Discount retailer Big Lots (BIG) appears to be benefitting from the current economic environment. The company reported earnings on August 28 and it saw earnings per share jump to $2.75 per share in the second quarter.

The EPS from the second quarter of 2019 were $0.53, meaning the EPS jumped by 419%. Analysts expect the company’s EPS to jump by 91% for 2020 as a whole. That rate of growth is considerably higher than the 3% growth rate the company has experienced over the last three years.

Revenue jumped 31% in the second quarter and it’s expected to jump by 9.5% in the third quarter.

Even though Big Lots trounced last year’s EPS numbers and beat analysts’ expectations, the stock dropped 23.5% in the next seven trading sessions. The decline was even more surprising to me because the sentiment indicators weren’t excessively optimistic.

Normally when a stock falls after such impressive results, you can trace the problem back to extreme bullish sentiment ahead of the report. But that wasn’t the case for Big Lots.

Looking at the sentiment indicators, analysts are more bearish toward the stock than the average company. There are nine analysts following the stock with three “buy” ratings, five “hold” ratings, and one “sell” rating. A buy percentage of 33% is approximately half as high as the average stock.

The short interest ratio is currently at 4.1 and that is higher than the average ratio of 3.0. Both the short interest ratio and the buy percentage from analysts are indicative of pessimism rather than optimism.

In addition to the sentiment being pessimistic, the stock wasn’t terribly overvalued. The P/E ratio was at 10.9 before the selloff and now it’s down to 7.6.

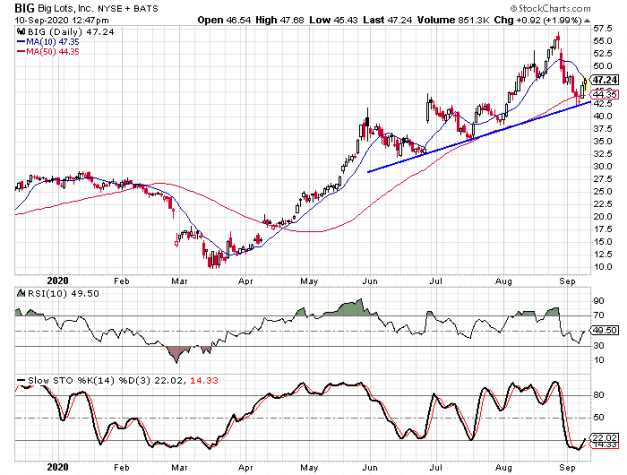

Pullback stopped at upwardly sloped trend line

Big Lots rallied sharply off of its March low, but there were a couple in June and July. Those two lows connect to form an upwardly sloped trend line and the stock hit the trend line in the last few days before turning higher.

In addition to the support of the trend line, the 50-day moving average is in the same vicinity and the stock is oversold. The 10-day RSI hit its lowest level since March as did the daily stochastic indicators. The RSI turned higher and the stochastic indicators made a bullish crossover in the last few days.

From the low in July through the high in August, Big Lots gained 63%. Another rally of that magnitude would move the stock up to $69 per share.

In order to maximize the possible gains, I suggest using options from the January series. The $42.50 strike calls are currently priced at $10.60 with the stock trading at $46.90. If the stock moves to $69, these options will be worth $26.50 and that would mean a gain of 150%. I recommend closing the trade should the stock drop below the $41 level.