Leon Cooperman, the Chairman and CEO of Omega Advisors, is well known for his value investing and fundamental analysis.

His firm, founded in 1991, and currently has $3.4 billion in assets under management.

In this interview, Cooperman touched on everything from the stock market to tariffs enacted by the Trump administration. Regarding stocks, Cooperman said he would take some profits on his holdings.

This is because he believes the market is fully valued.

“I’m sympathetic to the idea that sometime in the next 12 to 24 months, there will be events that will catch the market,” he said.

“In other words, I think that inflation and interest rates will catch up to the market as we normalize.”

As other analysts have been saying, Cooperman believes 2019 could be rough year for equities. Cooperman’s reasoning is that he sees the Federal Reserve tightening monetary conditions.

He also believes inflation is looking stronger.

“I would be a reducer on strength, not a buyer on strength,” he said.

“I think if we get the 10-year [yield] over 3.5 percent that could be very competitive to the stock market. We’re not there yet.”

Cooperman was also quick to note that while he sees some rumbling on the horizon, he would not be heading to the exits just yet.

“The conditions normally associated with a big decline are not yet present,” he noted.

Even if market troubles do pop up, Cooperman still sees an opportunity for some value plays.

“The thing that keeps me coming back to the game every day, for 50 plus years, is in November I owned 5 million shares of Time Inc. It was actively trading at $10,” he said.

“Nine days later, Meredith bought it for $18.50, cash.”

Cooperman also revealed that back in May he added to his position in Facebook while the shares fell earlier in the year.

He currently has an open order to buy more of Facebook’s stock at $180 per share. The social behemoth is currently trading around $189.

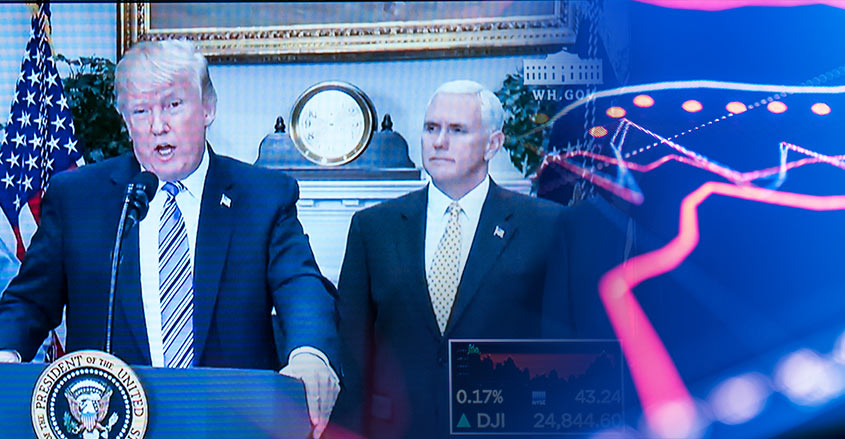

Trump tariffs

In the same interview, Cooperman revealed that he is “not a fan” of the recent metal tariffs on U.S. allies put in place by President Trump.

He hopes Trump will back down from the tariffs he has proposed.

“If he listens to his advisors, hopefully, enough sane people in Washington will tell him ‘let’s back off on this trade stuff,'” Cooperman said.

Last week, the Trump Administration decided to impose tariffs of 25 percent on steel imports and 10 percent on aluminum imports from Canada, Mexico and the European Union.

The three U.S. allies quickly announced retaliatory measures.