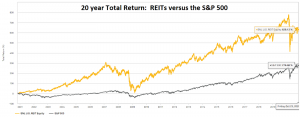

I came across two charts this past week that I think make a formidable case for owning real estate investment trusts (REITs) in general. Please refer to the chart below.

The above chart shows the total return of the overall REIT sector versus the S&P 500 over the past 20 years.

Over this time period, the REIT sector has generated an aggregate return of 629% versus the S&P 500 at 277%. Hence, the sector has more than doubled the return of the broader market.

Despite this overwhelming outperformance over the long term, there still have been times to make tactical adjustments in and out of the REIT sector to produce even better alpha relative to the general equity market. Please refer to another chart below.

Shown in the chart above is the spread between the U.S. REIT dividend yield and the U.S. Treasury bond yield going back 20 years.

Obviously, when this spread is wider, REITs are a more attractive investment vehicle versus bonds, certainly from an income-producing standpoint. But a comparison of the two charts above shows that a wide/narrow spread also has been an excellent time tool for buying, selling, adding, or trimming REITs.

In 2003, the spread went above 300 basis points. The REIT sector subsequently sported robust investment performance from 2003 to 2007, nearly three times the overall market performance.

Negative spread

Between mid-2006 and mid-2007, the spread was a negative 100 basis points on average. Bond yields were thus above REIT yields. Look at what happened subsequently, from 2007 thru early 2009. REITs grossly underperformed the S&P 500 by a factor of over two times.

From the end of 2011 through the full year of 2019, this spread ranged from 150 to 200 basis points. This was still enough of a positive amount, however, to subsequently result in outperformance of the REIT sector versus the S&P 500 between the years 2012 through 2019 by a factor of nearly 1.25 times.

At present, the overall REIT sector yield is approximately 3.9% and the 1-year Treasury yield stands at 0.9%, for a spread of around 300 basis points. The historical correlation between this spread and the subsequent REIT sector relative return is vividly displayed in these two charts.

If history is any guide, the next several months look to be a fine time to be invested in REITs.