-

Low-cost exchange traded funds (ETFs) have made it easier for individual investors to build investment portfolios that rival those used by wealth managers.

-

Long-term investing at a lower cost means better compounding returns for retirement.

-

Not all ETFs are equal, so creating an ETF portfolio requires focus and diligence.

Exchange-traded funds (ETFs) have experienced rapid growth over the last decade. Creating an ETF portfolio enables an otherwise average investor to have exposure to alternative assets such as real estate and commodities in their portfolio.

The key to success lies in creating an ETF portfolio that delivers powerful returns by using strong, well-chosen building blocks for each part of that portfolio.

Find ETFs that suit your portfolio

Consider the following factors while determining the most cost-effective and profitable ETFs to match with your portfolio needs.

ETF composition: Which sector is the main focus of an ETF is not enough information to determine whether you should have it in your portfolio. For instance, a number of ETFs comprise water sector stocks.

But when you analyze the key holdings of each, you will realize they have fairly divergent investment approaches within this niche.

While one ETF may have water utilities as its top holdings, another may be composed of water-related infrastructure stocks.

Returns will vary between these two ETFs depending on the prevailing demand conditions, competition, technology, government regulation, and so on.

Past performance and fees: Although past performance is no guarantee of future returns, it provides a reasonable basis to make a logical choice while comparing two very similar ETFs.

Most ETFs will typically have a low fee, but the fee is going to vary as well from ETF to another.

Particularly, when two ETFs have similar composition and similar past performance, the fee involved should be a factor to consider when creating an ETF portfolio.

Assets under management: The amount of assets under management is a critical factor while creating an ETF portfolio. ETFs with dangerously low levels of AUM would have a higher risk of closing, which is something you would want to avoid.

You should also take a look at the ETF’s bid-ask spread, the gap between price offers between buyers and sellers day to day, and the average daily volume.

A wide bid-ask spread or low volume could be indicative of low liquidity, which means your exit from the ETF could be more difficult.

Key steps to creating an ETF portfolio

Determine your goals: As a first step, you should be able to answer the following questions with complete clarity:

- What is my purpose for this portfolio (such as, saving for child’s college education or your retirement)?

- What are my returns expectations?

- What is my time horizon (you can afford more risk over a longer time horizon)?

- What are my distribution needs (for regular income needs, you may have to choose a fixed income ETF or an equity ETF that pays dividends)?

- What is my tax position?

- What is my financial position and overall investment strategy?

Evaluate your risk tolerance: Your goals for building an ETF portfolio and your risk appetite should be in harmony with each other. Risk and reward in stock markets generally follow these three rules of conventional wisdom:

- Equities carry a higher market risk than bonds. Therefore, equities will usually outperform bonds over an extended time period.

- Growth stocks are inherently riskier than value stocks. Therefore, value stocks will outperform growth stocks over an extended time period.

- Small- and mid-cap stocks of dynamic companies will outperform large-cap stocks over an extended time period because large caps are exposed to risks of diversification.

Considering these principles, you should determine your ETF portfolio allocation according to your willingness to take risk when creating an ETF portfolio.

If your risk tolerance is high, you should allocate a substantial part of your portfolio toward small-cap value stocks.

A large part of your ETF portfolio’s returns are determined by how you allocate the portfolio and not by timing the markets. Historical data continues to show that timing the markets is not a winning strategy.

Implement an allocation plan: A salient aspect about ETFs is that they allow you to choose an ETF for each index or sector where you want exposure. Based on your financial goals and risk tolerance assessment, you can analyze which ones are most likely to meet your allocation needs.

Once you have set your sights on targeted ETFs, keep buying on dips in small portions. It may not be a prudent strategy to place all buy orders at one time when creating an ETF portfolio.

Keep looking at the charts to see the support levels. When you are buying, you may choose to place a stop-loss order, which will limit the risk of loss.

The stop-loss should normally be no more than 15% to 20% below the entry price and, as the ETF price increases, it should be moved up in proportion.

Track portfolio performance: Monitor and evaluate your ETF portfolio performance, at least once or twice a year. Depending on your tax situation, a suitable time for an evaluation could be at the beginning or the end of the calendar year.

Compare the performance of every ETF against its benchmark index. Tracking error, which is the difference between the two, should be low. If the error is high, you have to consider replacing the ETF in question with another that looks more promising.

