Since the beginning of September we have seen the main U.S. indices drop. There are a number of possible reasons for the decline, but more importantly I expect the increased volatility will be with us through the next few months. Between the uncertainty about the virus and the impending election in November, I don’t see the market settling down.

Something that has gotten my attention in the last few days is how the indices have all fallen below their respective 50-day moving averages. Now it looks as though the S&P 500 will see its 10-day moving average make a bearish crossover of its 50-day.

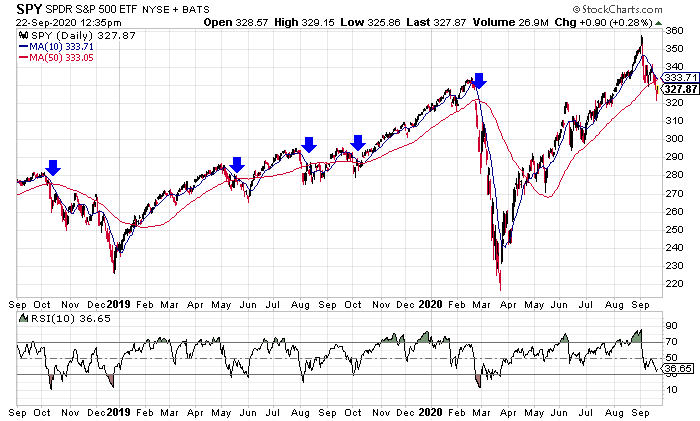

I used the SPDR S&P 500 ETF (SPY) in the chart because it is easier to read and it is easier to trade. There have been five instances where the 10-day has made a bearish crossover in the last two years.

In two instances the market continued to sell off for several months and substantial losses. In 2019, from May through October, the index waffled back and forth before eventually moving higher.

Because the bearish crossovers haven’t been consistently good indicators of big drawdowns, I think it makes more sense to buy portfolio insurance rather than sell your holdings.

Of course you can take profits on some holdings as well, but I think buying put options on the overall market makes more sense.

If you have a portfolio that is mainly comprised of big-cap companies, mutual funds, or ETFs that represent the broad market, I suggest buying puts on SPDR S&P 500 ETF. When the market dropped in Q4 2018, it dropped another 15% after the 10-day crossed bearishly below the 50-day. A drop of that magnitude at this time would put the Spyders down around $279.

When the crossover happened in the first quarter of this year, the fund dropped another 28% to its low. A similar drop this time would put the fund down around $236.

With the fund currently trading at $329.29, the January 2021, 328-strike puts are trading just below $20, or $2,000 each. If the fund drops to $279, these options will be worth $41, or $4,100. If the fund takes a steeper drop, like the one in the first quarter, and ends up down at $236, these options will be worth $92 or $9,200 each.

Tech drop protection

If your portfolio is worth $50,000 and takes a 15% hit, you would be looking at a loss of $7,500. The January puts would reduce your loss by $2,100 due to their gain. In the same scenario, but with a 28% drop, your portfolio would lose $14,000 but the puts would gain $7,200 and would cut your overall loss in half.

If your portfolio consists of more tech holdings or tech-oriented funds, you could use puts on the Invesco QQQ Trust (QQQ) to insure your portfolio. The fund is trading at $271.71 at this time and the January 271-strike puts are priced at $19.64.

This means they would be $1,964 for each option. If the QQQ drops similarly to what it did in Q4 2018, it would be down around $228. The QQQ didn’t drop as much in the first quarter of this year, but it still dropped around 22% once the 10-day crossed below the 50-day. A drop of that magnitude this time would put the ETF down near $212.

Given those two scenarios, if they play out similarly, the options would be worth between $43 and $59. This would generate gains between $2,336 and $3,936. This would offset a great deal of any losses.

We carry insurance on our cars and our houses, paying monthly or annual premiums, and we hope we never have to make a claim. Consider the costs of the put options as the premiums for your portfolio insurance.