Golf equipment manufacturer Callaway Golf (ELY) halted a short downward trend and has moved higher over the last few days. The bottom of that short-term trend came at the lower rail of a trend channel and now the stock looks like it is headed for an upward swing.

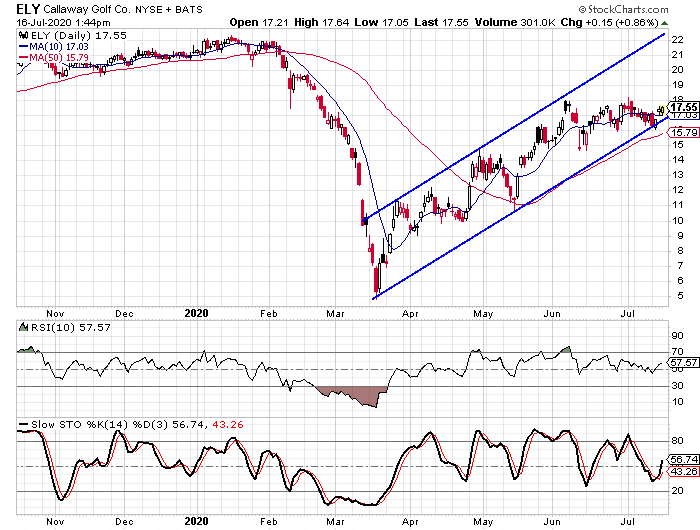

Looking at the chart we see that the lows from March and May form the lower rail of the channel with the upper rail being formed from the highs in March, April, and there was a close call in early June.

What is really interesting is that the stock hasn’t really dropped since hitting the high in June. It has been more of a sideways grind and that has allowed the lower rail of the channel to catch up and provide support.

The daily stochastic indicators had dropped down to the 30 area and have since reversed. We see similar patterns in late April, mid-May, and mid-June. The instances in April and May both preceded pretty sharp upward moves in the stock. From the low on April 23 to the high on April 30, the stock jumped 47.5%. From the low on May 14 to the high on June 5, the stock jumped nearly 67%.

The low on July 14 was $16.11, so a jump of 47.5% again would take the stock up to just over $23.75 and a jump of 67% would take the stock up to $26.90.

Obviously there is no guarantee that the stock will repeat what happened in April or May, but it isn’t unreasonable to think the stock can make another big rally either.

Right now the upper rail is up above the $22.50 level and it is moving higher each day. If the stock were to jump sharply, it would take a move of 27.6% to move the stock from its closing price on July 16 to where the upper rail is at this time.

Fundamentals and sentiment should help

Beyond the technical analysis, Callaway Golf has some other factors that could help propel the stock higher. On the fundamental side, the company has seen earnings grow by 33% per year over the last three years while revenue has grown by 23% per year over that same time period. The company should report earnings again in the first week or two of August based on when it last reported. The company’s investor relations calendar didn’t show a set date and time yet.

Another factor that could help Callaway move higher is the stock’s short interest ratio. The ratio is at 8.5 currently with 17.52 million shares sold short and average daily trading volume of 2.06 million.

The reason a high short interest ratio is good, at least from a contrarian viewpoint, is that it can help propel the stock higher. If the stock price continues to climb, short sellers may be forced to close their positions and that adds buying pressure to a stock that is already climbing.

If you wanted to be more aggressive and use options to take advantage of a rally, the September 15-strike calls would be my first choice. These options don’t expire until September 18 and they are currently priced at $3.60 or $360 for each contract. If the stock rallies up to $22.20 these options will double based on the intrinsic value. Investors would get a 200% gain should the stock rally up to $25.80.

Based on the trend line and the recent low, I would recommend a stop-loss at the $15.75 level. That is slightly below the 50-day moving average and pretty significantly below the lower rail of the channel. This gives the stock some room to drop without shaking you out of the trade.