While assessing your ETF performance, make sure to account for any imbalances that could be attributed to external market fluctuations. Avoid indulging in overtrading.

A maximum of once-a-quarter rebalancing is considered ideal for most ETF portfolios.

Stay focused on your original needs, goals and risk tolerance, and do not get swayed by market fluctuations. Maintain a long-term perspective and reassess your portfolio periodically in the context of your changed circumstances.

As circumstances change over time, your allocation will also change.

How to diversify an ETF portfolio

A diversified ETF portfolio with multiple asset classes will usually produce more consistent returns over time. While creating an ETF portfolio, you could begin by focusing on these:

Sector ETFs: A sector ETF, as the name suggests, is focused on one particular area, such as healthcare or financial sector. You can select ETFs from multiple sectors that are not interrelated.

For instance, owning both a a medical device ETF and a biotech ETF would not count as truly diversified choices. Base your decision to include ETFs on fundamentals such as the valuation of the sector, the future growth outlook, and technical data.

Commodity ETFs: Commodity ETFs are a valuable component in the portfolio of many investors. You can track everything from cotton to gold with the ETFs or another similar instrument called ETNs (exchange-traded notes).

If you have adequate experience in commodity trading, you may consider an ETF that tracks individual commodities creating an ETF portfolio.

However, an individual commodity can be highly volatile, so if you have low risk tolerance, a broad-based ETF may be more appropriate for you.

International ETFs: An international ETF covers a global market spectrum, encompassing both developed and emerging economies. An international ETF could track an index focusing on a single major market such as China, or a broader region such as Southeast Asia or Latin America.

The selection of the ETF should be based on an evaluation of both technicals and fundamentals.

‘Keep it simple’ investing strategy

To create a cost-effective ETF portfolio, you could adopt a no-frills approach and stick to the basics. This would mean investing in a bond fund and a stock fund and just stop there.

For example, you could combine Vanguard Total Bond Market (BND) with Vanguard Total Stock Market (VTI) when creating an ETF portfolio. This would get you a portfolio of 16,917 bonds and 3,676 stocks at a low expense ratio of 0.12%, which equates to an annual management fee of $12 for every $10,000 invested.

When you have only two holdings, it gets easier to track your portfolio and determine when to rebalance. At the same time, your trading costs are cheap.

You could even add some international exposure while still keeping the costs low. For instance, iShares Core International Aggregate Bond (IAGG) and iShares MSCI ACWI (ACW) provide exposure to both domestic and international markets via online trading.

When you have an all-ETF portfolio, you can easily adjust the weights of each component. Creating an ETF portfolio means you choose how much you want to allocate to stocks and bonds and in domestic and foreign investments.

Or, use a ‘granular’ investing strategy

If you are looking at something more than a very basic all-ETF portfolio, you might choose to fine-tune your investments to whatever degree you want.

If you want to adopt a middle-ground approach in creating an ETF portfolio, you could own 10 ETFs that focusing on domestic market large and small caps, emerging markets and junk bonds.

If your approach is more aggressive, you could invest in about 20 ETFs. If you want only a U.S. stock allocation, you could divide it between growth and value stocks, or mid-caps and micro-caps.

You achieve even more strategic benefits if you hold ETFs with tax-sheltered retirement accounts. If your tactical bet proves right, you will not have to worry about taxes in such accounts. Within a traditional IRA, you will not have to pay taxes on investment income or capital gains until it is time to withdraw the funds.

Consider putting your less tax-efficient assets in a tax-sheltered account. In general, a tactical allocation of five to 10 percent as part of your overall ETF portfolio may be judicious.

