Thanks to a long-running stable interest rate climate, holders of low-grade corporate debt — so-called “junk bonds” — enjoyed higher returns while assuming relatively minimal additional risk.

Now that the Federal Reserve has announced its intention to raise rates, though, the good times for high-yield bonds may be over.

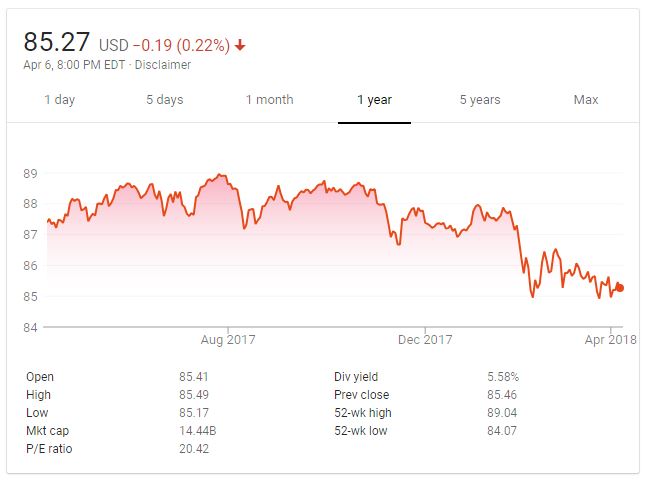

Recently, investors have become increasingly leery of the junk bond market, shunning risk as rates rise.

Junk bond ETFs have been hit especially hard as the reality of rising short-term interest rates takes hold on fixed income investors used to long periods of minimal rate increases.

According to Bloomberg News, during the week of February 5th investors withdrew $6.3 billion from high-yield bond funds.

Bond ratings are assigned on a sliding scale. With slight variations in between, Standard & Poor’s scale runs the gamut from AAA for the safest down to BBB for the riskiest.

Recent changes in the bond market have made holding Triple-B rated debt less appealing. Normally, lower-rated bonds trade at a higher yield as their credit-worthiness is much less than their AAA-rated cousins.

The risk premium measures the additional return investors demand for assuming the additional risk relative to Treasury Bonds.

This premium recently increased to 1.34% from 1.08%. The additional increase makes existing junk bonds worth less; the lower the rating, the steeper the percentage price decline.

Additional concerns are mounting. First, the amount of debt acquired by U.S. corporations of the last 10 years is staggering — particularly in the lower-rated corporate bonds.

Snowball effect

According to Morgan Stanley, there is currently $2.5 trillion in outstanding U.S. debt of companies rated Triple B versus $686 billion a decade ago.

One of the reasons for the increase is undoubtedly the favorable low interest rate environment for the past 10 years. But a significant portion of the increase is because many corporations have issued substantial low-grade debt for mergers and acquisitions.

There are a number of scenarios that could bode ill for holders of Triple BBB corporate debt.

In addition to the staggering amount of debt that many corporations have assumed over the decade, a slight economic downturn that impacts sales and revenues could have a negative effect on some corporations that are already top-heavy with debt, increasing the risk of failing to meet their debt-service obligations.

Those who continue to hold bonds risk further price declines that could accelerate in an environment where the expectations of inflation continue to rise.

This would prompt a renewed round of rate increases by the Federal Reserve. The yield curve would respond accordingly and the face amount of Triple B corporate bonds would decline.

Finally, some investors are concerned that the current ratings assigned to low-grade bonds do not fully reflect the additional risk given the dramatically different interest rate climate.

Should ratings be adjusted downward for some corporate issuers, it would have a snowball effect that could spread to the rest of the junk market.