The fund automatically reallocates the bond to equity percentage weighting in the retirement account. Given their popularity, TDFs have had an out-sized impact on the market.

In no small measure, these automated funds have helped support the 10-year long bull market.

Target-date funds were marketed to individuals in the early years of their employment history as a convenient way to ensure that risk in their retirement investment accounts was allocated appropriately.

For those individuals with no investment experience who were starting their careers, target-date funds freed them from the worry of making suitable choices.

Target-date funds are funds that invest in other funds. They are designed to provide an overall investment umbrella comprised of a mix of segregated mutual or index funds whose investment objectives vary over time.

The fund manager shifts the allocation or mix between equity and bond funds as an individual’s retirement approaches. The purpose for the reallocation is to lessen the amount of investment risk assumed commensurate with the number of years to retirement.

Target-date funds are offered with specified dates in the future. For example, an individual planning to retire in 30 years would chose a TDF prefixed as a “2050” fund.

The strategy is to decrease the amount of stocks or other investments with inordinate risks at predetermined or targeted periods in the investor’s working years.

In general, the funds seek to provide the investor with as little risk as possible upon retirement so as to maximize the amount of income generated by the fund. This is done by automatically increasing weighting in low risk interest-bearing bonds.

Because the fund makes the necessary years-to-retirement portfolio changes automatically, the investor is freed from making the necessary risk-tolerance readjustments himself.

Investment objectives are implemented by automatically shifting the investor into funds with a specified and suitable percentage of equities versus bonds.

Impact on the stock market

These unique retirement savings vehicles have had a profound impact on the market.

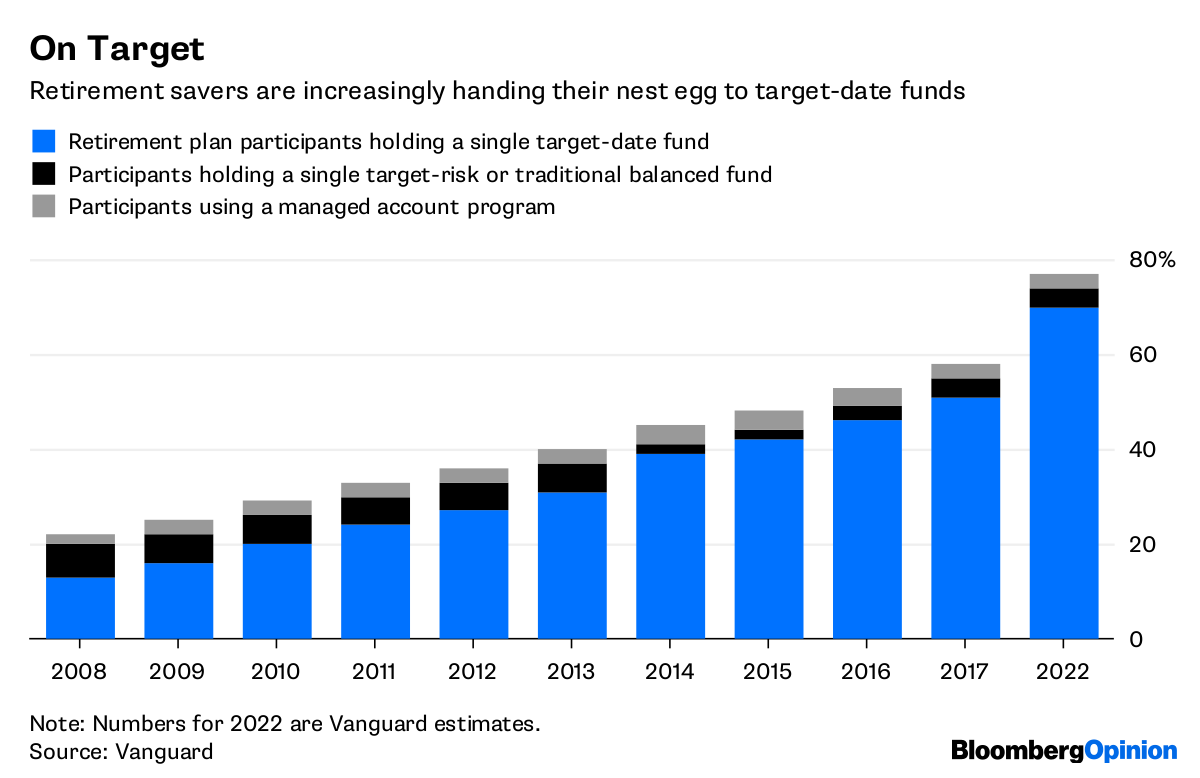

Consider the following: According to Morningstar, during the first seven months of 2019 investors poured approximately $36 billion of new money into TDFs.

That amount brought total TDF assets under management to a staggering $1.27 trillion. It is also instructive to note that target-date funds are now the preferred investment vehicle for workplace 401(k) retirement plans.

The principal reason TDFs have proved crucial for the continuation of the bull market is the manner in which they allocate between equities and fixed-income investments and how this strategy, despite short-term market turmoil, has facilitated a decade of relatively low-market volatility.

The TDF strategy overall has had a beneficial impact on the stock market because it has provided the market with a mechanism that insures a steady influx of funds on a recurring basis.

This has helped support the upwards trajectory of the market for the past decade. Investors with TDFs are not likely to shift their fund mix during periods of short-term market volatility.

In this regard, it is interesting to note that, according to Morningstar, there were a total of 652 target date funds as of Dec. 31, 2018.

Every single one of these funds lost money during 2018. The average decline among these funds, was 6.2% while the S&P 500 fell only 4.4%.

So why was there no panic among 401(k) investors when the market dropped?

Market stability

One of the reasons 401(k) target-fund investors remain calm when the market drops is that each TDF reports blended returns.

That means that any gains in bonds are counted against the stock losses, and an investor can’t sell stocks in the fund because the assets are inseparable and indivisible.

This instills discipline on 401(k) investors and induces them to look at the long-term and ignore short-term changes in the stock market. Indeed, for this very reason, investors pulled funds out of target-date funds 25% less than from conventional bond and stock funds during the 2008 financial crisis.

Another important reason why TDFs have helped buttress the market is stocks have offered far greater returns over bonds during the past decade. This has changed the risk profile of the funds’ portfolios, resulting in a gradual increase in the stock component of the portfolio.

As an example, Morningstar reported that in 2005 the asset weighting in Fidelity’s target funds was 58% in stocks for investors a decade away from retirement and 20% in stocks for investors 10 years into retirement.

Today, the equity mix for the same pre- and post-retirement time horizon is 67% and 34% respectively. TDFs increased stock weighting in the investment mix for longer periods of time, providing additional funds for the stock market.

An additional factor for the increasingly higher weighting of stocks in TDFs for longer periods of time is that the average life expectancy has increased over the last 30 years. What this means is that a 70-year-old in retirement may still have a 20-year horizon.

Living long means less money in bonds. Thirty years ago, there would have been more bonds in the traditional asset mix.

A few words of caution about conventional wisdom and TDFs: Most individual as well as institutional investors have heavily favored the stock market because of a decade-long investment environment of historically unprecedented low interest rates.

The Federal Reserve’s recent rate reductions would seem to indicate that low-rate conditions will continue for the foreseeable future. However, when the next market crash occurs the entire target-date investment philosophy favoring a slightly higher equity weighting may be tested.

Should this result in a massive selloff of target-date funds, the long-running bull market may be stopped in its tracks.