Investing in equities can produce high long-term returns but is subject to short-term volatility. In positive economic environments stock prices tend to do well. However, when business and the economy falter prices can decrease substantially.

Stock price moves in a stock portfolio can be counterbalanced by adding assets that may move in the opposite direction during downturns, sometimes referred to as haven assets.

Two popular choices for balancing portfolios in this manner are long-term dated U.S. Treasuries and gold.

In periods of uncertainty, when equities falter, gold and Treasuries may see sharp price increases. Gold and equities may perform well during inflationary periods. Treasuries can perform well in economic downturns and during low growth and deflationary periods.

All three asset classes have recently benefited from the low interest rate and high liquidity environment.

There is no rule set on stone on how much to include of each asset class in a portfolio. One choice is to have their allocation fluctuate, reducing gold and Treasuries after prices rally and increasing allocations after substantial equity rallies or profit-taking.

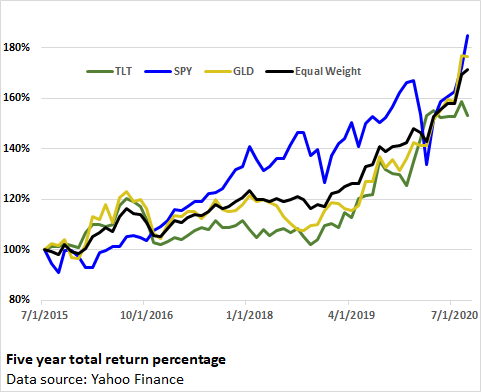

The chart above displays the last five years total return performance of equities, gold, and U.S. Treasuries. It tracks the SPDR Gold Shares ETF (GLD), the SPDR S&P 500 Trust (SPY) and the iShares 20+ Year Treasury Bond ETF (TLT).

Also displayed is an equally weighted portfolio of all three ETFs.

Note the stable performance of the equally weighted portfolio towards the end of 2018,and earlier in 2020. In both periods, equities sold off while gold and treasuries counterbalanced them.

Gold as an asset

Gold is widely seen as a store of value in periods of turmoil and when inflation picks up. As a financial asset it can be accessed purchasing shares of ETFs such as GLD, which provides ample liquidity, price transparency and ease of use.

Some advantages of investing in gold

- Haven nature, benefiting from flights to quality in volatile times

- Holds its real value against other assets and can be used as an inflation hedge

- Low correlation with other asset classes

Some drawbacks of investing in gold

- Custody fees (for physical holding)

- No periodic interest, dividends, or prospects for growth

- Gold can underperform in stable periods and during strong equity markets

To introduce some return into gold holdings some investors purchase shares of mining companies. Warren Buffet’s company recently acquired a mining company in a transaction of this type.

Long-term Treasuries as an asset

U.S. Treasury bonds offer a fixed stream of cash flows consisting of periodic coupons and the principal, which is repaid at maturity.

Price performance is directly connected to interest rates and the economic cycle. If interest rates increase, cash flows are discounted at higher yields, resulting in lower prices.

Some advantages of investing in Treasuries

- Mostly considered to have no credit risk

- Deep liquid market for multiple maturities

- Known nominal return; individual bonds have certainty of cash flows

- Appreciation in low interest rate and deflationary scenarios

Some drawbacks of investing in Treasuries

- Low yields — currently less than 2% according to Bloomberg News. Current yields after inflation are negative

- Lower yields than riskier fixed income asset classes

- Negative price exposure to increases in interest rates and inflation

- Loss of real economic value during inflationary periods

ETFs such as TLT do not have a specific maturity, as underlying bond holdings are rebalanced over time.

Using options to add gold and U.S. Treasuries to a portfolio

Low Treasury yields, and gold’s lack of dividends and intrinsic growth, favor the use options to capture exposure and minimize the cash used in the process.

Outright options are an alternative but can be expensive. One-year calls on at the money GLD cost close to 8%, and TLT cost about 6%.

Under the right circumstances options may benefit in volatile times from a simultaneous rise of intrinsic value and time value, due to rises in implied volatility.

Because of the haven nature of gold, GLD options have relative high premiums for out of the money calls, compared to premiums for lower strikes.

Purchasing GLD calls and selling higher strike calls is an alternative to purchasing outright calls. (You can see my previous article on the topic here.)

Disclosure: I hold SPY and related option positions in a net long.