The recent rise in interest rates has contributed to wild swings in the market so far this year. Stocks now are slightly negative for the year.

Nevertheless, anxious investors should realize that instead of indicating an imminent crisis, a rise in the Treasury yields signify a return to normalcy.

A decade of historically low interest rates helped stimulate the long bull run in stocks. A 3% yield on the 10-year Treasury note represents a rate aligned to interest rate history.

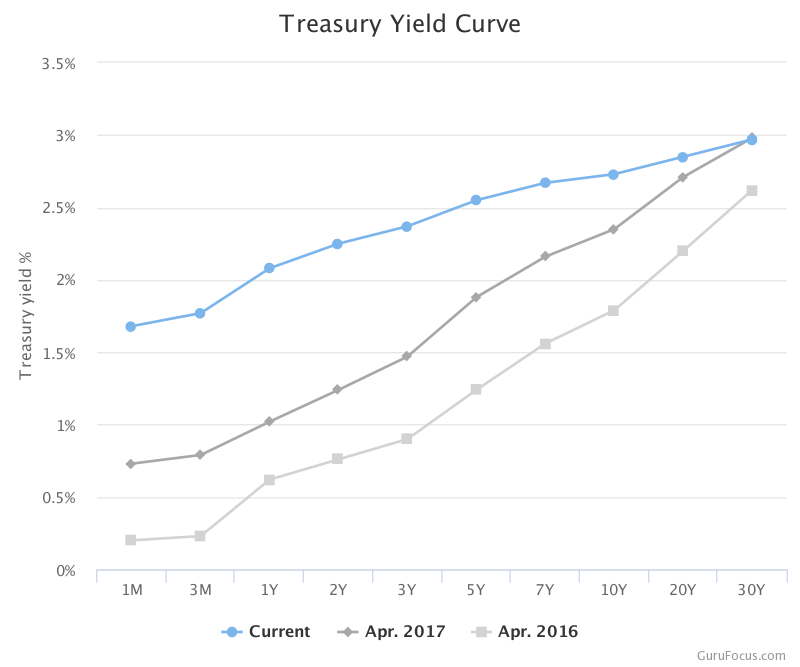

A look at the Treasury yield curve should allay investor fears.

One of the ramifications of the 3% threshold being crossed is that the 10-year Treasury note yield is an important factor that influences borrowing costs for governments, corporations and consumers.

Concern is mounting that continued rate increases may adversely impact the stock market by making money more expensive.

Higher financing costs could hamper economic growth and slow consumer spending, particularly on durable goods such as cars and appliances. The 10-year rate also is a reflection of investor sentiment. It can forecast economic growth and anticipate a surge in inflation.

There seems to be two schools of thought concerning the effect of rising rates on the intermediate and long-term stock market.

Some investors believe that a slightly higher bond yield is manageable, especially if corporate earnings continue to be strong and equity valuations are reasonable in light of the new investment climate.

Others worry that the long-term expectations built into the 10-year yield signal that the economy will slow, leading to only modest growth.

Some of these factors have been priced into the market; the impact of other factors on the direction of rates, such as a ballooning federal budget deficit, are unknown.

Another fiscal current, reflected in stock market gyrations and investor uncertainty, is that the recent federal tax cuts could lead to increased inflation expectations. Companies might increase wages with some of the savings or opt to invest in capital projects

New strategies

One area where both groups of investors seem to agree is that the decade-long aberrant inverse relationship between bonds and equities is over.

Current market conditions will no longer support investment strategies that rely on the bond and stock markets moving in tandem. The old rules no longer apply.

Investors whose holdings have been disproportionately weighted towards common stocks to maximize their returns in a constantly rising equities market may want to diversify into fixed-income investments such as bonds.

Now that the era of cheap money is over and the interest-rate environment approaches historical norms, bonds will most likely provide higher yields. That creates competition for the stock market that hasn’t existed for the past 10 years.

In short, investors should not be unduly alarmed at the rise in rates, but instead should keep a close watch on the direction of rates and be vigilant in terms of making prudent adjustments to their portfolios.