When the vaccine results from Pfizer (PFE) were announced on November 9, it sent the stock market on a wild ride. Sectors that had been underperforming the overall market screamed higher while stocks that had been outperforming since the pandemic started got hit with massive selling.

Oil stocks, airlines, and travel industry stocks saw huge gains. Work from home stocks and the tech sector saw some pretty sizable declines.

One stock that lost ground last week was McCormick & Company (MKC), the spice, seasoning, and condiment manufacturer. Sure the company has likely benefited from the current economic environment with more people cooking at home, but I don’t look for the sales to go backward anytime soon.

McCormick has seen revenue grow by 5% per year for the last three years and it increased by 8% in the third quarter of 2020. Analysts expect 2020 as a whole to maintain the revenue growth rate of 5%.

Earnings have grown by 11% over the last three years and they were up 5% in Q3. The overall growth for 202o is expected to show growth of 7%.

Those growth rates might not seem all that impressive, but for a consumer staple company those rates of growth are pretty good. McCormick also has good management efficiency measurements with a return on equity of 21.7% and a profit margin of 15.7%.

Buying opportunity

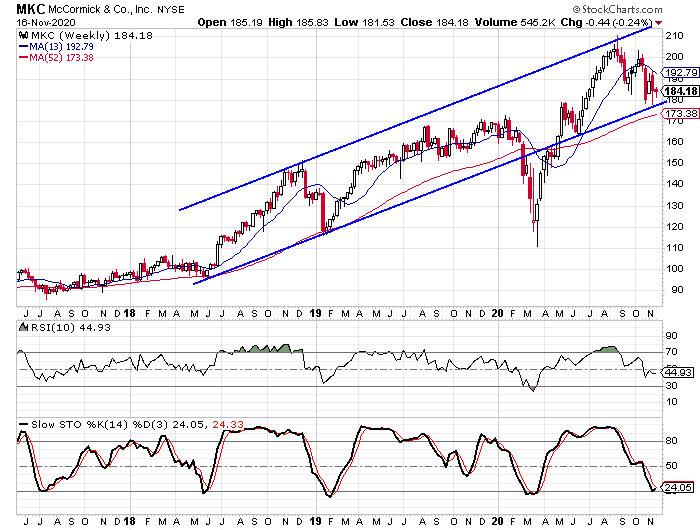

If we look at the weekly chart, we see that the stock has dropped a little in the last three months and that pullback has brought the stock down to the lower rail of a trend channel that has defined the various cycles within the overall upward trend.

We also see that the weekly stochastic indicators are right at oversold territory and it is only the fourth time in the last three years where the indicators have been this low. Each of the other instances preceded pretty substantial gains over the following six months.

The gains in 2018 and 2019 were 56% and 44%, respectively. The gain this year was much higher, but that was an exceptional selloff and bounce back.

If we see a similar move to what we saw in 2018 and 2019, I look for McCormick to move above the $250 level in the next six to seven months. Another reason I expect such a big move is based on the bearish sentiment toward the stock.

Only two of the 11 analysts following the stock rate it as a “buy” with five “hold” ratings and four “sell” ratings. The short interest ratio is at 4.9 and that is well above average. What these two sentiment indicators tell us is that analysts and short sellers are far more bearish toward McCormick than they are the average stock. If that sentiment flips to a bullish stance, it can help drive the stock price higher.

As for how best to take advantage of the move, I like the idea of buying the June 2021 170-strike calls.

With the stock trading at $184.18, the options are trading at $22.90. If the stock moves up to the $250 level like I think it will, these options will be worth $80 on an intrinsic basis. In order for the options to double, the stock only needs to move up to the $216 area.