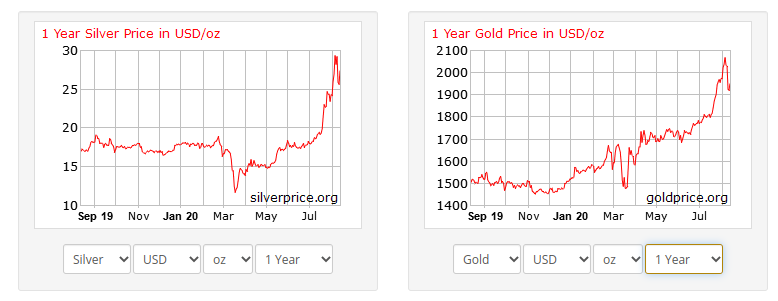

Many analysts predict that gold is going to increase dramatically and is ripe for buying. Some are saying that it can go as high as $5,000 per ounce.

Gold is often bought as a hedge to inflation and prevent loss of purchasing power. In the midst of the uncertainty in the markets, it is highly likely many buyers will listen to these analysts and purchase either the metal or gold ETFs, causing the price to increase.

Additionally, futures traders could also get on board and buy on speculation of an increase.

Whether these analysts’ forecasts will come true, there are ways that you can benefit from the increase in the price of gold. One is to buy gold investments, such as ETFs or gold mining stocks.

The other, less expensive way is to purchase silver metal or silver ETFs. Silver has a correlation with gold and the investment vehicles work similarly to the gold investments.

In good economic times, the correlation grows further apart because silver’s industrial and monetary uses have been reduced over the years. One of the main industrial uses that has pretty much vanished over the years is photography. With the advent of digital photography, the need for the element has dropped severely.

Like with gold, you can take advantage of the surge in silver prices with ETFs, such as Global X Silver Miners (SIL) or iShares Silver Trust (SLV). SIL is the miner’s index and SLV is based on the metal’s spot price; using either one gives you benefits.

SLV has about a 27% YTD return with more upward movement still available and positive growth over the last few years. SLV is up an astounding 72% since March when the S&P 500 is only up 25% during the same time.

You can buy and hold SLV as a regular investment as if you owned the actual precious metal.

Increase your profits

It is unlikely that gold will skyrocket to the level or as soon that the forecasters are predicting. However, it will most likely increase due to the uncertainty in the markets and you can benefit by using a conservative options strategy.

A better way to take advantage of the rise of silver is to sell options on those same ETFs.

Options allow you to mitigate the risk inherent in the markets. For example, if you were to purchase SLV, you will have to wait until you sell to earn you profit.

But when you sell a put option contract you can generate immediate income as you purchase the asset. If you sell a slightly out-of-the-money (OTM) put option, you will receive a premium and one of three things can happen — the price of SLV goes up, sideways, or down.

If the price of SLV goes up, you can close your put with the buy-to-close (BTC) at a lower price than you sold it for.

You can then pick up another slightly OTM option to receive more premium. You can do this over and over to increase your portfolio to meet your goals.

If the price goes sideways, you can let your contract expire or close it out, and then repeat it again as you would if the price goes up.

The third way is a little more challenging but not something that can’t be stabilized.

There are two things you can do if the price goes down. You can BTC your position to diminish your losses, but you won’t lose more than if you owned the stock itself and maybe even a little less.

If the price moves down one dollar, you can close it for a loss for about one dollar. If there is only a day or two left before expiration, the price will be less because of time decay, also known as theta.

As time decays the amount of the options decreases, which is why you won’t get a good return for selling an option late in the contract period.

The other way is that you can let the contract expire and have the shares put to you and you can sell a call with those shares to recoup some of your losses. So, you have two out of three chances of profiting rather than buying the stock outright.