I believe one very underappreciated risk for investors preparing for retirement is the concept of “sequence of returns.”

Sequence of return risk is the danger that the timing of withdrawals from a retirement account will have a negative impact on the overall rate of return and ending portfolio value.

If you happen to be in a rising market those withdrawals may be offset to a degree by the increasing paper gains. However, if in a declining market, each of the withdrawals is taking a bite out of a falling balance which is not being replenished by either market gains or external deposits.

This sequence of returns factor can have an enormous impact on the final portfolio value several years down the road.

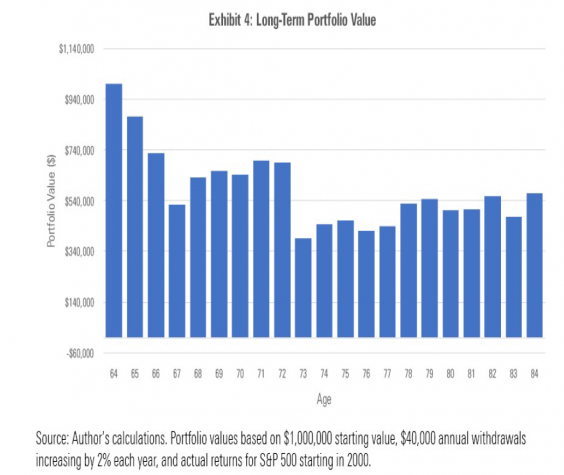

In a recent article on this topic that came across my desk, a hypothetical case is presented where an individual investor is retiring in year 2000 at age 65, just as the market is heading into a three-year downturn (-9% in 2000, -12% in 2001 and -22% in 2002).

The starting balance is $1,000,000 with an annual withdrawal rate of $40,000 increasing by 2% each year. The chart below shows this portfolio would have declined to roughly $567,000 by 2020, when the individual turned 85.

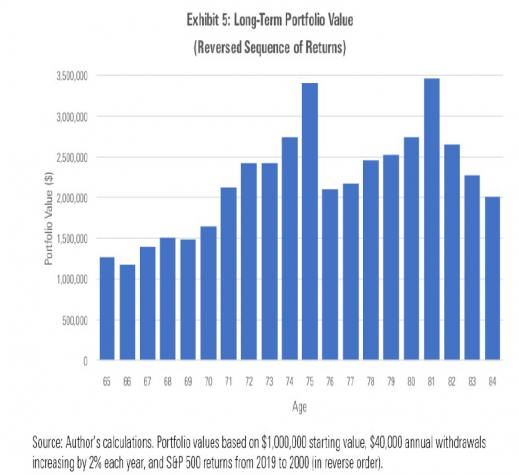

Now, assume that the sequence of market returns from years 2000 thru 2020 were exactly reversed, whereby the three upfront declining years referenced above occurred at the end of this period, not at the beginning.

We keep everything else the same, namely a $1,000,000 starting balance and annual withdrawals of $40,000 increasing 2% per year. The chart below shows a markedly different ending portfolio value of just over $2,000,000!

Why such a dramatic difference in the ending portfolio value, despite the individual withdrawing the same exact amount in aggregate over these 20 years?

Critical years

It is simply due to the heavily declining portfolio value in the early years that occured in the first case, declines which cannot be made up in the latter years given the steady annual withdrawals with no offsetting contributions.

This shows the importance of keeping the portfolio value intact as much as possible in these critical early years of retirement.

Sequencing risks can be mitigated to some degree by properly executing a balanced asset allocation, minimizing withdrawals especially in the early retirement years, and working longer to enable longer contributions.

Even with all of these actions being put into place, this key risk element still remains and really is one of the more underappreciated dangers of retirement investing.