You many have heard the term “TINA” mentioned in various financial and investment commentaries in recent months. This is an acronym for “There is No Alternative.”

It is built around a key central question. Where else are investors going to go, outside of equities, for return or for yield? Put another way, is the stock market overvalued?

This can be a dangerous game to play. More than once over the past many years this mindset has preceded sharp downturns. However, I do offer one interesting chart I saw this past week that relates to this discussion.

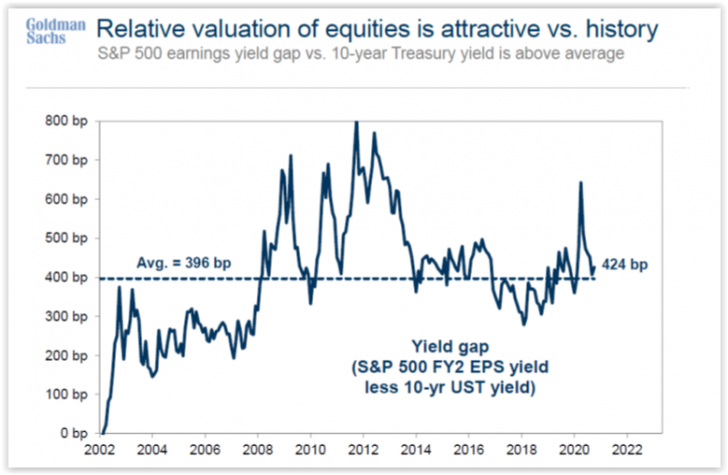

This chart shows the earnings yield of the S&P 500 (earnings/price) minus the 10-year Treasury yield.

This is known as the relative earnings yield. Obviously, the larger this amount, the more attractive the market valuation is in general, and vice-versa.

Relative earnings yield is currently around a level of between 4.0% and 4.25%. Despite its sharp rebound in stocks since their March 2020 bottom, I note that this spread is still very near its 20-year average of just under 4%. On this one valuation measure, I see this as certainly not at an alarming level.

A key reason this measure isn’t flagging a concern is simply because current nominal interest rates are extremely low. Nominal interest rates consist of real interest rates plus expected inflation.

Low nominal rates can very much be a compelling tailwind for the stock market if it is largely because of expected controlled inflation and not necessarily because of low real rates. Low real rates can be attributable to low expected economic growth or lower expected fixed investment spending, which are not typically favorable for the equity market.

Risks

In the current situation, much of the low nominal rates is driven by controlled inflation expectations. Based on this one measure, relative earnings yield, one could make the case that equities certainly are not grossly overvalued.

The risks that could start to erode this relative earnings yield are obvious. A decline in expected earnings, possibly due to elongated pandemic effects, is one risk. Also, rising inflation boosting up nominal rates and hence bond rates is another potential risk.

But, at the present time, we harken back to the term TINA. Where else are investors going to go?

Unfortunately, the only true clarity on this comes from an ex-post evaluation, or after the fact. But it does give us something to consider as we watch the stock market do its thing.