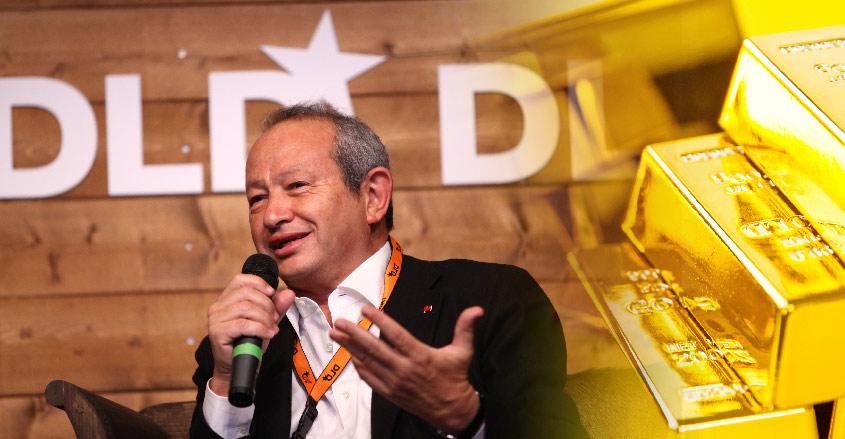

Egyptian billionaire Naguib Sawiris, a member of the Forbes 2018 global list of billionaires, says that he is investing half of his $5.7 billion fortune in gold.

Sawiris says that the world is struggling in the midst of multiple global crises. He sees gold as a safe-haven investment that continues to be strong as ever.

Sawiris also believes that the stock markets are significantly overvalued and that sharp decline in equities worldwide is imminent.

Why make a massive bet on gold now?

Sawiris believes that investors tend to embrace gold during times of crisis and the world is currently going through such a phase.

Furthermore, there have been no major findings of new gold in the last few years. This means that scarcity is on the rise, according to Sawiris.

Sawiris has first-hand knowledge of gold mining in recent years. He acquired share in two of the world’s biggest mining companies, West Africa’s Endeavor Mining and Australia’s Evolution Mining.

Sawiris also is bullish on copper.

Sawiris has made a fortune through large investments in unconventional markets such as Bangladesh, Iraq, Pakistan, and even North Korea.

He founded North Korea’s first telecom corporation, built a hotel and made other investments in the reclusive nation. The current peace negotiations between North Korea and the United States could provide a boost to those investments.

Sawiris frankly says that he and his family are investing in frontier markets not for any altruistic reasons but because they see opportunities in these regions.

Billionaires club

His massive investment call on gold, meanwhile, has created a flutter even among seasoned gold investors. Few other billionaires seem to share the same faith in gold as an investment.

Billionaire hedge fund managers Ray Dalio and John Paulson have maintained their focus on gold even as a rise in interest rates has led to a trimming of gains in the yellow metal.

New York based Paulson & Co. held 4.32 million shares in SPDR Gold Shares (the largest bullion-backed ETF) as of March 31, per a regulatory filing.

That remains close to 4.36 million shares the fund manager held on December 31.

Bridgewater Associates, the hedge fund of billionaire Ray Dalio also maintained its stakes in iShares Gold Trust, the second-biggest bullion-backed exchange traded product, and the SPDR Gold Shares fund.

Paulson’s gold and special situations hedge funds are believed to be returning client capital as the company narrows its focus to selected asset classes, according to sources who are familiar with the matter.

Paulson made his first fortune by betting against the housing market at it peak. Ray Dalio is a widely admired and highly scrutinized investors who manages billions.

That both of them remain in gold is a sign that the investment could have some legs in the near future. Whether it’s a half-your-wealth bet, as Sawiris believes, is harder to justify, but the Egyptian is clearly a big risk-taker.