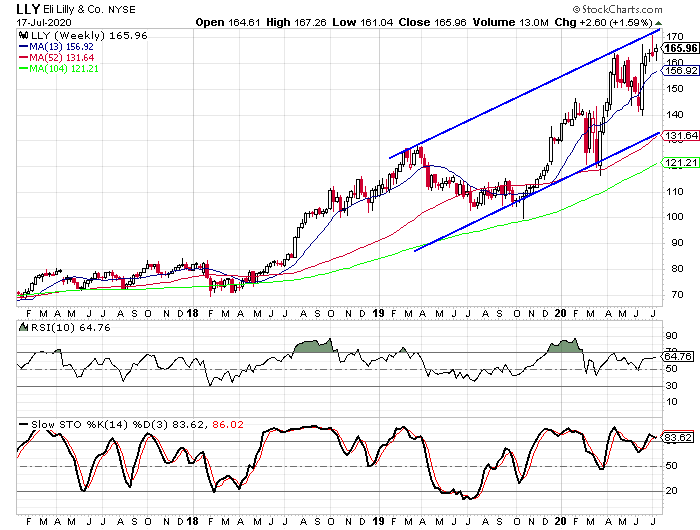

I am bullish on Eli Lilly (LLY), but I don’t own the stock yet. I would like to add the stock to my portfolio, but I don’t think now is the right time to buy it. The reason I don’t think now is the time to buy is because the stock is up near the upper rail of an upwardly sloped trend channel that has defined the various cycles within the overall trend.

We also see on the chart that Lilly is overbought based on the weekly stochastic indicators. Personally I would like to buy the stock down near the lower rail of the channel. Or buy it when the stochastic indicators are down below the 50 level and then make a bullish crossover. Timing my entry in such a manner would fit my investment style better than just randomly jumping in to the stock right now.

So what should I do? Should I just sit and wait to see if the stock pulls back and then buy it? That doesn’t make me any money and I’m not a big fan of having money on the sidelines doing nothing.

What I am considering is selling puts on Lilly and collecting the premium and then if the stock drops down to the strike price of the puts I sell, I will be obligated to buy the stock at that price. Let me give you an example.

Right now the October 140-strike puts on Lilly are selling for $2.60. That means that we would get $260 for every contract we sell. If I am interested in buying 100 shares of Lilly, I can sell one put for $260 and then wait until October 16 to see if the stock drops down to the $140 level. If the stock drops below $140, it doesn’t matter how far below, I am obligated to buy the stock at $140. That’s approximately 16% below the current level.

In order to sell the puts, you have to put up margin. In this case the margin requirement is $1,660 and we get $260 for selling the puts, so our return on margin is 15.7%. If the stock moves higher from here, we keep the $260. If the stock moves down to $150 between now and October, we keep the $260.

The only time we have to worry about the stock being put to us is if the stock drops below $140. If it does and we buy the stock, our cost basis is $137.40 ($140 minus the $2.60 we collected).

Put-writing? Make sure you want to own the stock

You can use this strategy to buy stocks at better prices and earn something while you wait. If the October options expire worthless and you still don’t own Lilly’s stock, you can repeat the process. You could do it four or five times per year if you want.

If you are going to use this strategy, I suggest that you only write puts on stocks that you really want to own. For instance, the reason I want to own Lilly is because of the fundamental analysis. The company has seen earnings grow by 19% per year over the last three years while revenue has been flat. In the first quarter earnings grew by 32% while revenue was up 15%. The company boasts a return on equity of 89.6% and a profit margin of 28.8%. These stats are the ones I find to be the most useful and they are what attracted me to the stock. Now I just have to find the right time to buy the stock.

Eli Lilly is set to report second quarter earnings on July 30 and that could make now the right time to write the puts. When a company is getting ready to report earnings, the implied volatility goes up and the price of the options usually increases ahead of an earnings report. As a put seller, a higher option price is very appealing.