Florida-based risk ratings firm Weiss Ratings has released the first formal rating for cryptocurrencies — reviewing thousands of data points on each coin’s trading patterns, technology, and usage.

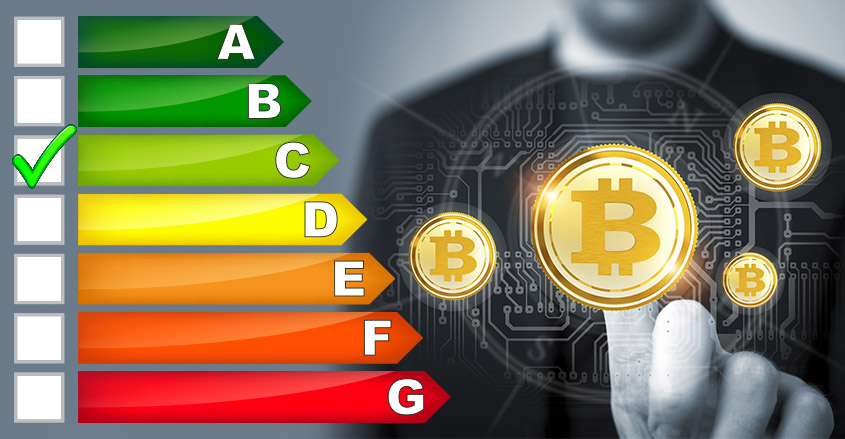

Bitcoin gets a C+, while Ethereum rated a B. No coin on the list got an A.

Weiss instead lays out the case for developing a more mature ecosystem for both crypto currencies and blockchains clearly and persuasively.

“Despite early growing pains, cryptocurrencies and blockchain technology are emerging as a potentially powerful force that could affect investors and consumers in profound ways.

“Indeed, the unprecedented speed of the changes is a telltale sign of a global paradigm shift — in e-commerce, banking, communications, social networking, Big Data, the Internet of Things, possibly even essential pillars of government and society,” the report said.

“Depending on how institutions and the public interact, the paradigm shift could be disruptive and revolutionary, fostering greater extremes of boom and bust, aggravating income inequality and creating more political divisiveness.”

Crypto currencies have been difficult to rate and review analytically, resisting easy classification or clarification.

Ethereum, Steem, Cardano, EOS and NEO all ranked higher than Bitcoin even though EOS hasn’t been launched yet. Weiss responded to an initial wave of criticism from Bitcoin fans.

“Bitcoin falls short in two other important areas: Our Risk Index, reflecting extreme price volatility, and our Technology Index, reflecting Bitcoin’s weaknesses in governance, energy consumption and scalability,” the firm said.

Weiss bases its results on four major factors: The Cryptocurrency Risk Index, The Cryptocurrency Reward Index, The Cryptocurrency Technology Index, and the The Cryptocurrency Fundamental Index.

Methodology

Weiss Ratings has provided research and analysis for consumers and business professionals for 46 years with 55,000 investments reviewed.

It offers financial strength ratings on the U.S. and global banks, other banks and thrifts, credit unions, health insurers, life and annuity insurers, property and casualty insurers, Medicare supplement insurance, and Medicare prescription drug coverage; and sovereign debt ratings.

The company is well respected and considered ethical and insightful about complex markets and their risks and rewards. Still, some in the crypto industry have concerns about Weiss’s methodology.

“It’s odd that Weiss is touting the fact that they don’t take compensation for their services,” says Jay Blaskey, a digital currency specialist at BitIRA. He told Investopedia that such ratings may not be as applicable for cryptocurrencies as it is for credit ratings.

“I expect this to be the first of many more systems to come, especially as more and more participants in the financial ecosystem integrate these assets into their business models,” he said.