Top investors often have divergent approaches to investing, but they all agree that to make money you need to have a set of fundamental principles around which you should build your investing strategy. Here are seven of the world’s most outstanding money managers, gurus of investing with long-proven track records. Take a look at some […]

Category: Real Academy

Creating an ETF Portfolio That Delivers Powerful Returns

Low-cost exchange traded funds (ETFs) have made it easier for individual investors to build investment portfolios that rival those used by wealth managers. Long-term investing at a lower cost means better compounding returns for retirement. Not all ETFs are equal, so creating an ETF portfolio requires focus and diligence. Exchange-traded funds (ETFs) have experienced rapid […]

Naked Put Options Trading Means Unlimited Risk? Hold On There…

You have probably heard or read that selling (writing) uncovered puts, also known as naked puts, is extremely risky. This is actually true, but only part of the story. The whole truth is — all market investing has risk! As with any investment strategy, there are trade-offs along with downside consequences. As a whole, selling […]

3 Income Generating Option Strategies

Interest rates are at historically low levels, creating investor appetite for income producing strategies. Below I present three option strategies that seek to generate income from stock positions. Covered calls The strategy consists of selling a call option against a stock position. The option is sold for an upfront premium. The option buyer acquires the […]

Opinion: Value Investing Is Dead? Not By a Long Shot

According to some, hunting for stocks that are undervalued as a basis for portfolio selection — commonly called value investing — has been out of favor as former value investors have embraced higher-risk growth stocks. The idea of researching companies with the goal of buying stocks that are cheap or undervalued was an investing philosophy […]

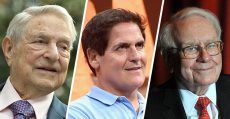

Wealth Building Tips From Soros, Cuban, and Buffett

Billionaires George Soros, Warren Buffett, and Mark Cuban did not become rich accidentally. They made consistently smart investment decisions, which helped them create great personal wealth as well as economic value for society. While there is no guarantee that what worked for them would also work for you, here are a few vital tips from […]

4 Red Flag Warnings of a Bad Stock Investment

When looking to buy a company that you want to add to your portfolio, there are several things to look for. There are also several things to beware. I believe that any of the following red flags — signs of a bad stock investment — are sufficient cause to pass on a specific company. Major […]

3 Simple Money-Making Rules for Stock Investors

There are lots of different ways to invest and so many companies to choose from. It can become overwhelming, especially for a new investor. If you are new to investing or are thinking about getting into the stock market for the first time, there are three things I believe everyone should know. Think simple The […]

These 5 Numbers Determine When to Buy a Stock

It can be overwhelming when you are evaluating a company and considering adding it to your portfolio, but I believe there are five numbers that are key with any company. Before investing any money into a company, make sure you look at these five numbers. They can tell you exactly when to buy a stock […]