Automobile expenses are a high and often overlooked. Most people do not take the time to shop around or look at ways to adjust their policy to get the best coverage for what they are willing to pay.

Here’s a primer on how to shop for and buy car insurance correctly, get the coverage you need and save money.

Most state laws require drivers to buy two types of liability car insurance coverage to drive legally.

The first, bodily injury liability (BI), pays, up to your policy limits, for injuries or death that you (the policyholder), or other drivers covered by your car insurance policy, are found responsible for after a motor vehicle accident.

Policy terms vary but typically bodily injury liability coverage will pay, up to your policy limits, for:

- Medical expenses

- Funeral expenses

- Loss of income

- Pain and suffering

- Legal defense if a lawsuit results from the auto accident

Meanwhile, property damage liability (PD) pays, up to your policy limits, for damages to someone else’s property that you (the policyholder), or other drivers covered by your car insurance policy, are found responsible for after a motor vehicle accident.

Property damage typically is damage to another car, but property damage liability also covers damages you may cause to someone’s house, tree, fence, guardrail, pole, etc.

Property damage liability provides you with a legal defense if another party files a lawsuit against you regarding property damage that resulted from an auto accident.

Property damage liability does NOT cover in any way damages to your own vehicle. For such coverage, you need collision coverage and comprehensive coverage.

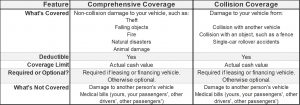

Together, these two common types of auto insurance offer you protection when your vehicle is damaged.

The type of damage they cover, however, is very different. See the chart below:

How much does coverage cost?

What you pay depends on the amount of your deductible.

Your deductible is the amount you must pay toward repairing or replacing your car before your insurance pays the remainder (no limits).

Collision and comprehensive coverage both have deductibles. A deductible is a separate cost from your insurance rate and this amount varies based on what you drive as well as how far you typically drive in a year.

The good news is you choose your deductible amount.

The lower the deductible amount you choose, the higher your insurance rate will be. That’s because you will pay a lower amount toward repairing or replacing your vehicle, while your insurer picks up a greater portion of the remaining cost.

For example, a low deductible could be as little as $100.

You can choose a higher deductible, instead — say, $1,000 — and pay a lower monthly insurance rate.

But remember, if you ever need to use your collision or comprehensive coverages, you’d have to pay this higher $1,000 deductible before your insurance kicks in to cover the rest.

Paying $1,000 after being in an accident might make you more upset and frustrated.

What surprised me was that the difference between the deductibles wasn’t that much, higher or lower, between increments $250-$500-$750. Nevertheless, collision is one of the most expensive parts of the insurance premium, along with bodily injury and property damage.

Rising rates

One thing to note, while there are places in the U.S. where car insurance rates have dropped or stayed about the same, the average annual premium nationwide has risen about 23 percent in the past decade.

Several forces are behind surges in car insurance prices, such as an increase in severe weather events that damage cars and cause accidents are to blame in some regions.

Vehicle thefts keep increasing year over year. High-tech car features have increased car safety but have also driven up repair costs.

Distracted driving (such as texting, eating fast food, and applying makeup) is up and contributing to many more accidents. Lastly, 1 in 8 drivers goes without car insurance, a statistic that’s been fairly constant for more than two decades.

When selecting insurance, the carriers want to know what the primary use is for pleasure/personal, business, or farm.

They will want to know if you use the vehicle for ride-sharing and the primary location the vehicle is stored. Depending on the zip codes, this plays a big role in setting your rate.

They will also ask who are the registered owners and who are all the drivers, and how many tickets or accidents have there been over the years? Have you taken a safe or defensive driver course?

If you have minors now driving your vehicle, make sure your great students share that report card. If you have kids doing great in school share the report card and get the additional discount!

Discounts happen when you have multiple lines of product involved, such as additional cars, homeowners or rental insurance and umbrella insurance. Just because you have been a safe driver and with one insurance company for many years doesn’t mean you are getting the best rates, however.

Furthermore, some companies are offering devices to help reduce your rates. However, please note, they are now monitoring the time of day you drive, where you drive, how fast you drive, how hard you stop, and more.

I would recommend that everyone make sure you have proper gap protection, whether you buy or lease a car. Many insurance companies do not offer this feature but several of them do and it is very inexpensive. For just a few dollars a month if there was an accident and the car is totaled you won’t owe the lender money.

Finally, don’t be afraid to shop around and compare prices to make sure you are getting the best deal possible.