-

Early retirement now is entirely possible — if you plan ahead.

-

The pathway to early retirement involves cutting unnecessary expenses, a frugal lifestyle, earning more, and investing as much as possible.

-

Resist the temptation to spend lavishly during the first few years of retirement to make sure your savings last.

Is early retirement now possible? This is a question that pops up in many people’s minds from time to time.

Not many people, however, think that early retirement is an attainable goal.

It’s understandable, given the fact that a large number of people in the country live from paycheck to paycheck. Many Americans have substantial debts — student loans, auto loans, mortgages, and credit cards.

The Federal Reserve says that four out of 10 Americans could not come up with $400 in an emergency.

For many of us, that’s why retirement can seem far-fetched.

The truth, however, is that early retirement now is entirely achievable — if you formulate an aggressive savings and investment plan and execute it properly.

First, the numbers

The thing you need to figure out first is the approximate amount of money you need to save up to attain your goal of early retirement now.

Traditionally, people have used the 4% rule for their retirement savings calculations.

The rule is quite simple. If you withdraw 4% of your retirement plan balance every year for your expenses, your savings are likely to last you 30 years.

That’s because invested money grows even as you spend some of it down.

To figure out how much you can spend, take your post-retirement annual expenses and multiply the number by 25.

The answer you get is the amount you need to save up. For example, if you need $50,000 per year, then you need to save up $1.25 million. ($50,000 x 25 = $1.25 million)

The 4% rule is apt for people who retire at the age of 60 and have to plan the next 20 to 30 years of their life. It is not appropriate for early retirees, who could be in their 40s or 50s.

Those folks need to make your calculations based on a more conservative 3% withdrawal rate. In that case your savings need to last you 40 to 50 years instead.

Laying the groundwork for early retirement now

Calculating how much you need to save up for retirement is the easy part.

The more challenging part is coming up with a savings and investment plan and executing it properly.

It can certainly be done — if you adopt the right mindset and have the discipline to stick to a plan, irrespective of whatever troubles you face in the short term.

Budgeting

A survey by the National Foundation for Credit Counseling (NFCC) says that more than half of millennials do not keep track of their monthly expenditures.

This is a huge mistake, since budgeting is the first step in a retirement plan and crucial to achieve your financial goals — both in the short term and long term.

You can find plenty of free apps and programs on the Internet to help you keep track of your monthly spending. If you are not a fan of online tools, you can use a computer spreadsheet or the good old pencil, paper, and a calculator.

No matter what kind of tool you use, you need to make sure every dollar you earn and spend is accounted for.

Cutting expenses

Cutting unnecessary expenses is absolutely necessary for early retirement now, irrespective of how much you make.

Even if you are struggling to make ends meet, there are a number of ways in which you can cut your monthly expenses.

- Try to find a carpool buddy and share a ride with them to and from work.

- Use public transportation whenever possible.

- If you have a credit card, try to negotiate with your bank for a reduced interest rate or make use of the balance transfer offers.

- Pay your credit card bill in full every month.

- Make the switch from premium to basic cable. Better yet, get rid of it completely and watch your favorite shows online.

- Cancel your newspaper and magazine subscriptions.

- Avoid dining out or eating take-out food on a regular basis. Home-cooked meals are healthier and cost a fraction of restaurant fare.

- Yearly trips to exotic locations are a luxury, not a necessity. On top of it, timeshares are a waste of money.

- Avoid processed food, unhealthy snacks, and sugary drinks entirely. Apart from being an unnecessary expense, these are harmful to your health and increase the risk disease in the long run.

- Grow your own fruits and vegetables. It is a healthy way to spend your free time and you can save a lot of money in the long run.

- Avoid branded items like the plague and open the door for cheaper generic items instead.

Housing costs

There are many ways in which you can reduce both your one-time as well as ongoing housing costs.

If you are planning to buy a house, resist the temptation to buy a large house, even if you can afford to.

Instead, buy a moderately sized house and invest the rest of the money.

Alternatively, you could buy a duplex and rent out the extra unit. This way, you can earn a steady source of monthly income in the form of rent.

If you already have a large house, consider selling it and downgrading to a smaller, cheaper house. You should save a significant amount of money on property taxes and maintenance costs.

If you keep the large house, rent out a room to a student or retiree. If you are living in a rented house, try moving to a cheaper part of the town to reduce your monthly rental expenses.

Moving is an excellent option, particularly for people who can afford to work from home.

For instance, you could choose an area where living costs are significantly lower while earning the same salary, which gives you an opportunity to save more.

Some folks seeking early retirement now even move abroad, if they can earn dollars by working virtually while keeping expenses in cheaper foreign currency.

Finance buffs called this “geo-arbitrage.”

Increase your income

After aggressively cutting all the unnecessary expenses, the next step is to early retirement now is to look for ways to increase your income.

Can you get a promotion or a raise at work by improving your skills or by learning new skills? If so, it should be your first priority.

Is it possible for you to switch to a higher-paying field? These are options you need to consider if you are looking to earn more.

