Financial bubbles and bursts are difficult to spot and time.

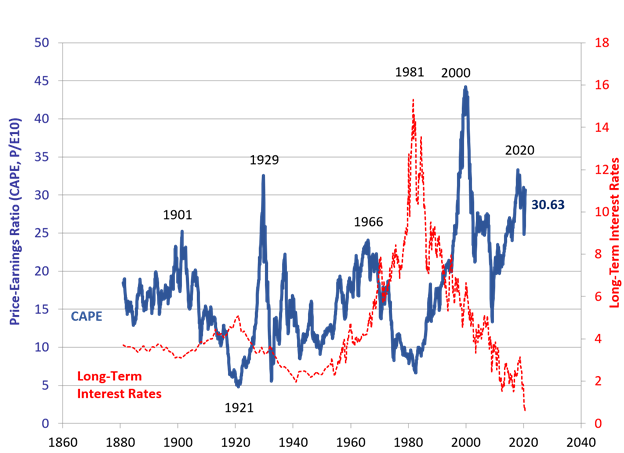

Professor Robert J. Shiller’s chart of historical S&P 500 price to earnings ratios is a yardstick for U.S. stock market valuations, which are currently at very high historical levels.

Below I outline tools that can help reduce portfolio risk.

Some preliminary steps

- Organize and declutter your portfolio. List holdings and determine long term investment goals.

- Reduce appreciated and undesired positions.

- Identify and reduce the riskiest positions. Looking at historical price moves during turbulent periods will help size potential losses in a downturn.

- Address other risky elements such as margin, oversized positions, and near-term economic needs. Seek professional help if needed.

- Picture an ideal, balanced portfolio. Size allocations to risks you can tolerate. Revisit periodically, making and implementing plans each time.

Five option strategies to reduce risk

1. Protective puts

A long asset position combined with a long put. It is a simple and effective way to protect assets against downward moves. Until the put expires, no risk remains below the strike.

The main drawback is the option premium cost. Usually it’s a poor index strategy, as out of the money low strike index puts have relatively expensive premiums.

2. Collars

A higher strike covered call can be used in combination with a protective put, with the same expiration. The resulting strategy is well suited for reducing volatility of individual stocks. Payouts can be attractive for growth and technology stocks like Tesla (TSLA) and Amazon (AMZN), where high strike calls command higher prices than low strike puts.

3. Index bear put spreads

Stock indexes are “skewed” towards lower strikes, which command higher relative value premiums. Index skews can be exploited by selling low strike options, while buying higher strike options.

As an example, use a SPDR S&P 500 ETF Trust (SPY) three month out of the money puts, struck 10% below the current price of SPY cost 4.25% of the ETF. If struck 20% out of the money, same expiration puts cost 2%. Thus, a 10% to 20% three-month bear put spread costs 2.25% of the notional. A put spread with the same strikes and a year expiration costs 2.5%. The maximum payout of the strategy is 10%.

4. Haven assets bull call spreads

Haven assets rally when risky assets sell off. Yen, gold, and long-dated U.S. Treasuries are considered as havens.

The asset class low yield favors using options to add exposure, minimizing the cash used.

Gold can be traded via SPDR Gold Shares ETF (GLD). GLD options have relative high premiums for high strike calls, compared to lower strikes.

Bull call spreads are constructed buying a call, and simultaneously selling a higher strike call. Both options expire on the same date.

A one year out-of-the-money call, struck 10% above the current GLD price costs 5.5% of the ETF price. A GLD out-of-the-money call for the same expiration struck 20% out of the money costs 3.5%. Thus, a 10% to 20% GLD out of the money bull call spread costs 2% of the current gold price. The maximum payout of the strategy is 10%.

Similar strategies can be constructed for iShares 20+ Year Treasury Bond ETF (TLT). Gold is a better hedge against inflation than treasuries.

5. Covered calls

A long position in an asset combined with a short call option on the same asset.

Resulting positions remain mostly unchanged in upward price moves. In downward moves, losses are partially offset by the option premium. Main drawbacks of the strategy are the limited upside and unprotected potential for depreciation below the strike.

A good choice for highly volatile stocks. They also release cash from existing positions and lower their cost basis.

Short term at the money covered calls collect more premium than longer term ones. At the money three-month premiums are about half of those for same strike one-year options.

Low strike options on indexes also command high relative value premiums. A year call struck 20% below the current price of the index for the iShares Russell 2000 ETF (IWM) costs 24% of the price of the index, removing risk above the strike while pocketing the premium and preserving additional income from dividends.

Disclosure: I hold SPY and related option positions in a net long.