Retirement is a time of financial freedom and relaxation, but it’s also crucial to ensure a steady stream of income to sustain your lifestyle.

One strategy that can help you achieve this is using covered calls. Covered calls are a popular options trading strategy that can generate additional income from your existing stock holdings.

In this blog, we will delve into the details of covered calls and explore how you can utilize this strategy to generate income in retirement.

Understanding covered calls

Covered calls involve selling call options on stocks you already own. By selling a call option, you grant the buyer the right to purchase your stock at a predetermined price (strike price) within a specific time frame.

In return for this right, you receive a cash payment as a premium. This is the income. You get paid whether the stock is called away or not.

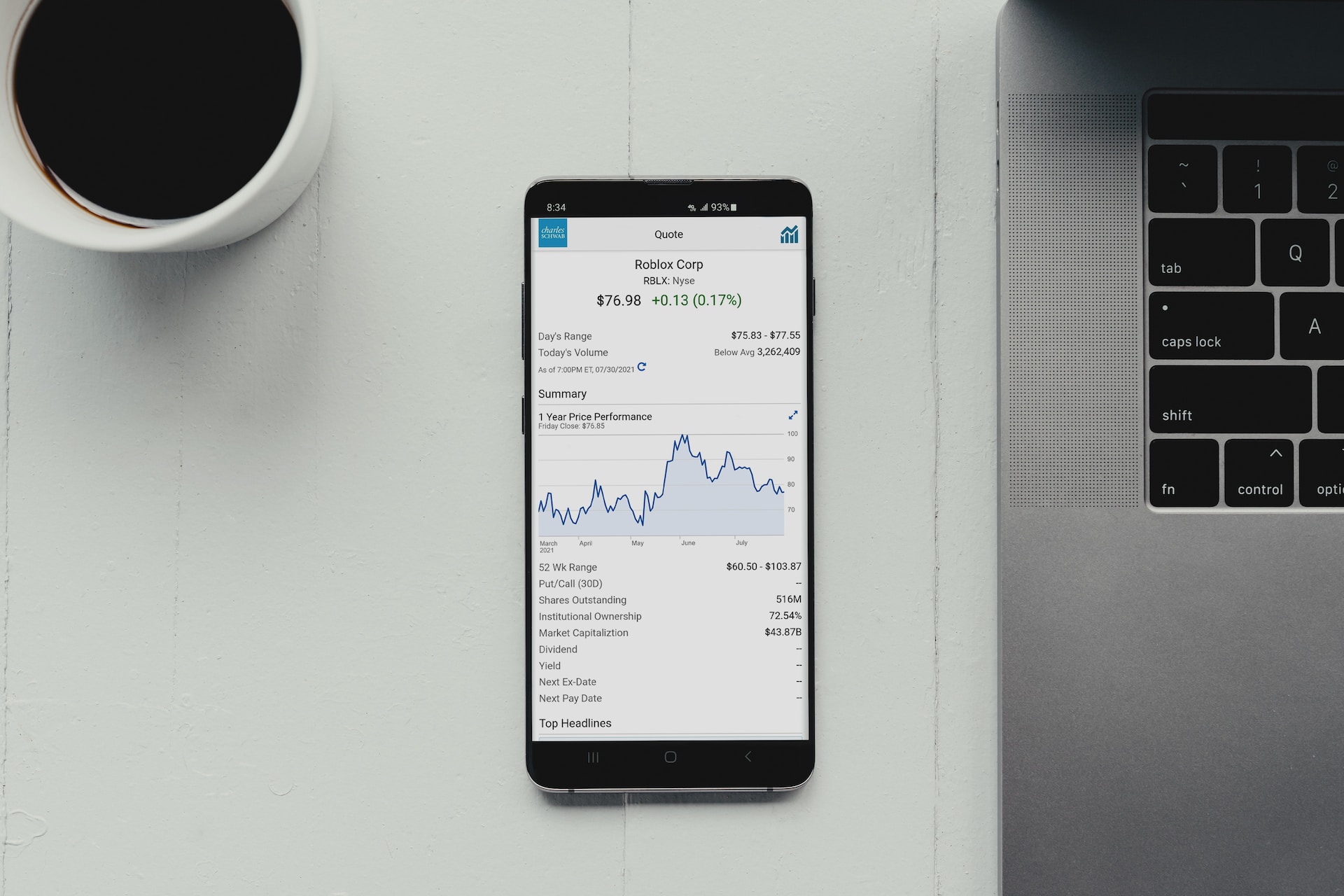

Selecting the right stocks

To successfully implement covered calls, it’s essential to choose stocks that are suitable for this strategy.

Look for stable, blue-chip stocks with moderate volatility. These stocks are less likely to experience significant price swings, reducing the risk of the stock reaching the strike price and being called away.

Setting strike prices and expiration dates

Determining the strike price and expiration date is crucial when implementing covered calls.

The strike price should be above the current stock price but at a level where you would be comfortable selling the stock if it reaches that price. The expiration date should allow enough time for the stock to potentially reach the strike price.

Calculating potential income

The premium you receive from selling a covered call represents the income generated.

By multiplying the premium by the number of contracts sold, you can calculate the potential income. It’s important to consider the time commitment involved, as selling covered calls requires regular monitoring of the market and your positions.

Managing risk

While covered calls can provide income, it’s important to understand the associated risks. One primary risk is the potential for the stock’s price to exceed the strike price, resulting in the stock being called away.

To mitigate this risk, consider selecting a strike price that provides a reasonable buffer and allows for potential upside.

Tax implications

Before implementing covered calls, it’s essential to understand the tax implications. Covered call income is typically treated as capital gains and subject to applicable tax rates.

Consult with a tax professional to understand how covered calls may impact your specific tax situation.

Monitoring and adjusting

Active monitoring is crucial when using covered calls. Keep a close eye on market conditions, stock performance, and any significant news or events that could impact the stock price.

If necessary, you can adjust your positions by rolling the call options forward, buying them back, or selling new options.

Diversification and portfolio management

To reduce risk, diversify your covered call positions across multiple stocks and sectors.

By spreading your investments, you can minimize the impact of any single stock’s performance on your overall portfolio. Regularly review and rebalance your portfolio to ensure it aligns with your retirement income goals.