How are consumers set up now as we move into the COVID vaccination phase and eventually arrive at some point with the virus in our rear-view mirror?

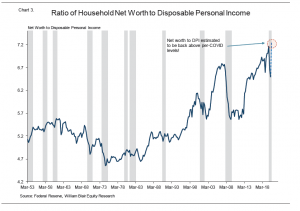

One investment research shop I regularly read put out some interesting charts recently that gave some interesting insight related to this topic. Refer to the chart below.

Shown above is the aggregate household net worth relative to disposable income going back to 1953. As a result of the strong financial markets, as well as the robust housing market, household net worth currently stands at its highest level ever in relation to income.

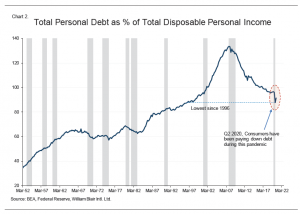

Next, let’s look at household debt. The above chart shows household debt as a percentage of disposable personal income.

As seen, it has fallen to its lowest level in a quarter of a century, going back all the way to 1996. This ratio was actually already trending down quite rapidly prior to the COVID pandemic, but it really took a further drop down during the virus.

What this all means is that consumers have been actively paying down debt during this sharp economic slowdown, in contrast to the government and corporations, which have both been aggressively taking on more debt.

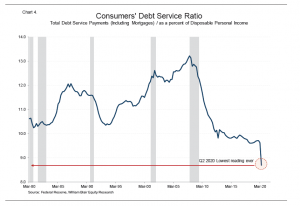

Finally, let’s look at the debt servicing costs for consumers. The chart above shows debt servicing costs (including home mortgages) as a percentage of disposable personal income. The Federal Reserve has only been reporting this specific ratio since 1980.

As a result of record low mortgage interest rates, low overall borrowing rates, as well as the debt reductions by households cited above, debt costs for consumers are currently at their lowest level since the Fed starting publishing this data 40 years ago.

Despite the terrible news we see daily regarding the pandemic there is ample evidence that show U.S. households in aggregate will emerge in the spring or summer next year with stronger balance sheets and considerable pent-up demand.

That can only be good news for the economy and the markets.