-

Many of us are not ready financially for retirement, yet getting to $1 million is not impossible.

-

Most 401k millionaires got there with steady saving and investing over decades.

-

Getting to retirement with wealth means knowing how to make sure it compounds with minimal risk.

Shocking new statistics reinforce a basic truth of the world’s richest country: Many Americans are so far behind in retirement savings that they risk retiring flat broke. Many of us would like to know how to become a 401k millionaire, yet so few are on track to reach the magic number.

In fact, studies show that 61% of Americans have less than $100,000 saved in a retirement plan and 42% of Americans have $10,000 or less.

An Economic Policy Institute report shows that many working families have anywhere from $5,000 to nothing at all saved.

The main reason people give for not having enough saved is that they do not contribute very much to their retirement investment plans, often becomes of very low incomes.

Yet it’s essential, no matter how much you earn, to contribute at least something to your own retirement.

GoBankingRates.com polled 1,000 people from different age groups. It found that 55% have less than $10,000 in savings for their future retirement.

The figure was nearly the same in 2016, at 56%.

The 2016 survey had also found that one-third of Americans have nothing saved for their retirement. The 2017 survey again shows that 34 percent have zero in retirement savings.

Nevertheless, you will need money if you expect to stop working.

According to the U.S. government, people in the age group of 65 and above spend about $45,000 per year, which means that most Americans do not have enough saved to cover even one year’s retirement expenses, let alone decades.

For Millenials, (18 to 34 years) 71% have less than $10,000 in retirement savings, with the bulk of them having saved nothing.

Millennials with zero retirement savings has remained same between 2016 and 2017 at 42%, which could indicate that they are burdened by student loan debts or struggling to improve their earnings at work.

The situation is not pretty, even among Americans in older age groups. Fifty-two percent of Gen Xers (35 to 54 years) and 44 percent of baby boomers (55 years and above) have less than $10,000 in retirement savings.

No access

There could be many reasons why so many Americans are not saving anything for retirement.

According to Frank O’Connor of the Insured Retirement Institute, one of the key reasons could be that many people have no access to workplace retirement plans.

Many employees do not have a 401k, which despite mixed press is a systematic and easy way to save for a retirement.

Tom Zgainer, founder and CEO of America’s Best 401k, agrees that those with no access to workplace retirement plans are less likely to set aside retirement savings on their own.

Many Americans, too, fail to realize that they have several retirement saving options beyond the standard workplace plans, such as tax-deferred Individual Retirement Arrangements (IRAs).

Seeking to close the gap, some state governments are moving to create state-run 401k plans that would be offered to anyone with a job. Typically, small businesses don’t operate their own plans because of the expense, something a statewide plan would offset.

People would still have to choose to join the plans and, of course, set aside income from their pay to realize the benefit.

How to become a 401k millionaire

So while most Americans are failing to save for retirement, there are at least some who managed to learn how to become a 401k millionaire.

By the end of the first quarter of 2018, at least 157,000 workers had at least $1 million in their 401k, representing a jump of 45% over last year, according to Fidelity Investments.

Jeanne Thompson, a senior vice president at Fidelity, said that 401k millionaires get that way by contributing enough to ensure their full company match, they do not cash out when they change jobs, they are less likely to take 401k loans, and they invest with a focus on growth.

On average, 401k millionaires currently hold 75% of their savings in equity mutual funds, that is, they owned stocks.

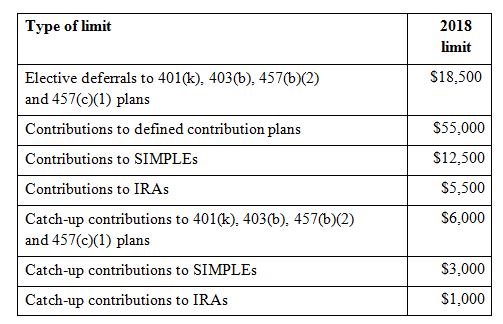

Employees are now allowed to contribute up to $18,500 a year in plans such as 401k. A catch-up provision for workers over 50 allows them to contribute an additional $6,000 in an employer-backed retirement plan for an aggregate contribution of up to $24,500.

Many people change employers often, but the key to achieving the 401k millionaire status may be the ability to continue working consistently for a good employer with an excellent 401k plan for the longest possible time period.

Robust company profit sharing in such cases can dramatically boost 401k savings.

