If you aren’t familiar with ZTO Express (ZTO), it is an express delivery service in mainland China. It’s kind of like the FedEx of China. The company has done well in recent years and the stockholders have benefited from the company’s strong performance.

ZTO has seen its earnings grow by 22% per year over the last three years while revenue has grown at a rate of 29% per year. The company did see earnings drop by 33% in the most recent quarter when compared to the same period of 2019. Revenue was down 19% as the global pandemic took its toll. ZTO should report again in mid-August and the company is expected to show earnings and revenue growth once again.

A couple of other fundamental factors that got my attention were the management efficiency measurements. The company boasts a profit margin of 28.8% and a return on equity of 14.6%.

The fundamentals being positive is all well and good, especially for long-term investors, but it was a development on the chart that really got my attention.

Cycles within a channel provide an opportunity

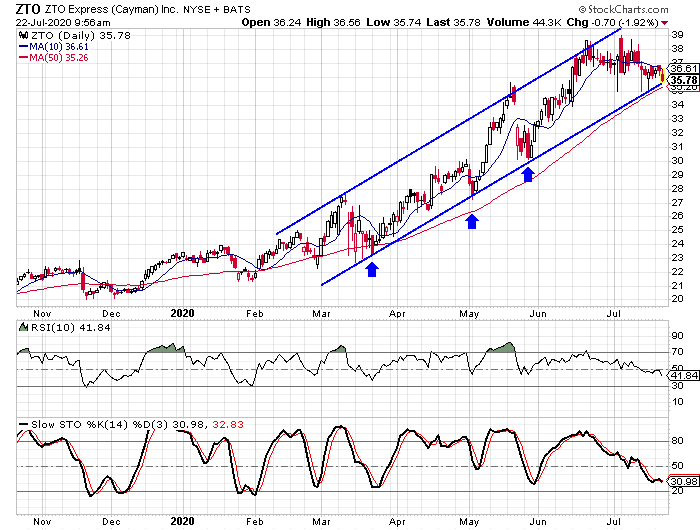

We see on the daily chart that a trend channel has formed for ZTO over the last four months and the stock is sitting right on the lower rail currently. The lower rail is just above the 50-day moving average and that gives the stock two layers of support that can help the stock bounce higher.

The stochastic indicators are pretty low and in the same area they were at back at the end of May and in March as well. The indicators haven’t been in oversold territory since the end of January. The indicators did make a bullish crossover earlier this week.

What really jumped out at me was the pattern of what happened after the stock hit what is now the lower rail of the channel. We see it in mid-March, early May, and again at the end of May. In all three of those instances, the stock gained at least 28% within the next month and a half.

From March 23 through April 28 it gained 28.9%. From the May 4 low through the May 19 high, the stock gained 30.9%. And from the May 27 low through the June 19 high it gained 28.5%.

Those are some pretty impressive gains and I think almost any investor would be happy with such returns. However, I think there is an opportunity to use the leverage of options on ZTO.

The recent low on the stock was $35.02. If the stock repeats the pattern and gains at least 28% over the next month to month and a half, that would put the stock price at $44.82.

The September options will expire on September 18 and that gives us almost two full months for the pattern to play out if it’s going to. The $33 strike options are priced at $4.20 currently and if the stock goes up to $44.82, these options will be worth at least $11.82 based on the intrinsic value. If it plays out exactly like that, investors would be looking at a gain of 181%. The options would double in value if the stock gains 16% from its current level.

To protect the downside, I would suggest closing the trade out should the stock fall below $34.50. That price level is far enough below the lower rail and the 50-day moving average that it shouldn’t be easy for it to be reached. It will also limit the loss on the options to less than 50%, at least theoretically based on different pricing models.