The coronavirus pandemic has massively and adversely changed how struggling companies view their dividends payments. Companies cut the amount of money they returned to shareholders to the tune of $42.5 billion.

“There were massive dividend suspensions in Q2 2020 as companies had no time to ride out the virus, as sales were cut off and positive cash-flow turned to burn-rate analysis,” says Howard Silverblatt, senior index analyst at S&P Dow Jones Indices.

The $42.5 billion is the most significant drop since the $43.8 billion decline seen during the first quarter of 2009.

Barring the resurgence of COVID-19, this is likely to be the worst of the dividend cuts.

“The cuts … appear to have subsided, as those most impacted have taken their actions, and those currently able to ride through the initial downturn are continuing to pay,” said Silverblatt.

“If the overall reopening improves and regions act to limit any upturns, we would expect to see fewer and smaller dividend increases in the second half, and a significant decrease in cuts and suspension, which could limit the overall 2020 damage to a low single-digit decline.”

The loss of dividends will continue into the third quarter, however.

Still, Silverblatt believes dividend suspensions rather than decreases will be the norm going forward, should a company need to take action.

If virus continues to surge in some parts of the country that might mean “a return to significant cuts,” he said.

Wells Fargo cut

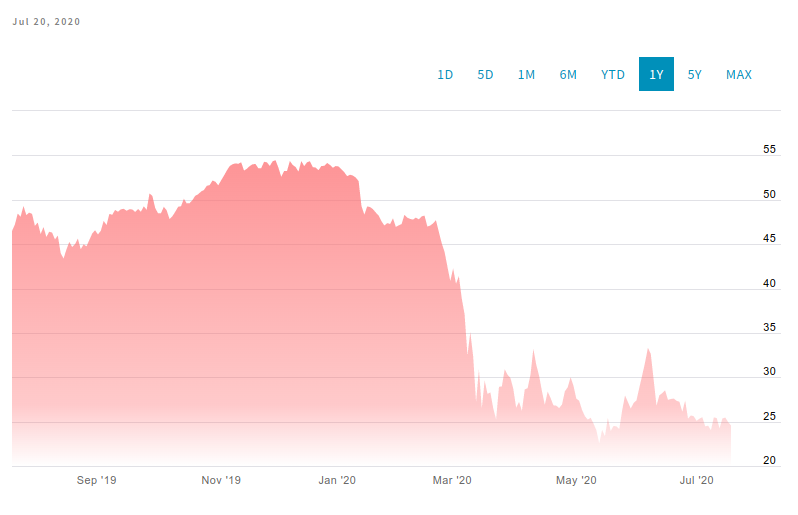

Wells Fargo (WFC) is one company that has had to cut its dividends.

The bank slashed its dividend to 10 cents a share from 51 cents.

“Our view of the length and severity of the economic downturn has deteriorated considerably from the assumptions used last quarter, which drove the $8.4 billion addition to our credit loss reserve in the second quarter,” said CEO Charlie Scharf.

The drop in dividends comes after a disastrous earnings call for Wells Fargo that saw a Q2 loss of 66 cents per share, missing by $0.56.

The loss is Wells Fargo’s first quarterly loss since the Great Recession.

“We are extremely disappointed in both our second-quarter results and our intent to reduce our dividend,” said Scharf.

Wells Fargo was also recently the only bank among the biggest six lenders in the United States to be forced to cut its dividend.

The mandate to cut dividends came after an annual Federal Reserve stress test.

One group that disproportionately depends on dividends are retirees.

“The board recognizes the importance of dividends and just where those dividends go. Those dividends wind up in retirees’ hands, in savers’ hands. Those are the people that are investing either directly or through various funds, and it’s important, and so we understand that,” Scharf said.

There is a twofold hit to seniors when dividend payments are cut.

First, there is obviously the loss of income. Many retirees depend on dividend payments are a source of income.

To name one example, Halliburton (HAL) had to cut its dividend payments to 18 cents a share — a 75% decrease.

The second hit to seniors comes because a cut in dividend payments decreases a stock’s value. If a person needs fast cash, they aren’t going to wait around for dividend payments. They are going to go ahead and sell their shares outright.

Lowered dividend payments also drive shares lower because they are perceived as worth less. And investors must consider giving up dividend payments in the future if they decide to sell shares outright.