“A house divided against itself cannot stand” is one of the most memorable lines of Abraham Lincoln’s renowned oratory.

However, maxims in politics do not necessarily hold when it comes to investing.

There are still uncertainties whether the Senate will flip to Democratic control. We have two Georgia runoff elections in January with which to contend.

A Democratic sweep could give the incoming Biden administration control of all three branches of the government, the same as President Trump enjoyed in his first two years in office.

Given the circumstances, it is useful to look at historical return patterns. A divided Congress, it turns out, may not be so bad for financial markets after all.

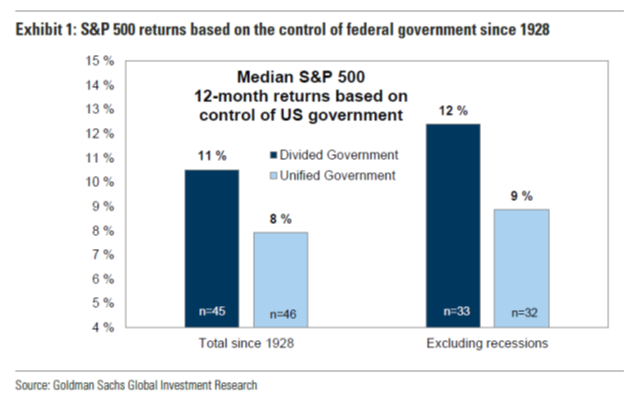

In the United States, equity returns during periods of divided federal government have typically exceeded returns achieved when one political party controls the White House, Senate, and House of Representatives.

Since 1928, excluding recessions, when the federal government was controlled by a single party, the S&P 500 median 12-month return equaled 9%.

In comparison, the median return under a divided government was 12%.

However, this same analysis also shows the returns variance to be tighter for the divided governments occurrences vs. for the unified governments.

The return data above encompass all periods, election and non-election years. Interestingly, equity returns for the two-month period immediately following an election show a different story.

Since 1928, when the election resulted in a divided government, the median stock market return between Election Day and year-end equaled 1% compared with a 3% return when the outcome was a unified government.