the June meeting of the rate-setting Federal Open Markets Committee.

At the sector level, all 11 sectors have a positive return, with a majority of them producing 10% or more. Energy led the way, followed by financials and real estate.

At the bottom of the sectors were utilities, consumer staples, and discretionary. Plus, U.S. stocks continue to outperform international EAFE emerging stocks.

Expect the U.S. bull market to slow a bit in the second half as we interpret new economic data and market conditions, as well as the spread of the COVID-19 delta variant.

There is little expectation that the U.S. economy will grind to a halt as it did in March of 2020 because of this variant, however. There is a huge push for everyone to get vaccinated, continue to wear masks, as well as take safer protocols at work to avoid another pandemic-stalled economy.

Underestimation

While analyst estimates are typically reliable, it seemed that many grossly underestimated the strength and pace of the economic recovery from 2020-2021. Many analysts were too aggressive in their downward revisions to EPS estimates during the first half of 2020 at the height of the COVID-19 lockdowns.

Since March 31, 2021 there has been a revised upward revision of the expected earnings growth rate for companies in the S&P 500 Index. With the second quarter 2021 earnings season approaching, I am certain that we will see earnings come in well above current estimates again.

The only risks on the horizon are possible higher corporate tax rates that might restrain earnings growth in 2022 and the Fed being “hawkish” on interest rates in 2023.

Concerns about inflation are on the rise, commodity prices have surged, supply chains continue to remain challenged, and small businesses are desperate to hire workers. Past income support from enhanced unemployment insurance and fiscal stimulus helped drive spending; now analysts are now waiting to see how the economy runs on its own.

U.S. payrolls in June rose by 850,000, handily beating the consensus expectation of 720,000. Meanwhile, the unemployment rate edged up to 5.9% as more workers return to the labor force.

Analysts are adjusting 2021 GDP growth and trying to interpret current headwinds such as jobs, inflation, and select materials that remain elevated. Consumers see a wide range of price hikes within their normal purchases.

Gasoline prices have been on the rise as well as summer travel costs are above average as demand for travel has increased.

The one apprehension is whether consumer spending will continue in the second half without having those additional stimulus checks. Back-to-school shopping, Halloween, Thanksgiving, and Christmas are the top shopping holidays, all during the second half of the year.

When inflation proves to be persistent, we have historically seen investors demand higher interest rates to compensate for higher costs.

The Fed uses the so-called “dot plot” to signal its outlook for the path of interest rates, with each dot representing the interest rate forecasted by one of the 12 members of the committee.

It now shows two rate hikes in 2023. While not an official forecast and a moving target, that represents a more hawkish tilt in the Fed’s monetary policy.

Importantly, however, the first-rate hike will likely not occur for another year or two.

While the second half of the year could be bumpier for financial markets, many analysts still expect equity markets to continue their upward path. One key item still on the table is the Biden administration hype of a $1.2 trillion infrastructure framework bill, which includes almost $579 billion in new spending.

Transportation is outlined for more than half of that spending with payments of around $125 billion allocated to roads, bridges, and ports; $66 billion for railways; and $15 billion for electric infrastructure and transit.

Other physical infrastructure improvements include $65 billion for broadband access, $73 billion for power grid improvements, and $55 billion for water infrastructure.

Many analysts expect positive economic growth in the United States through the second half of this year. Real gross domestic product (GDP) growth of around 7% for 2021 would mark the best outcome for the U.S. economy since 1984.

When the U.S. economy returns to normal, pre-pandemic levels, estimated GDP growth will probably return to 3.5%.

Furthermore, many analysts expect the dollar’s depreciation trend versus developed market currencies to become more apparent by early 2022. As a result, this might be a good time to revisit, rebalance, and diversify your investment portfolio.

Overweight equities

While several equity indexes have continued to soar near record highs, many analysts still favor equities over fixed income.

The consensus on the street is that investors should utilize a barbell approach with exposure to both growth and value domestic large, mid and small-cap stocks as the economy moves from early cycle to mid-cycle.

While U.S. stocks have outperformed international stocks for the past few years, it does make sense to start diversifying and increasing exposure to emerging markets (EM) and developed international (EAFE) markets.

For income-focused investors, continue to look at high-paying dividend stocks. They have been performing well within the energy, consumer defensive, real estate, and healthcare sectors.

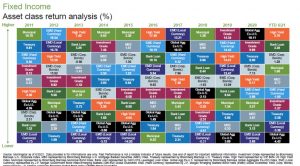

Underweight fixed income

Fixed-income allocations require risk-aware active management. Many analysts are recommending strategies with lower interest rate sensitivity (duration) and higher credit quality in diversified fixed income portfolios.

The best performing areas that are expected to continue are high yield, bank loans, and emerging market debt at the expense of investment-grade credit and government bonds.

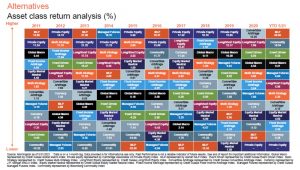

Neutral weight alternatives

Finally, as we expect more volatility in the coming months, not only for equity markets but also for fixed income markets, many analysts believe that an allocation to alternatives could help increase portfolio resilience.

Considering to increase exposure to energy MLPs, commodities, and hedge fund event-driven investments.

It’s not easy to predict the future, so having a broadly diversified portfolio and combining holdings from a variety of asset classes can reduce overall portfolio volatility and improve risk-adjusted performance.

During times of heightened risks and market volatility, being tactical and rebalancing your portfolio can help your portfolio withstand the ups and downs within the market and provide you with a more stable return over time.

Seek fiduciary help

Lastly, if you are looking for professional investment management to help you manage your portfolio, look to those who operate and adhere to the higher fiduciary standard of care. Most banks and wealth management institutions operate under state or federally issued trust powers requiring them to act in a fiduciary capacity.

When a person accepts a fiduciary duty on behalf of another party, it creates an ethical relationship of trust with specific duties.

Two such duties are to act in good faith and trust (the term fiduciary comes from “fiducia,” the Latin word for “trust”).

Duties owed to another party are not always financial in nature — lawyers, for example, have fiduciary duties toward their clients — but in the context of investment, fiduciaries are expected to manage their clients’ assets for the investor’s benefit, not their own.