Currently, most money market funds or bank accounts offer little to no interest, effectively making funds held there dormant and not working in any way for you.

So I’ve designed and am currently personally using a simple cash alternative portfolio built around low cost Vanguard Exchange Traded Funds (ETFs).

The portfolio I have set up as an alternative to this maintains a low maturity and duration, has a high quality bias to it, sports solid reward/risk metrics, and provides an approximate 2% dividend yield for investors.

The cash-alternative model portfolio is structured as such:

- 20% BSV Vanguard Short-Term Bond ETF

- 20% VTIPS Vanguard Short-Term Inflation Protection Securities ETF

- 20% VMBS Vanguard Mortgage-Backed Securities ETF

- 20% VSCH Vanguard Short-Term Corporate Bond ETF

- 20% VGSH Vanguard Short-Term Treasury ETF

Each of these funds hold three stars or higher in the Morningstar rating assessment, hold a Gold or Silver rating in the separate Morningstar Analyst Rating or both.

Analyzing this portfolio through Morningstar’s comprehensive portfolio analyzer, I note the following attributes:

- Blended expense ratio of .05% (5 basis points)

- Blended maturity of 2.77 years; Blended duration of 2.66 years

- All investment grade: AAA 74%, AA/A 14%, BBB 12%

- Three-Year Risk & Return Statistics:

- Standard Deviation 1.49% vs Benchmark 2.03%

- Mean Return 3.26% vs Benchmark 3.25%

- Sharpe Ratio 1.04 vs Benchmark 0.76

- Down Capture Ratio (relative to Benchmark) 42%

- Average weighted coupon rate 2.19%

- Benchmark: US Treasury T-Bill 3 Year

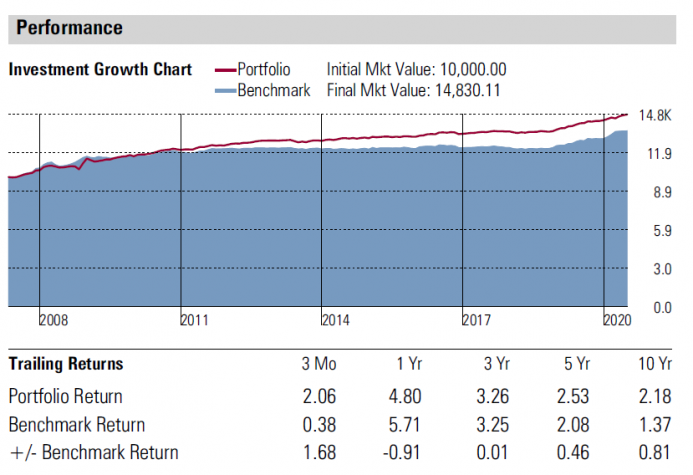

The chart above shows the historical back-test of this portfolio as of the last full quarter end date of June 30, 2020.

For the most part, the portfolio has produced positive excess returns over several years. An amount of $10,000 invested in this portfolio in 2007 would have grown to $14,830 today as compared to approximately $13,300 if invested in the benchmark.

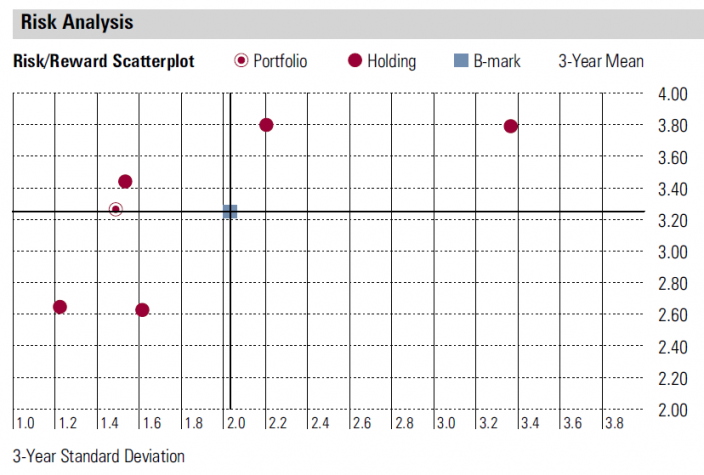

The chart below shows a risk/reward scatterplot visually displaying the higher risk-adjusted return of this portfolio relative to its benchmark over a three year period.

While the return is close to the benchmark return, it has produced this return with a measurably lower standard deviation.

One needs to keep in mind that in today’s ultra-low rate environment it is necessary to extend out on maturity or duration to some degree in order to generate any monthly income. There is no free lunch!

However, I believe this portfolio does so in a lower risk and efficient manner using these very well managed Vanguard funds with razor thin expense ratios.