The fallout from the coronavirus threat to the world economy has created enormous uncertainty in the markets. But also an unprecedented opportunity for some.

Currently, the full extent of the epidemic and geographic scope of its reach are unknown. Many investors remain unnerved by the sudden and unpredictable changes in the market that have ensued.

The S&P 500 Index began to slide around Feb. 20 and is down 30% at this writing year to date.

So who is better equipped to weather the storm and capitalize on potential opportunities a turbulent market environment provides. Large investors, or small, individual participants in the market?

Common wisdom has always held that it is the professional money managers who are more likely to profit in the stock market, due to their superior knowledge and experience, leaving small retail investors at a distinct disadvantage.

Conventional wisdom notwithstanding, individual investors may be able capitalize on buying opportunities that larger institutional investors are forced to forego. Mutual funds, for instance, constantly look to increase their assets under management as well as enhance their fee income, so the pressure to avert losses is huge.

Should a fund’s rate of return decline substantially, investors are likely to fire the manager by transferring their assets to another mutual fund or an index fund. In addition, management fees for active as well as passive funds have plummeted over the past ten years.

As a result, fund managers now have little margin for error. Money managers increasingly must forego long-term investment strategies in favor of maximizing short-term profits.

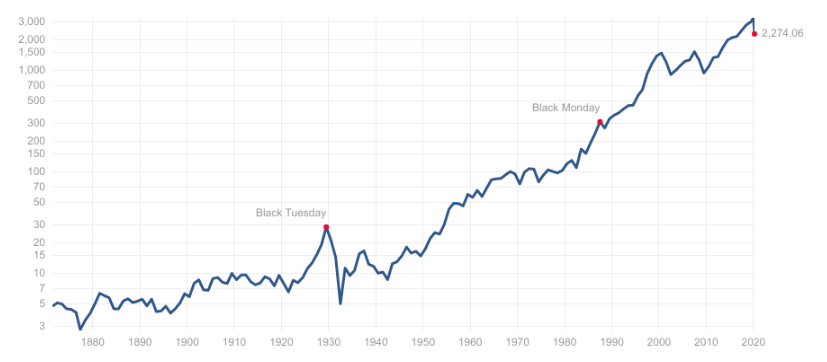

The constraints imposed frequently result in institutional investors that follow the Wall Street herd so as to insure their returns are consistent with the overall market and their fund competitors. This strategy was successful during the roaring bull market of the past decade. The stock market had been on an unbroken upwards trajectory.

Due to the stress to post positive returns fund managers sell more stock during periods of market turmoil than do individual investors. In short, when it comes to investing discipline, patience is a luxury individual investor can afford and use to enhance their returns.

In comparison, because they are under relentless pressure to provide favorable short-term quarterly results, the time-horizon of most professional investors, is more limited and their investment strategies more limited.

Buying opportunities may abound as the shares of stable and profitable companies drop for no other reason than being dragged down by an overall market decline.

Due to their risk-aversion during periods of pandemonium, however, institutions will rarely commit funds under such conditions.

Opportunities for individual investors

To date, individual investors have remained steadfast despite spasms of panic selling since the first wave of coronavirus infections left China.

Indeed, many retail investors view the current market environment as an occasion to profit from the rash decisions of others. The Wall Street Journal reported recently on how various individual investors have reacted to the coronavirus market downturn. Their responses indicate how a disciplined investment approach provides small investors with inherent advantages over large, sophisticated institutional funds.

A 2002 study by finance professors Patrick Dennis and Deon Strickland revealed that during large market declines professional fund managers sell more than individual investors. The study also showed that the more crowded a trade among giant mutual or passive index funds, the greater its trading volume during abrupt and unforeseeable market drops.

Additional data from the study showed the stocks sold by the largest investors on market down days tended to outperform the market as a whole over the ensuing six months. The study’s authors concluded that selling by large institutions when the market declines at least 2% “drives prices below their true values.”

Different market strategies

A study of 16,000 individual investors conducted by mutual fund giant Vanguard, is telling. It bolsters the view that the overall investment strategies of individual investors are quite different from those of their professional institutional counterparts.

One of the most striking findings of the report is that rate-of-return expectations of retail investors, are far more realistic than those of institutional investors. The report found that for individual investors, nearly 60% forecast one-year returns between 0% and 6%, and approximately 70% predicted 10-year average annual returns in that same range. By comparison, institutional investors frequently project annual returns in excess of 7.5%.

One of the starkest distinctions is that most small investors buy and hold stocks, rather than taking short-term profits or dumping shares that have declined. According to Vanguard researchers Stephen Utkus and Jean Young, the typical investor in the survey is 61 years old and has been with the fund for 17 years. The median investor account value is approximately $221,000, with a 72% weighting in stocks.

Perhaps one of the most notable findings, is that the average annual turnover ratio — a measure of how frequently an investor buys and sells or establishes new positions — is only 10% for individuals. According to research firm Morningstar, the turnover rate for mutual-fund managers is an astonishing six times that rate.

While the myth that the large players on Wall Street always enjoy an edge still prevails, the reality is that individual investors enjoy numerous advantages over institutional participants, particularly during moments of market tumult. Astute retail investors can capitalize on these favorable conditions.