The financial sector was the first one to garner the spotlight in this earnings season and we saw some big moves in each direction for some of the companies that reported. Some of the big banks issued positive surprises while a few reported negative surprises. For the financial sector as a whole, a great deal of the risk associated with the earnings season has already passed.

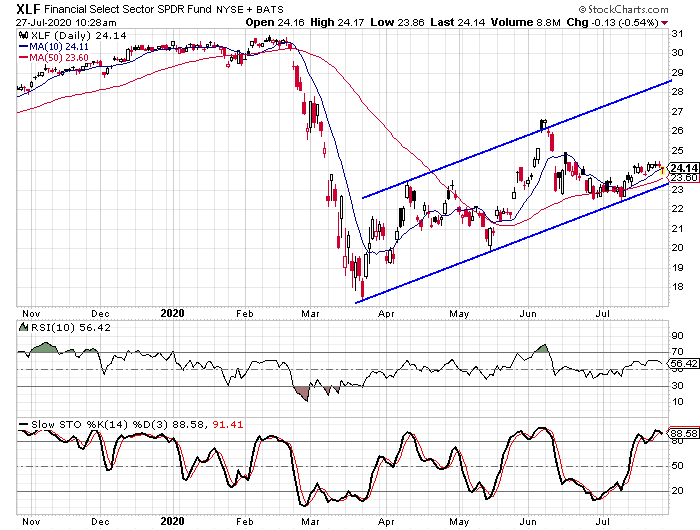

Something I took note of about the earnings reports was that they didn’t move the Financial Select Sector SPDR (XLF) out of its upwardly-sloped trend channel. The channel has formed from the March low with the May low connecting to form the lower rail of the channel. The ETF hit the lower rail again in early July and has since been hovering just above the trend line.

The 50-day moving average is just above the lower rail and that gives the XLF two different forms of support. Because of the support, I see the XLF moving higher over the next few months and I found an options trade that can provide a pretty significant reward while exposing investors to very minimal risk.

The leverage of options

The October options will expire on October 16, and that date is just before the next round of earnings should start for the big banks, so we won’t face that risk again between now and then. At the present time the XLF is trading at $24.10 and the October 20-strike calls are priced at $4.40. This means that investors are paying $4.10 in intrinsic value and only $0.30 in time premium. And you are getting three months for the trade to play out.

If the XLF moves up 15% over the next three months, it would be trading at approximately $27.73. The 20-strike calls would have an intrinsic value of $7.73 if that is the case and that would mean a 75% gain in the options from where they are trading today. That gives us leverage of 5 to 1 — a 15% gain in the fund leads to a 75% gain in the options.

On the downside, I would be concerned if the XLF fell below $22.50. That is below the lower rail and it is below the 50-day moving average. If we set a stop-loss to close the trade if the XLF drops below $22.50, it would be a decline of only 6.7%. If that happens, the October 20-strike calls would likely be trading around $3.00. That price is based on the current price and the delta of the options. Should the options drop to $3.00, those that bought them at $4.40 would be looking at a loss of 31.8%.

One of the biggest worries for many option traders is time decay. Because options have an expiration date, the premium loses a little value with each passing day — that’s time decay. The common term for measuring time decay is expressed as theta. The theta for these options is currently at -0.0051. That means the price will decay at approximately half a penny per day. The reason the theta is so low is because of how deep in the money the options are and how far out the expiration date is.

Because of the upside potential and the fact that most of the top holdings within the XLF have already reported earnings, I feel the risk is reduced greatly at this time. And as for having the XLF rally by 15% over the next three months, the fund rallied over 33% during the March to April rally and again during the May to June rally.