The stock market constantly moves in cycles. Over its history, the tendency of the stock market is to move upward.

However, there have been many periods that it will trend lower. Sometimes for days, but other times it can be weeks.

Most retail investors look at a falling market as scary rather than an opportunity to buy. But when the market is falling, the short answer is to buy.

Think of it as a sale on stocks. You will be able to purchase more shares for the same amount of money.

One way to invest in a down market is to buy a sector ETF.

During recessions and down markets, some sectors can be relatively stronger than others.

That doesn’t mean that they may not be going down as well, but there is relative strength in those other areas.

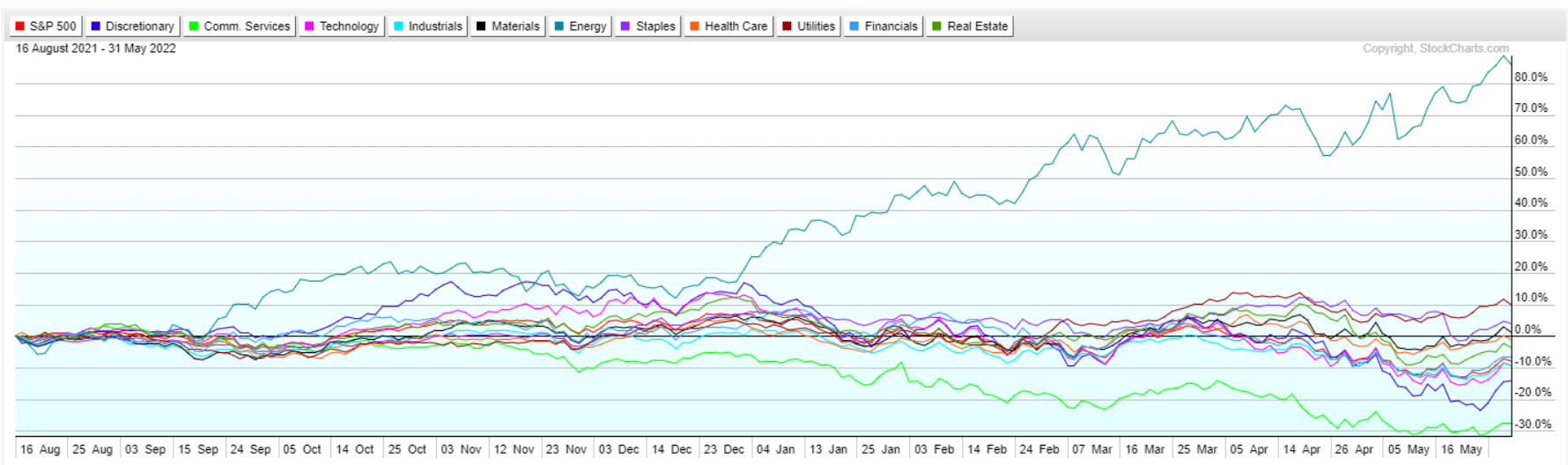

For example, you could look at the chart below, you will see that Energy ETF is way up.

Most retail investors think that would be one to buy, but that would be incorrect.

Of course, it could continue moving up, but has it hit its peak? Only time will tell, but you should be buying the ones that will be going up and not the ones that have already gone up.

During a recession, ETFs like Consumer Discretionary and Materials will be at the bottom looking as if there is no value.

However, those ETFs can and probably will grow once the recession has ended and consumers start buying again. You can acquire these shares for cheap when no one wants to own them.

Options strategy

Another way is to sell put options. When the stock or ETF starts falling, puts become more expensive because there is more demand.

You can sell these puts on stocks you would like to own but thought they were too expensive. If the underlying drops to the price that you sold the option, the shares will be assigned to you.

Not only are you buying the stock for less, but you were paid a nice premium for selling the owner insurance. This premium will help offset any additional losses in the stock price if any.

Buying stocks when they are down is not only the smart thing to do in down trending markets, but whenever there is a downtrend in a stock.

And, selling put options is an effective way to get paid while you wait for the price to come down to the level at which you want to buy.