The past year has been unique and challenging for everyone around the world with the quick spread of the Covid-19 virus resulting in a global lockdown and creating an immediate drop in economic productivity.

I was quite surprised when the gross domestic product (GDP), after contracting by 5% in the first quarter of 2020, fell another 31% in the second quarter of 2020.

However, I was very excited when it rebounded, rising 33% in the third quarter of 2020. This was mainly due to the Trump administration employing immediate stimulus packages and monetary policies to prevent a major crash.

Still, lofty valuation levels keep many investors from having higher optimism in equity markets. Many analysts now expect only moderate returns in 2021. This is based upon the V-shape economic recovery staying on track, as well as a successful Covid-19 vaccine deployment.

The Coronavirus Aid, Relief and Economic Assistance Act (CARES Act), passed on March 25, expired at the end of December 2020. An extension was signed at the end of that month, yet many struggling businesses impacted by the virus and forced shutdowns face the risk of permanent loss.

Analysts expect the government to continue to provide more stimulus packages in 2021 along with other government fiscal spending, including changes to foreign tariffs to help both small and large businesses succeed.

During times of heightened risks and market volatility, it’s a great time to review your goals and objectives and make sure your portfolio is aligned accordingly. A diversified portfolio that includes holdings in a variety of asset classes can reduce overall portfolio volatility and improve risk-adjusted-performance.

Asset allocation strategy

With a positive economic outlook, equities are still expected to outperform fixed-income investments in 2021. However, instead of being too tactical in the sub-asset classes, consider shifting your portfolio from an asset allocation positioning to a patient, disciplined, and valued security selection.

The reason I make this statement is that the market still seems expensive and we are still dealing with many uncertainties. There is a saying on Wall Street, “Bulls make money, bears make money, pigs get slaughtered.” It’s a warning to investors about excessive greed.

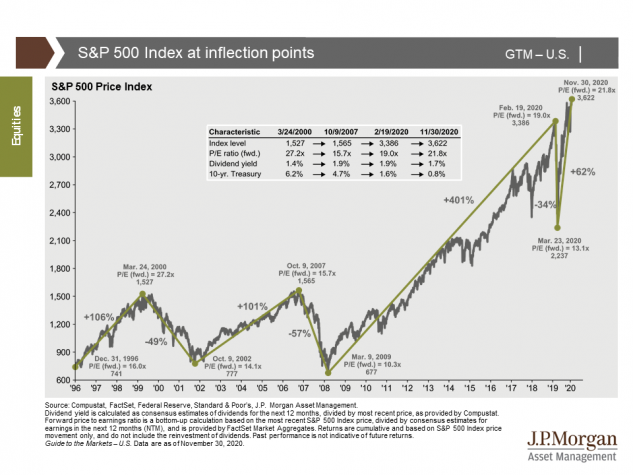

After all, as of November 30, 2020, the market was up over 60% from March 2020 correction and more than 400% since the March 2009 financial crisis bottom.

Investors have received higher than average returns during this period and they should be quite grateful for single-digit returns in the year to come.

Therefore, look for large-cap stocks that have strong balance sheets, dividend growth, access to capital as well as being innovative in 2021, companies such as AT&T (T).

AT&T owns HBO/Cinemax and is looking to work with Hollywood in releasing movies to stream on their 5G network the same say as theater releases are scheduled. That should generate huge earnings for the company. Plus, T already pays a high dividend of 6.8%.

PepsiCo (PEP) would also be a great stock to consider. With its diversification across the globe and within many business segments PEP is positioned well for global recovery and the weaker U.S. dollar. PepsiCo also has an attractive dividend of 2.8%.

Kimberly Clark (KMB), a household products company since 1872, produces tissues, toilet paper, paper towels, soaps, and more. It was a pandemic favorite as such supplies were swept off the shelf in 2020. Plus, it pays a 3.2% dividend.

Tactical plays

If you are going to make a tactical asset allocation adjustment within your portfolio, focus on domestic small-cap and mid-cap equities. Most analysts expect both the Russell Midcap (MDY) and Russell 2000 Small-Cap (IJR) index to rebound with a modest upside.

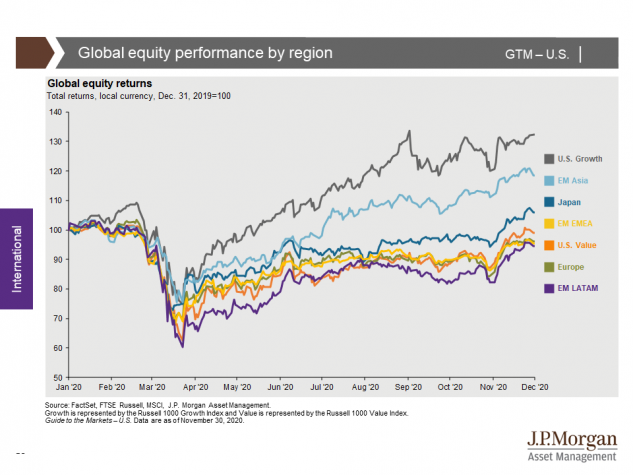

It might also make sense to add or increase your portfolio exposure within emerging markets using the iShares MSCI Emerging Markets ETF (EEM) as incoming President Biden will reconnect past trade relationship and is likely to eliminate some of President Trump’s tariffs.

Nevertheless, the growth prospects for developed international countries appear weaker than those for the United States.

Also with fixed-income yields relatively low, investors may want to diversify their holdings to seek yield in products outside of traditional bonds.

As uncertainties fade and with the continued support from the Federal Reserve in U.S. credit markets, investors should consider intermediate and long-term investment grade as well as high-yield corporate credit as they will pay a higher premium.

Consider the iShares Broad USD High Yield Corporate Bond ETF (USHY) or iShares 20+ Year Treasury Bond ETF (TLT).