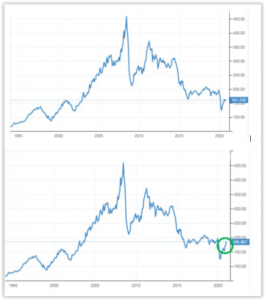

Is there a commodity super cycle in its early formation? Take a look at the two charts below.

They show the Commodity Research Board (CRB) Index. This index tracks the futures prices of 19 commodities, including aluminum, coffee, nickel, cattle, silver, and oil. The first chart is as of October of last year.

The second chart is as of now with the green circle showing the move since October.

In all fairness, it is a small move up so far. To be more precise, that encircled part of the chart reflects about a 15% move up in the CRB Index.

However, there is a lot of information out there right now that gives some merit to this being just the start of a multi-year bull market in commodities.

For one, we have gone through decades of under-investment in mining, oil, copper, nickel, etc. as the economics simply weren’t there to justify this production activity.

As the global rebound takes hold in a post-COVID world, the supply shortfall across many commodities as a result of this production shortfall will likely become apparent, resulting in robust pricing in many areas.

Do you believe the green energy movement will continue to gain momentum and traction? Well, this will require huge amounts of nickel, copper and silver and other base metals for items such as solar panels and wind turbines.

Is it your belief that electric vehicles (EVs) are the wave of the future? You better have plenty of copper on hand to facilitate that, as it is used extensively in the wiring, inverters and charging stations.

Buckle up

How about the batteries that power all of those EVs? You are going to need a lot of nickel and lithium as well for that. You get the picture — all of these promising new technologies will require an enormous amount of commodities.

Secondly, the very large fiscal and monetary expansion we are seeing today could result in dollar debasement and higher inflation, which will ultimately result in higher commodity prices.

The key driver of higher inflation is too much money chasing too few goods. Superimpose that on the supply-demand scenario I outlined above and you can see some ammunition for the argument that we on the forefront of some type of a commodities super cycle.

The unknown is basically the depth and magnitude of this new cycle. So strap yourself in and buckle up! We may be on for quite a ride on a commodity supercycle over the next few years.