Choosing when to claim Social Security is a big decision for many of us. Your benefit will depend on the average income you earned over your working years, the average income of your spouse, and when you file for benefits.

As you make plans for your retirement, you may ask, “How much will I get from Social Security?”

If you have a personal “My Social Security” account online, you can get an estimate of your personal retirement benefits and see the effects of different retirement age scenarios.

If you don’t, create one at www.ssa.gov/myaccount.

A personal account gives you access to your online Social Security statement.

In the statement, a bar graph shows your retirement benefit estimates for up to nine ages when you may want to start collecting your benefits.

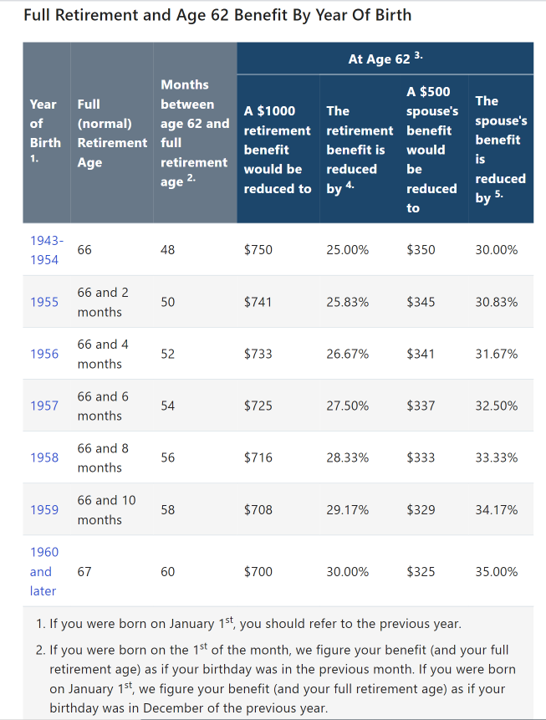

Are your current retirement planning plan generating enough funds for you to meet your retirement goals? You have the option to take retirement benefits as early as age 62. However, so-called “full” retirement benefits are payable at age 67.

If you delay collecting your retirement benefit until age 70, it will be for a higher monthly amount. It amounts to an 8% “raise” every year you wait after your full retirement age, which varies by birth year. There is no incentive to delay claiming after age 70.

Understanding timing

Taking benefits early may seem bad at the time, but those who start getting checks will probably continue receiving them for longer.

The government doesn’t reward you for starting Social Security payments early, on time, or late. It’s the same total estimated payment regardless of the time frame you choose.

The million-dollar question is how long will you live, and do you want a reduced amount for more years or higher amounts for fewer years.

Besides your likely longevity, what also matters is your financial needs, current health condition, and if you enjoy working or not.

The best thing you can do to help you answer this question is to hire a certified financial planner (CFP) to have them put together a custom financial plan based on your current assets, liabilities, as well as needs, wants, and wishes.

He or she will have you fill out a detailed questionnaire so that they can better understand how you live today and how you want to live in the future.

Most advisors today use financial planning software because it provides sophisticated solutions and smart assumptions to help advisors navigate the complex financial elements of their client’s lives.

Getting help

The main focus of these programs is around:

- Retirement planning

- Tax planning

- Retirement savings and income planning

- Estate planning

- Investment planning

To find a CFP near you, use the group’s official website. You can search by zip code.

The CFP certification is the standard of excellence in financial planning. CFP professionals are required to meet rigorous education, training, and ethical standards, and are committed to serving their clients’ best interests today to prepare them for a more secure tomorrow.

If you don’t want to pay for professional help or feel that your needs are simple, you can visit the Social Security Administration directly and learn more about retirement planning and the benefit credits you have accumulated over the years.