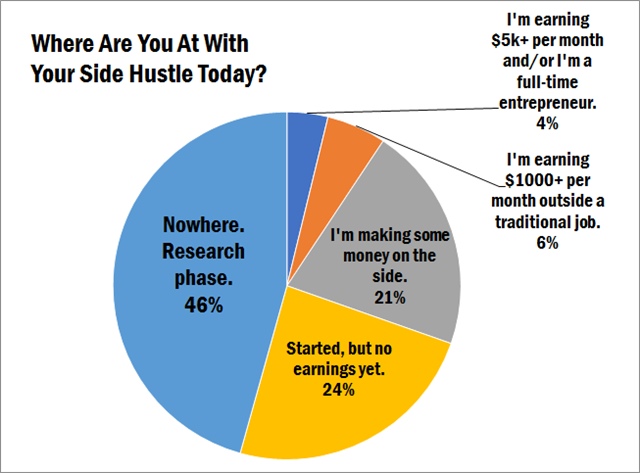

Try to get a part-time job, even a modest-paying one. If you have skills that you could monetize, you could work from home as a freelancer as well.

It could be web designing, content writing, coding, translation, or any other skill that could be turned into a part-time gig.

No matter what you do, you should make sure that the extra income you earn goes directly into your savings and investment accounts. There is no point in earning more if you use the money to upgrade your lifestyle.

Instead, start aggressively saving for your early retirement now!

Investing smart

You should earmark a reasonable amount of your savings (typically three to six months’ salary) and use it only in case of an emergency.

Once you have done that, you can invest your income in the following manner.

- Buy stocks and bonds

- Prudent real estate speculation

- Business ownership

Stock and bonds

Many people are hesitant to invest in the stock market owing to its volatility. However, if you are looking for higher returns on your investment in the long term the stock market is hands-down the best option.

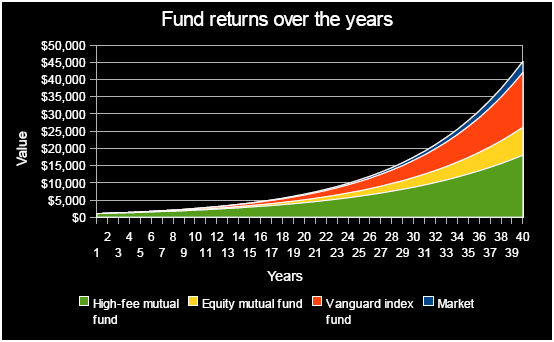

Low-cost index funds are one of the most profitable and affordable investment options available for you. All you need to do is allocate a portion of your monthly income into a low-cost S&P 500 index fund and continue contributing to it until you retire.

Index funds are designed to mimic the performance of an index. They invest in the same stocks and in the same proportion. Most are highly diversified and hold all kinds of stocks, from startups to large corporations such as Apple, Google, and Microsoft.

Unlike mutual funds, low-cost index funds do not have exorbitant fees.

In most cases, you would be paying a tiny fraction of 1% in fees, which is a huge advantage. Moreover, index funds typically offer higher returns than mutual funds on a consistent basis, thanks in part to low cost.

Index funds are highly recommended by many investment gurus for early retirement now, including billionaire and investing icon Warren Buffett.

Buffett says that you should keep investing in index funds irrespective of the short-term hiccups in the market.

The U.S. stock market has strong fundamentals and is likely to outperform any other international market or any other investment option for that matter in the long run, Buffett notes

Real estate

You could buy a duplex or a triplex and rent out the extra units.

If you currently live in a large house, you could sell it, move into a smaller house, and use the rest of the amount to pay off your debts and for investment purposes.

A solid rule of thumb to follow when it comes to real estate investment is that you should buy a second house only if the rent covers the mortgage payments and other expenses of ownership.

Before buying another house, consider the property taxes, living costs, and other expenses associated with the property. Pull the trigger only if you are sure that you can afford it.

If the rent you can earn is less than the mortgage and expenses you have to pay, that would be the wrong investment for sure.

Business ownership

This is basically an extension of the part-time gig option mentioned above. If you possess a skill that could be monetized, you could work as a freelancer from home and make money for early retirement now.

The next logical step is to convert it into a small business, which you can run out of your home.

In time you might hire a couple of people to work for you and set up an office, at which point it becomes a legitimate business that can help you reach the income you are aiming for.

It is, however, vital to take one step at a time and be very conservative with your spending — even if it is for business purposes.

For instance, do not hire anyone unless you have paying projects piling up and you cannot possibly get everything done by yourself.

Similarly, do not move into an office unless you reach a stage wherein your monthly income from your business is considerably larger than all your business expenses combined.

Early retirement now pitfalls

- Resist the temptation to splurge while you are saving up for retirement. Even if you start making and investing more money than you had previously calculated, you should stick to your financial plan until you reach your goal.

- Keep your expenses within a reasonable limit, especially during the first few years of your retirement. It might be tempting to “live it up,” since you are likely to be younger and more active than a typical retiree, but you should keep in mind that you are entirely dependent on your retirement money until your Social Security benefits kick in.

- An additional source of income during your post-retirement years — in the form of a part-time gig, a small business, or anything else that you love doing — is always welcome. It not only helps you generate more wealth, but also allows you to stay productive and happy.