Therefore, before you choose to change your stable and well-paying job, you must evaluate what you will be forgoing in terms of company benefits. It can be tempting, for instance, to go work for a startup or a promising new company that has no 401k plan or no 401k matching benefit just because fatigue has set in to their current job.

The longer you contribute to your 401k, the larger your retirement nest egg can be.

According to Fidelity, employees who contributed to their 401k for 10 straight years saw their average balance go up to $286,700, recording an increase of 22.5% over the previous year.

For workers who have contributed to their 401k plan for 15 consecutive years saw their average 401k balance go up to $387,000, which represents a jump of 21.5% over the previous year.

How 401k savings grow

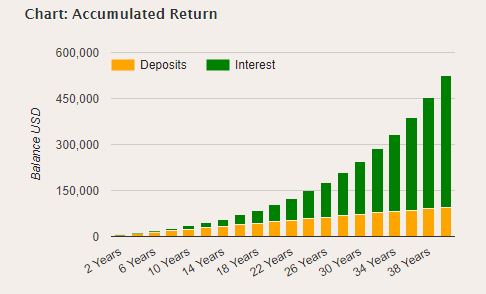

Many economists stress that something for your retirement is better than nothing. Through the power of compound interest and company matching in a 401k, even modest regular savings can grow exponentially. And that’s how to become a 401k millionaire.

Consider this simple math: If your rate of return is 7% (not unusual for a stock and bond portfolio) you can amass $100,000 in 40 years by simply putting $50 aside each month.

That’s a family meal out. Each month. A pittance, but a real difference once retirement begins.

And while it’s true that this amount will not last through retirement, it’s certainly better than contributing zero to your future.

Starting with a small amount such as $50 a month may be perfect for those who already have a 401k or IRA plan and want to grow their savings.

How much you should save each month is highly personal and depends on your lifestyle and individual needs.

However, it’s a good rule of thumb to have at least the same amount as your yearly earnings saved by the time you’re 30 and three times that amount by 40.

For instance, if you make $50,000 a year, then have $50,000 in a retirement account by age 30. Ten years later, the number should be $150,000.

The good news is, compounding alone means your $50,000 at 30 will turn into $100,000 by age 40 with no additional saving. You’re more than halfway there just by making the first milestone.

Economists also point out how to become a 401k millionaire: The earlier you begin to save, the easier it is to set aside a livable amount for retirement.

For example, let’s say at age 25 you set aside $200 each month. By the time you’re retirement age you will have accumulated more than $500,000.

However, if you start saving at 35, you’ll have to put aside over $400 monthly in order to reach the same amount by retirement age.

Of course, everything from Social Security benefits to reverse mortgages can be taken advantage of to supplement your retirement income. These options should be used in addition to having a healthy savings amount, instead of as alternatives to traditional savings and investment.

Bottomline: No matter what your financial situation, it’s crucial to start and put even a small amount aside in order to avoid retiring broke.

Rising limits

Whether you have a 401k, IRA or both, there have been a number of significant changes that will affect your retirement plans in 2018.

One notable change is that workers will be able to contribute an additional $500 to their 401k this year. Additionally, the income limits to qualify for tax breaks for participating in traditional and Roth IRAs have increased as well.

Here’s a breakdown of the changes and how they affect you.

401k plans

401 (k), 403(b) and most 457 plans will be increasing their limits by $500 to a total contribution limit of $18,500.

“Take advantage of the additional pre-tax savings and future tax-deferred growth,” certified financial planner Patrick Rush told US News.

Even by increasing your 401k contribution by as little as $20 extra a pay period can produce amazing investment results over the course of a working career, Rush added.

IRA plans

If you or your spouse have access to a workplace retirement plan, such as a 401k, you may not be eligible to make tax-deductible contributions to an IRA plan depending on your income level.

For example, individuals who make at least $63,000 or couples that make $101,000 are not eligible for tax-deductible IRA contributions in 2018.

It’s important to note that these limitations have actually gone up by $1,000 over last year.

However, individuals and couples that have no access to a workplace plan can make tax-deductible contributions to their IRA no matter what their income level.

Savers who have opted for a tax-free Roth IRA will be happy to learn that the income limits have increased for contribution eligibility.

Now individuals who make less than $130,000 a year and couples that make less than $199,999 are eligible to make contributions to a Roth IRA in 2018.

Saver’s Credit

Lower earners will qualify for the saver’s credit, which is a tax credit worth $2,000 for individuals and $4,000 for married couples.

