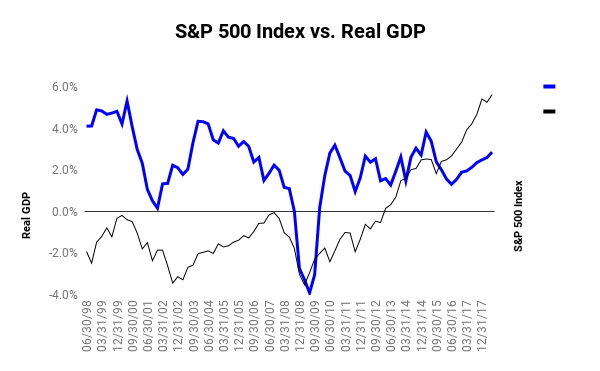

The U.S. Department of Commerce reported this morning that the United States’ economy grew at a 4.1% annualized quarterly pace for the three months ended June 30 of this year, representing the fastest quarterly increase in the country’s gross domestic product (GDP) since the third quarter of 2014.

In comparison to the same period a year ago, data provided by the Department of Commerce indicate that the country’s GDP expanded by 2.8% for the quarter ended June 30.That’s the biggest year-over-year rate of growth since the second quarter of 2015.

Although the general media and most so-called financial market “experts” cheered today’s GDP announcement, a closer review of that report suggests that last quarter’s economic results were not nearly as positive as those persons suggested.

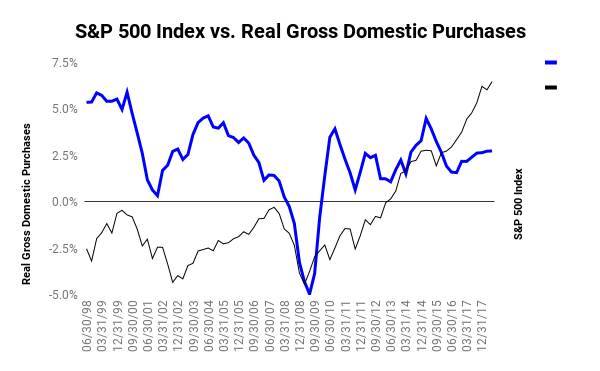

For example, data released by the Department of Commerce indicate that after factoring out net exports of U.S. goods and services, the United States’ economy grew at only a 2.9% annualized quarterly rate for the three months ended June 30, which is a slower rate of growth than during the first quarter of this year.

Note: For those of you who aren’t economists, any given country’s GDP is computed by adding the following components:

- personal consumption expenditures,

- business fixed investments,

- government expenditures and

- net exports

Factoring out net exports shows a country’s gross domestic purchases as opposed to its gross domestic product.

- Exclusive Access: Get Frazier’s Small-Cap Profit Confidential delivered to your inbox!

That’s a significant factor because my research indicates that U.S. net exports will likely grow at a much slower pace for the quarter ending September 30 of this year than during each of the three prior quarters as a result of

- retaliatory tariffs that foreign countries have placed on U.S. exports and

- because the exchange-value of the U.S. dollar will likely continue to increase after bottoming on February 1 of this year, causing the prices of U.S. goods and services to continue to increase for foreign purchases of such goods and services.

Hence, there’s a good chance that the U.S. economy will expand at a slower pace during the third quarter of this year than it did in the second quarter.

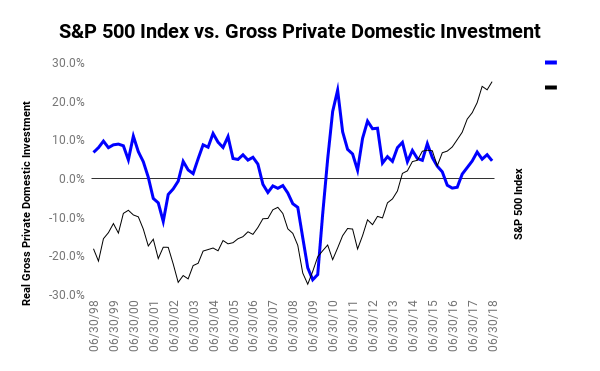

Additionally, the Department of Commerce reported that gross private domestic investments, which are composed primarily of business investments in commercial and industrial complexes, computer equipment and software, industrial machinery and equipment, and transportation equipment, declined during the quarter ended June 30.

Slower growth

That’s also a significant and negative development because such investments tend to account for approximately 18% of the United States’ total output of goods and services — of the country’s gross domestic product.

Hence, in the event that gross private domestic investments were to continue to decline, the country’s overall pace of economic growth would likely slow.

The fact that institutional investors (i.e. large pension funds, endowment funds and insurance companies) are well-aware of the factors and developments mentioned above is likely the primary reason that U.S. stock prices in general declined today in spite of the supposedly strong GDP report.

Further, my research suggests that those well-informed, big-money investors continued to reduce their allocations to stocks after increasing their allocations to cash-like investments (money-market securities) during six of the past seven months.

Make money in any market

Now, I realize that you’re probably thinking I’m one of those perennial bears who always focuses on negative economic/geopolitical factors and developments.

Wrong! Instead, the negative developments that I discussed above bother in no way at all!

- YES, sign me up! Market-destroying trades for serious short-term investors that crush the indexes in days, not months or years!

That’s because I have found in my more than 30 years of investing, speculating and trading in the financial markets that by doing thorough research and analysis one can make money in the markets regardless of whether stock prices, in general, rise, decline or move sideways.

As an example, persons who followed my investment advice from the October 2007 peak in stocks to the 2008 collapse in stocks were able to generate approximately a 5.6% return on their financial market investments while more than 90% of stock mutual funds lost money and most of those funds declined by over 25% from the 2007 market peak to the end of 2008.

More recently, 75% of the closed-out stock recommendations that I’ve made for my new financial market newsletter, Small Cap Profit Confidential, have generated positive returns, ranging from 4.7% gain on Alarm.com Holdings (ALRM) in only 11 trading days to a gain of 90.7% on The Trade Desk (TTD) in 52 days.

And, the first two short-term trade recommendations that I’ve made for my latest newsletter, Maximum Profit Trader, generated gains of 3.0% and 5.1% in only five trading days.

Based on my success, my publisher is considering raising the cost of these newsletters. Click now to get Small Cap Profit Confidential or Maximum Profit Trader before he makes up his mind!