With interest rates at record lows, many analysts are questioning the benefits of running the classic 60%/40% (equity to fixed) balanced portfolio.

The historical argument for such a portfolio hinges on the non-correlated performance of stocks and bonds. During times of equity drawdowns, fixed income securities typically provided offsetting positive performance, so over time the total portfolio return volatility has been lower versus a 100%/0% (all-equity) portfolio.

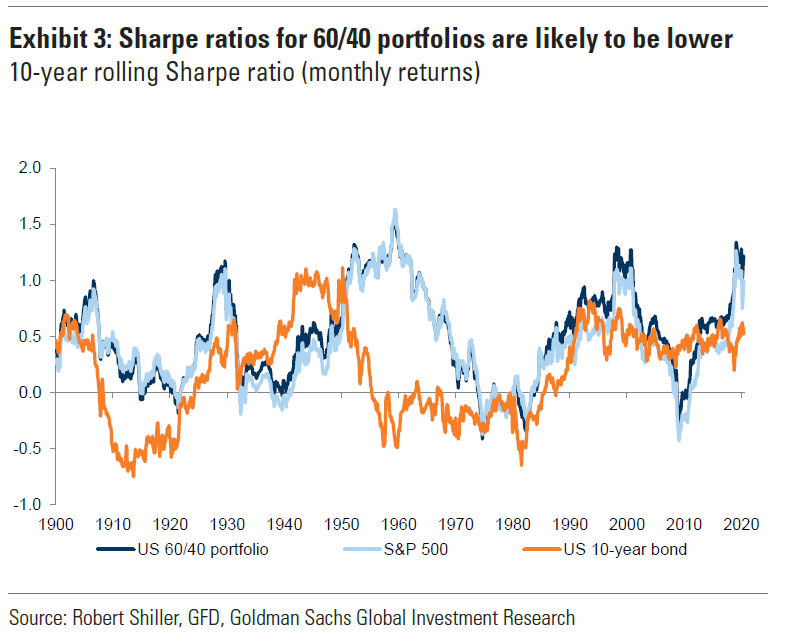

The resultant Sharpe ratio (return divided by risk) has accordingly been higher for the 60%/40% portfolio versus the 100%/0% portfolio and certainly the 0%/100% portfolio.

The illustration is a 120-year snapshot of the Sharpe ratio for the 60%/40%, 100%, and 0%/100% (all fixed income) portfolios. Data is presented for monthly returns on a rolling 10-year basis.

As shown, generally the 60%/40% portfolio provided better return vs. risk performance versus the other two for much of this very long period. There were periods where it was neck-and-neck for the first two though, as in the stretch from 1960-1980.

But certainly since 1980 until roughly now, the 60%/40% portfolio has provided for a definitely higher Sharpe ratio compared to either a 100%/0% or 0%/100% portfolio.

Breakdown

So, the key argument from the “balanced bear scare” proponents currently is that the negative equity/bond correlation that has been so prevalent over much of history will finally break down, given the exceptionally low bond interest rates presently.

Hence, they argue, the risk-adjusted return benefit of a 60%/40% portfolio will go away, providing investors with a confused roadmap going forward.

Whether this scenario does indeed play out remains to be seen. It is probably safe to say, however, that a breakdown in this long-held portfolio management principle could cause irrational investor behavior both within and across asset classes as investors adjust.