The current interest rate environment provides challenges for those investors seeking to maximize income while minimizing risk.

For the past decade, a zero-interest rate environment strongly favored the stock market and made fixed-income vehicles unattractive, due to their paltry yields.

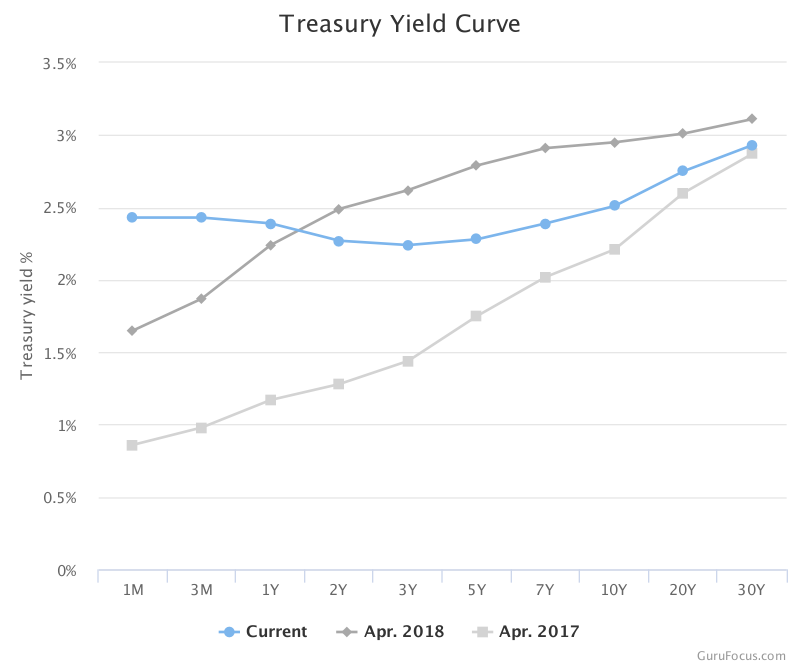

Five years ago, the average yield for a one-year Treasury bill was less than 0.2% and bank CD’s barely cracked the 0.5% barrier. Yields today have increased substantially — 1 month T-Bills are returning 2.42%; 3 month T-Bills are yielding 2.43% and the return on 10-year Treasury Notes is 2.54%.

Before making an investment decision, it is imperative to note the current interest rate posture of the Federal Reserve. A lower than anticipated inflation rate that has not crept forward, even with an historically low unemployment rate, so the Fed has stated there will be no further rate increases for 2019.

Whether rates will increase thereafter is uncertain. Last month, the yield curve inverted, meaning short-term rates exceeded long-term rates.

Though the curve has since flattened, the short/long-term yield differential is negligible. The current rate environment will be a factor in determining which fund is the most suitable for your particular needs.

Investment objectives

The type of bond fund you chose will depend on your specific investment objectives and your tolerance for risk. First, you should determine your time horizon.

If you are retired and are counting on current income for living expenses, a stable bond fund that invests in Treasurys or AAA rated bonds may be the most suitable.

If you are young and beginning a long-term investment strategy, a bond fund with longer maturities may make more sense, as your need for income is not of paramount importance. Or, an aggressive fund that seeks to enhance investors overall return by actively buying and selling various bonds might be a viable option.

Risk and reward are inversely related; the higher the risk, the better the return. Some bond funds seek to maximize yield by investing in junk bonds. Thought the return is much higher, so is the attendant risk.

There are numerous bond funds available, which makes matching a particular fund with your investment objectives a fairly easy task.

In general, bond funds can be categorized as follows: actively managed funds, short- and long-term funds as well as passive, or exchange-traded funds (ETFs).

Each type has distinct investment characteristics that are tailored to investors diverse investment objectives. Given the meager spread between longer versus shorter dated instruments, there is no compelling reason presently for buying longer or intermediate bond funds.

ETFs vs. managed funds

As a general rule, ETFs have a lower cost structure than actively managed mutual funds. A distinct advantage of some active funds is that they can be nimble and adjust quickly to changes in the rate environment.

This is a distinct benefit in the current neutral and unpredictable interest rate environment. Although the Fed has stated that it doesn’t intend to raise rates that is not an ironclad guarantee, no matter how favorably the stock market has reacted to the Fed’s current stance.

Fed Chairman Jerome Powell has stated previously that his preference, given mixed economic signals, is to adopt a wait and see attitude on future rate increases.

Although the management fees of ETFs are lower than active funds, 10 years of brutal competition has forced actively managed funds to lower their fees substantially.

Before making an decision between active and passive, investors should carefully review the fee structure of active and passive funds and asses this against the total return figures for the fund for a specified period of time

Your choice may depend on your time horizon, your particular needs for income, and whether you want to seek the highest total return or are primarily interested in a reliable stream of current income.

Short-term funds

Most short-term bond funds invest in debt instruments with a maturity of one year or less. Currently, given the minimal difference between short and long-term rates, these short duration bond funds can be appealing.

The short-term holding can be advantageous in an uncertain interest rate environment.

When interest rates rise, the price of long-term bonds fall more in price than those with shorter maturities. The lower volatility to changes in interest rates makes them less risky than intermediate or longer-term bond funds.

The shorter maturities of the fund in conjunction with high yields relative to longer dated bonds allows you to take advantage of the high short-term rates without tying up your money in longer duration bonds.

A short-term bond fund can take advantage of changes in the yield curve by purchasing bonds with higher coupons as rates rise. This strategy can help you maximize your overall yield.

As of March 31 of this year, the largest ultrashort mutual fund, Pimco Short-Term (PSHAX) with $19 billion assets under management, had an annual yield of 2.63%.

Another option for investors in the current unsettled interest rate environment is the SPDR Bloomberg Barclays 1-3 Month Treasury Bill (BIL). It has a 0.14% fee structure and a 2.40% yield. At some brokerage firms, such TD Ameritrade and Vanguard, it can be purchased commission-free.

The important factor is to compare the differential or spread between Treasurys and high-grade corporate paper. If the difference is nominal, an investor is better off buying the Treasury bond fund, as the additional compensation for the risk taken with corporate bonds is minimal.

Where the spread, or risk premium, is narrow, investors need to carefully review the expense ratio of each particular fund or ETF, as any advantage of a slightly higher yield may be eaten up by the fee.

When purchasing short-term bond funds, be mindful of the composition of the fund’s debt holdings.

Some funds invest purely in Treasurys and seek to aggressively manage the assets to buy and sell particular Treasurys when rates either rise or decline.

Other funds are comprised of high-grade corporate bonds. They generally have higher yields than Treasurys, which are considered “riskless” investments.

High-yield corporate bonds

For those who are looking to maximize their income and are willing to assume greater risk, short-term funds that invest in lower rated corporates that are slightly above junk status may be appropriate.

The risk is that if the economy sours, many debt-saddled corporations may find it difficult to meet their credit obligations.

Currently, investment-grade corporate bonds rated BBB, a step above junk status, are yielding 4%; higher grade corporates are returning 3.7%.

Bonds with significantly lower ratings yielding 6.1% as of May 3.

Two funds in the high-yield category are the Fidelity Advisor High Income Advantage fund (FAHDX) and the Loomis Sayles High Income Opportunities fund (LSIOX).

Both purchase debt obligations that are riskier than the average high-yield bond fund, but may be appropriate for those who are comfortable assuming the additional risk. Both funds are rated by Morningstar.

There are a plethora of bond funds available that can match your particular investment needs, time horizon and tolerance for risk. By choosing carefully, an investor can maximize their income and total annual return.