The Saver’s Credit can be claimed in addition to the tax deductions you’re eligible for by participating in a traditional 401k or IRA plan.

HSA contribution limits

Savers that are taking advantage of the triple-tax-free advantage of having a health savings account (HSA) will be thankful to know that the contribution limits have increased for 2018.

The new limits are $3,450 per year for self-only HSAs and $6,900 for family coverage HSAs.

Savers should take advantage of all the contribution limit increases this year in order to ensure healthy growth of their own retirement plans.

It’s never too early to start planning for your retirement. It is likely to come whether you anticipate it or not.

Safeguarding your future

America’s 401k millionaires control a lot of money. A staggering $5.3 trillion lies in the company-sponsored 401k plans of baby boomers planning for their retirement.

If these are your hard-earned funds, then you might be wondering what you should do with it.

Should you roll it over to an Individual Retirement Account (IRA) at a financial firm? Or maybe just leave the money where it is?

When it comes to managing your 401k, even financial advisers can’t agree on a “one size fits all” solution for everyone. There are simply too many pros and cons.

But whatever you choose to do, be careful to avoid this key mistake that could potentially derail your whole retirement. Here is the one thing you should never do with your 401k if you the goal is to become a 401k millionaire.

Don’t take an early withdrawal. Easy enough, right?

But, life isn’t always so simple — maybe you’ve lost your job and are having a hard time paying the bills, or maybe you’ve been hit with a sudden unexpected expense.

So why not dip into the money you’ve saved in your 401k? After all, It’s the fruit of all your hard work, you deserve it.

But, there are two very good reasons why you shouldn’t even consider dipping into the 401k. Not only will you be taxed on whatever you withdraw, but if you withdraw before reaching age 59 and 1/2, then you’ll be hit with a 10% early withdrawal penalty on whatever you take out.

Dan Houston, chairman, president and CEO of Principal Financial Group in Des Moines, has something to say to those considering cashing out their 401k.

“My number one piece of advice is this — keep it in the plan, roll it over into an IRA or convert it to lifetime income, but please do not cash it out […] People say ‘I want to buy a car.’ All you’ve done is mortgaged your retirement future. It’s bad math and it doesn’t end well for that participant,” Houston told NextAvenue.

Rolling over

Perhaps you aren’t inclined to dip in to your savings but you are changing jobs.

If you stop working for the company that sponsors your 401k, then you might fancy cashing out and starting a new one with your next employer.

This could be a mistake however, as the early withdrawal penalty still applies when you cash out a 401k upon leaving a job.

Your best bet is actually to transfer that money into your new employer’s plan, or roll it into an IRA. Otherwise, you will be hit with taxes and penalties that will quickly shrink those hard-earned savings.

Regardless of the penalties, the more money that you withdraw before retirement, the less you will have to enjoy when you do decide to retire — which is reason enough to stay away from that nest egg until you actually retire for good.

Inevitably rich

Meanwhile, in more humble spheres of life, ordinary Americans are managing to preserve their savings well into retirement. A surprisingly large number of retirees even have more money two decades after retirement.

A study by Sudipto Banerjee of the Employee Benefit Research Institute (EBRI) found that in the first 18 years of retirement around a third of seniors managed to increase their assets.

These hailed from a range of socioeconomic backgrounds, including retirees who were well-off but not truly wealthy.

Even retirees with less than $500,000 in financial assets for retirement were found to have spent only around a quarter of that within the first two decades — which is less than many retirement models predict.

Meanwhile, those with assets of more than $500,000 were more likely to have increased their wealth after retirement.

Millionaires save for life

Generally, a surprisingly large number of seniors held on to their financial assets for the first couple of decades, but how did they do it?

By scrimping and saving, reducing spending to match income, and living within their means so they didn’t have to rely on savings too much.

The study excluded housing that was used as a primary residence and 401ks but did include other housing assets, along with stocks, bonds, mutual funds, savings accounts, CDs and automobiles.

A similar study conducted for the National Bureau of Economic Research looked at the changes in financial assets of those aged 70 and older and found that generally those with little wealth before retiring tended to have little wealth in retirement.

The study also found that if the wealthy managed to preserve their assets up to age 70, then they would die with them.

There were a few exceptions: Those who went through a divorce were found more likely to run out of money, as were those who suffered ill health, such as a stroke.

And, naturally, those who lived to a very old age also ended up spending much of their money on care.

Can you learn how to become a 401k millionaire? Discipline and time are the main ingredients, as well as a solid sense of how prudent investing really works.