Value investing has outperformed growth investing over the past century. However, since most of us weren’t investing a hundred years ago, this information may not be as valuable as one might think.

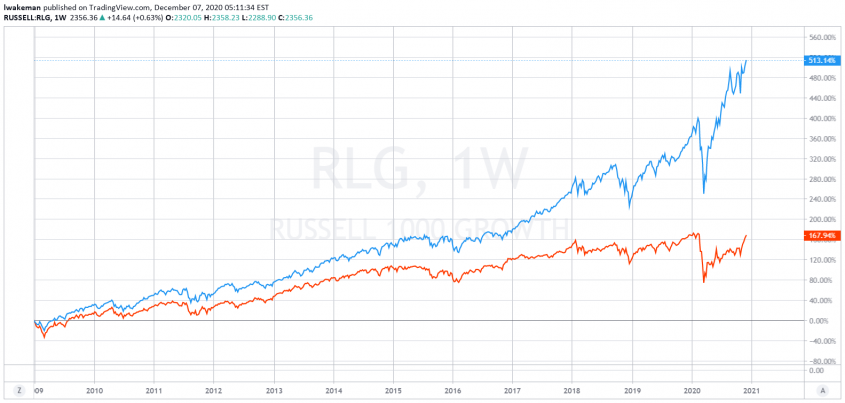

Meanwhile, since the end of 2009 growth stocks have outpaced value stocks 513% to 167%, respectively. This is mainly due to technology stocks. And this trend has exponentially increased over the course of 2020, as the chart below indicates.

But what if you could invest in both value and growth? One stock that can offer both of these elements is Huntington Ingalls Industries (HII).

Huntington designs, builds, and maintains ships for the U.S. Navy in Newport News, Va. The company doesn’t design and build just any ships. It is the sole government contractor for nuclear aircraft carriers.

It also is one of two companies that build nuclear submarines, as well as other non-nuclear vessels.

Value and growth

As a value company, HII had a price-to-earnings ratio last year of 14.01 and is expected to increase to 15.47 this year, which is relatively low compared to the average of the S&P 500 average of 33.79, according to the Shiller P/E Ratio.

Compared with other companies in the defense sector, it is still an excellent value below the industry’s 15.94. Its price-to-book ratio decreased in 2020 from a high of 6.75 to 3.53 adding to its value.

HII pays a dividend of $4.56, with a yield of 2.72%, beating the 2020 expected inflation rate of 2.2%.

As a growth company, HII’s earnings of 5.45% in November 2020 beat expectations by 30% and reported total revenue of $2.31 billion compared to the estimate of $2.23 billion. I

t received orders worth $1.6 billion in the third quarter, which increased the company’s order backlog of $45.3 billion.

The current year’s growth estimate is 10.42% as opposed to the industry expected of −1.6%.

According to Zacks.com, HII has a value rating of A and a growth rating of A, making it an excellent investment possibility for those looking to invest in companies that offer both growth and value.