President Trump and his administration are finalizing a list of goods from China that will be subject to the newly imposed 25% tariff with the tariff going into effect soon.

This is only one of many details and deadlines that are looming in the ongoing trade debate between the United States, China, Canada, Mexico and the European Union.

The Trump administration has made trade deficits a priority and now we are seeing the actions they are looking to take.

As you would expect, the other countries are also issuing their own lists of U.S. goods that will be subject to additional tariffs in retaliation to the U.S.’s actions.

So far one of the biggest losers has been the consumer staples sector.

Consumer staples companies are getting hit from both sides of the tariff battle it seems. The U.S. imposed tariffs on steel and aluminum and companies like Pepsi, Coca Cola, Campbell’s Soup, and Molson Coors are getting hit with an increase in price for their packaging materials.

The retaliatory tariffs from Canada have targeted food and agriculture products while Mexico has targeted everything from fruit to meats and cheese. The EU’s tariffs are targeting many consumer staple products like peanut butter, orange juice and other food exports.

So these companies are getting hit with higher packaging costs and they are looking at lower sales due to the tariffs being put on their products once they enter the other countries.

This is not what the sector needed right now as it has already been the worst performing sector so far this year.

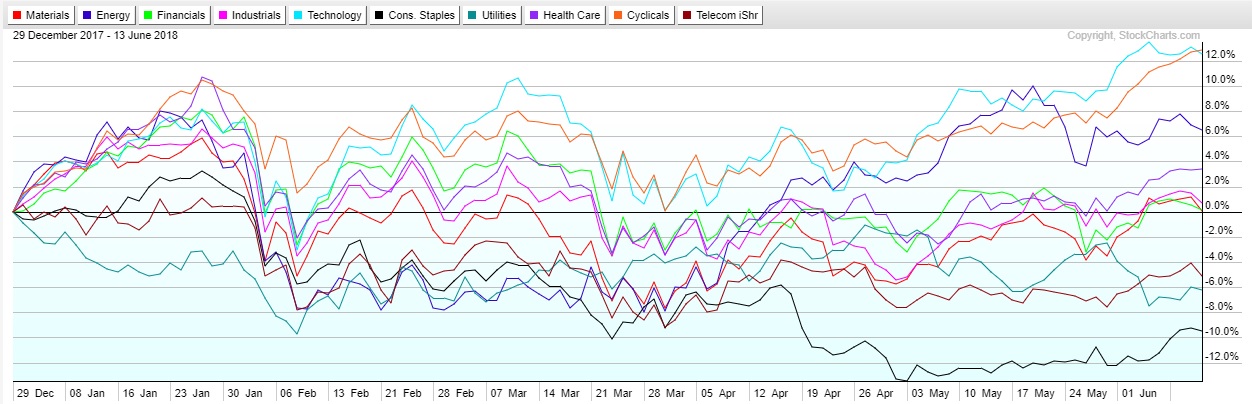

Looking at the chart below, you can see that the Consumer Staples Select Sector SPDR (NYSE: XLP) has underperformed compared to the other sector ETFs.

The XLP is down almost 10% while the tech sector and consumer discretionary sector are both up over 12% on the year. The S&P 500 itself is up 3.8% through June 13.

Trade imbalances need to be addressed, but the way the administration is going about them is taking a toll on consumer staples companies and it could take a big toll on American consumers.

Losses

The industry already is dealing with higher costs at the producer level and it has little pricing power right now as sales haven’t been growing. This puts these companies in a no-win situation.

Sure there are going to be winners and losers in the trade war, but it isn’t a zero-sum game. While President Trump is right to address the trade discrepancies, it’s not clear gains that will be had in certain sectors are going to be enough to offset the losses in other sectors.

There will be loss of jobs, loss of revenue and higher inflation, potentially far more losses than gains.

The consumer staples sector just happens to be the first one feeling the pain.