Potential ETFs for your portfolio

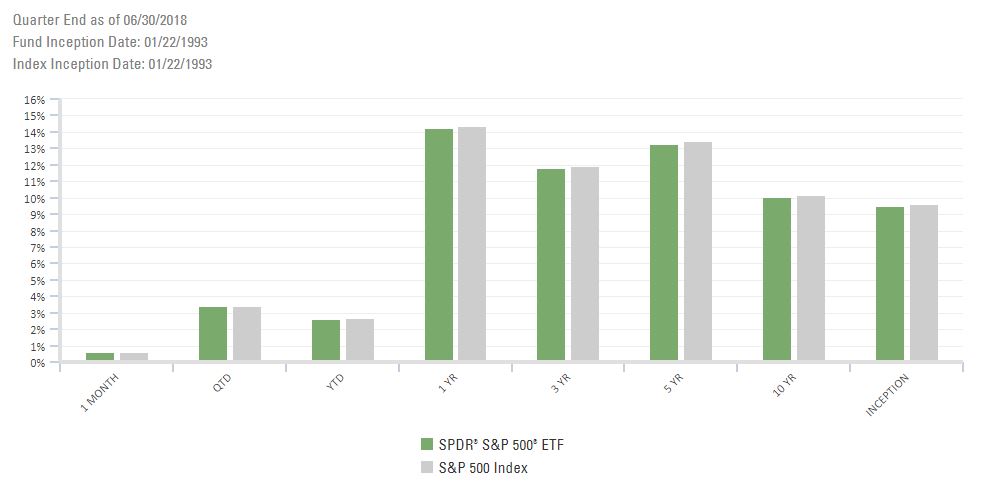

Spider S&P 500 (SPY): SPY was the first ETF launched nearly 25 years ago. The ETF passively tracks S&P 500 Index, which index represents 500 of the biggest U.S. stocks according to their market capitalization.

When you invest in this ETF, you will have a diversified stock portfolio.

It has a low expense ratio of 0.0945 percent, or an annual fee of $9.45 for every $10,000 invested, making it cheaper than most other S&P 500 index funds.

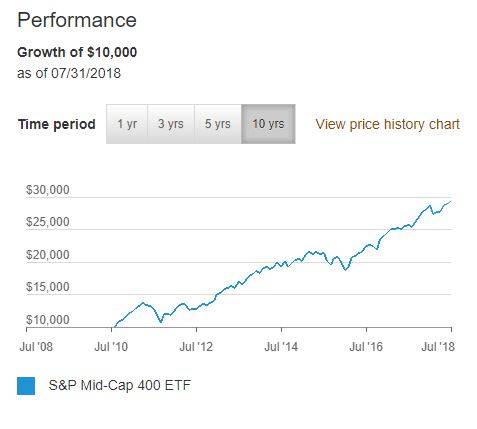

Vanguard S&P 400 Mid Cap 400: If you are looking for a good mid-cap ETF at a low cost, Vanguard could be your best choice.

Mid-cap stocks are considered as the market’s sweet spot because investors have historically earned better long-term returns with these stocks than with large caps. At the same time, they carry a lower risk than small caps. A combination of both of these qualities makes this an attractive choice.

iShares MSCI EAFE: If you are looking to buy just one international ETF, this one would be a concrete choice while creating an ETF portfolio.

The MSCI EAFE index, which is tracked by this ETF, represents more than 900 stocks in the developed markets of Europe, Australia, New Zealand, and the Far East (Japan, Korea, Taiwan etc.) The ETF focuses on large caps as well as mid-cap stocks.

Sectors ETFs to consider

When you want to diversify your ETF portfolio or increase your long-term returns, you could add sector ETFs. Here are some of the most promising sector ETFs to consider:

Energy Select Sector SPDR: For a diversified ETF portfolio, the Energy Select Sector SPDR fund can be a smart addition. This ETF seeks to provide targeted exposure to companies in the area of oil, natural gas, consumable fuel, and energy equipment and service industries. It will let you take tactical or strategic positions in a more precise manner than traditional investing.

Health Care Select Sector SPDR: This index includes companies in the business of healthcare equipment, supplies and services, biotech and pharmaceuticals, and healthcare providers. It combines the benefits of long-term growth with defensive qualities. The healthcare sector is poised for a strong future performance with advancing medical technologies and an aging population.

Consumer Staples Select Sector SPDR: For diversification into defensive stocks, you can choose this ETF, which focuses on some of the more conservative consumer staples companies. The fund’s holdings are almost entirely in large caps. Consumer staples include products such as food, utilities, healthcare items, and tobacco.

Final thoughts on creating an ETF portfolio

You should be prepared to accept ups and downs in your ETF portfolio over time because the markets will always fluctuate due to internal and external factors.

However, with a cost-competitive ETF portfolio and a logical investing strategy, you should be able to persist through the periods of volatility and achieve your financial goals.