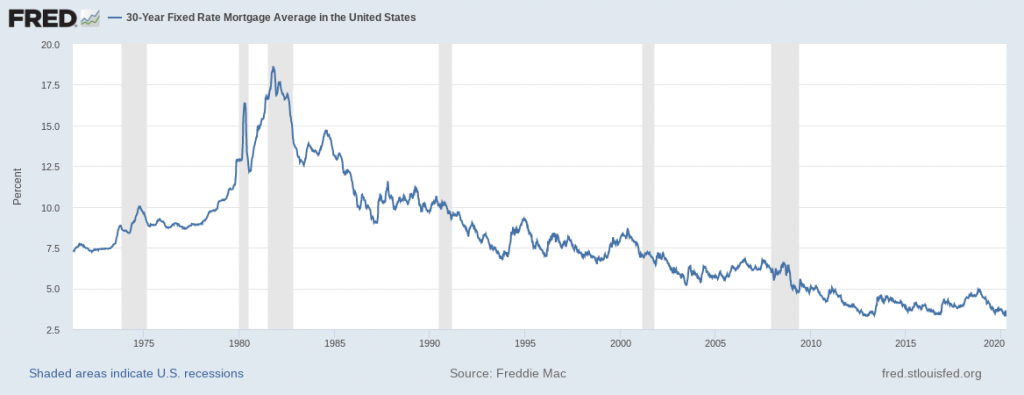

Mortgage rates have come down significantly, creating attractive refinance opportunities for millions of American homeowners. The prospect of lower monthly payments can make it tempting to go ahead with refinancing your mortgage.

However, before you make a decision, keep the following considerations in mind:

In general, if mortgage refinance will bring down your existing interest rate by at least 1%, the refinance strategy might be worth considering. It will not only save you money on monthly payments but also build home equity faster.

If you are getting a significantly lower interest rate through refinance, you might even be able to switch to a 15-year mortgage from a 30-year fixed mortgage without having a serious dent on your monthly budget.

Nevertheless, closing costs must be factored in. You will have to account for costs such as lawyer’s fee, title insurance costs, transfer fee, appraisal costs, and taxes. These costs of refinancing in aggregate could be anywhere from 3 percent to 6 percent of your principal amount.

If you’re not careful about closing costs, you could end up in a situation where the final cost of your refinanced mortgage is virtually the same as the cost of your initial mortgage.

In addition, be wary of lenders that are promising “no closing costs” refinance. They might be charging you an interest rate higher than the market or have other hidden costs that will defeat your purpose.

How long you will stay in the home?

You should carefully consider the duration for which you expect yourself to stay in your home. In general, if you do not intend to stay for at least five years or so, chances are that your mortgage refinance strategy may not do you any favors.

You will need to recoup the mortgage refinance costs. Therefore, it makes sense to determine beforehand how long you will take to recover these costs (by way of savings on interest rates for your new loan).

If the recovery of these costs is going to occur in four years but you are planning to move out after three years, refinancing would not be a financially meaningful proposition.

For example, if your mortgage refinance strategy is saving you $125 a month in mortgage payments and the total closing costs involved in loan restructuring are $5,000, you need to own your home for a minimum of 40 months just to recoup the closing costs. Your net savings on the mortgage will begin after that.

Look at PMI

In times when real estate prices are low, your home may get appraised for a lower value than what it may have been historically appraised for. If this happens at the time of your mortgage refinance, the valuation of your home might mean that you do not have the requisite home equity needed for a 20% down payment on your new loan.

In this scenario, you will either have to provide a bigger amount for down payment or you may have to purchase private mortgage insurance (PMI). This will effectively add to your monthly payout. Account for this potential cost to determine your net savings and assess whether mortgage refinance makes sense for you.

But the converse of this situation is also true. If mortgage refinance is going to free you from an existing PMI, the money you save might make refinancing a worthwhile strategy. If your home equity is higher than 20% you will not be required to pay PMI, unless you are a high-risk borrower or have an FHA mortgage loan. Getting rid of PMI could alone be a good enough reason to go ahead with refinance.

Do you qualify for loyalty discounts?

It is prudent to check with your existing lender whether they will offer you a loyalty discount if you refinance your mortgage through them. Special incentives that your lender may be offering to existing borrowers could be similar to the loyalty discounts that an automobile dealer offers to existing customers.

Here is another cost-saving element to consider. If you are not planning to take equity out of your home, your lender may not require you to have a full interior appraisal done as part of eligibility for refinance. Talk to your loan officer about this aspect while you are evaluating your options.

This could not only bring down your cost from $750 to $75, but it may also expedite the closing of your new loan. The faster you close, the faster your savings begin.

Other issues to consider

When you are weighing your refinance strategy, closing costs are not the only key factor. You also need to consider how the new loan payments are structured. It is possible that the new monthly payments may include less or more payoff of the principal amount than what was the deal in your initial mortgage.

The timeline of your 30-year fixed mortgage could also get altered when you refinance. Therefore, you must carefully evaluate whether extending the life of your loan suits your long-term needs.

For instance, if you are already six years into a 30-year mortgage and you get it refinanced for a new 30-year mortgage, the face value of your apparent monthly savings may not be a true reflection of the actual mortgage costs you will end up paying over time.

You need to remember that the longer is the term of your mortgage, the larger will be total interest amount you will end up paying if you continue to stay in the home until the end of the loan term.

Timing of your deal is another vital factor that will impact your costs and benefits. Whether your mortgage refinance strategy is worthwhile will, to a large extent, depend on the direction that the interest rates are headed to. If the rates continue to decline further, you probably refinanced too soon.

The bottom line is that mortgage refinance can be a valuable strategy when the potential savings are likely to be higher than the potential costs, and the gap is significant enough to make the entire exercise worthwhile.